17 Jan 2024 - {{hitsCtrl.values.hits}}

- Manufacturing PMI at 52.7 index points while services at 58.9

- Seasonal demand, rising tourist arrivals buttress activities

- Lending activities seen getting back up after nascent start in prior months

- Respondents express anxiety about higher taxes, utilities prices & rising tensions in Red Sea

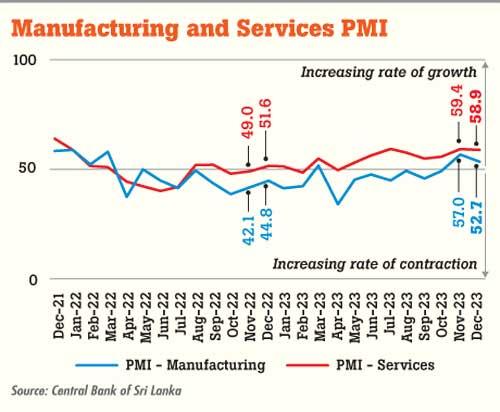

The Purchasing Managers’ Index for December showed that both manufacturing and services activities in the economy had continued to expand although there was some softening observed from a month ago.

economy had continued to expand although there was some softening observed from a month ago.

Accordingly the manufacturing sector PMI recorded an index value of 52.7 in December 2023, attributed to the increases in all sub-indices under the category except for employment while the services sector recorded an index value of 58.9 supported by the expansions seen in new businesses, business activity and expectations for activity.

The two sectors recorded index values of 57.0 and 59.4 respectively in November.

PMI is one of the most widely watched economic readings to gauge how best the economy is doing compared to the previous month and its future trajectory.

Under PMI, an index value of 50.0 separates an activity between growth and contraction while a value of 50.0 indicates a neutral activity level between the two months.

While the services sector has for the most part remained in expansion territory in 2023, the manufacturing sector has long been in decline before returning to growth in November, helped by the signs of recovery in the textiles and apparel sector as well as the year end festive season.

Manufacturing was in decline for eight straight months before turning a corner in November.

The December expansion in manufacturing was also driven predominantly by the food and beverage sector demand driven predominantly by the year end festive season though the consumer is still a long way from returning to pre-crisis era spending habits.

Consumer demand, although has relatively picked up, remains largely subdued due to manifold increase in prices since 2021 which made consumers worse off as their incomes haven’t closely kept up with inflation which rose to 70 percent levels at its peak in September 2022.

The manufacture of textiles and apparel declined once again partly offsetting the seasonal pop from the food and beverage sector.

This became a drag on employment in manufacturing too which made an about face after a considerable period of time in November reflecting that job markets are yet to return to stability. Meanwhile, the services sector has continued to plough ahead, anchored by the significant increases observed in business activities related to personal services activities, transportation and accommodation, food and beverage, again amid the festive and holiday season and the strong tourist arrivals. Further, the wholesale and retail trade activities were also propelled by strong seasonal sales while financial services improved further due to the uptick in lending activities seen during the months. However, employment declined reflecting the still remaining fragility in the country’s employment market as companies have not yet begun to meaningfully add people into their pay rolls on a more permanent basis.

While expectations for both manufacturing and services activities remained positive for the next three months and grew, the respondents to the PMI survey have expressed apprehensions over the higher taxes, shipping disruptions due to unrest in the Red Sea and increases in fuel and utility costs.

28 Oct 2024 1 hours ago

28 Oct 2024 2 hours ago

28 Oct 2024 3 hours ago

28 Oct 2024 4 hours ago

28 Oct 2024 7 hours ago