07 Oct 2022 - {{hitsCtrl.values.hits}}

|

|

Dr. Nandalal Weerasinghe PIC BY PRADEEP PATHIRANA |

|

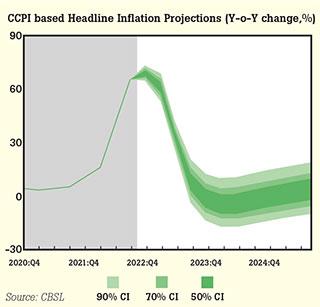

The Central Bank, which kept its key interest rates unchanged yesterday to continue with its bone-crushingly tight monetary policy, said a significant deceleration in inflation is expected in the early part of next year, particularly with higher base effects kicking in.

Inflation in Colombo district measured by the Colombo Consumer Price Index (CCPI) – the most up-to-date price index—surged to 69.8 percent in September, which according to the Central Bank’s projections could be the peak.

According to Central Bank Governor Dr. Nandalal Weerasinghe, Central Bank’s inflation projection for September was 67.8 percent.

“We missed it by 2 percentage points. But inflation will start turning around this month onwards. Going forward, based on our projections, we expect the inflation to decelerate—this month below what we saw last month,” he said.

“We expect that trend to continue towards December and also January onwards because we maintain this tight monetary policy,” he added.

Sri Lanka’s monetary tightening cycle, which began in August 2021, has seen a cumulative 1, 000 basis points or 10 percent policy interest rate hike, including the 700 basis points bumper rate hike in April.

Central Bank maintains the current Standing Deposit Facility Rate (SDFR) or overnight excess liquidity absorption rate from the banking system at 14.50 percent and the Standing Lending Facility Rate (SLFR) or overnight liquidity injection rate at 15.50 percent.

The Statutory Reserve Ratio (SRR) or the proportion of deposit liabilities banks need to maintain with the Central Bank, was kept at 4.00 percent.

Although Central Bank expects inflation to significantly decelerate early next year, based on its own presentation made to Sri Lanka’s external creditors a couple of weeks ago, inflation is expected to hover around 30 percent next year. When asked whether he expected further deceleration from this projection, Governor Weerasinghe answered in the negative. Central Bank’s desired inflation target remains at 4-6 percent. Meanwhile, in the monetary policy announcement statement released yesterday the Central Bank said, “… headline inflation is expected to follow a disinflation path in the period ahead. Subdued aggregate demand pressures resulting from tight monetary and fiscal conditions, expected improvements in domestic supply conditions, normalisation in global food and other commodity prices, and the timely pass-through of such reductions to domestic prices, along with the favourable statistical base effect, will be instrumental in bringing down inflation over the medium term.”

Sri Lanka’s private credit contracted for the third consecutive month in August and the economy is expected to contract by about 9 percent this year amid tight monetary and fiscal policies. The Central Bank expects the economy to bounce back next year with the envisaged improvements in the supply side along with the timely implementation of deep reforms backed by an International Monetary Fund (IMF) programme.

23 Nov 2024 6 hours ago

23 Nov 2024 6 hours ago

23 Nov 2024 8 hours ago

23 Nov 2024 9 hours ago

23 Nov 2024 23 Nov 2024