09 Aug 2023 - {{hitsCtrl.values.hits}}

Inflation is one of the important macroeconomic variables that has received significant attention considering the unprecedented economic crisis that began in 2021. The rate of price growth over a specific period is referred to as ‘inflation’.

over a specific period is referred to as ‘inflation’.

Inflation measures how much more expensive a particular group of goods and/or services has grown to be over a particular period, most commonly a year. Since the COVID-19 epidemic showed a drastically growing trend in inflation rates worldwide, most governments adopted several countermeasures to mitigate the escalating inflationary pressures.

This increasing inflationary pressure was caused by several factors. The epidemic disrupted the supply chain and rising transportation costs had a considerable impact on overall production costs, which led to cost-push inflation around the globe.

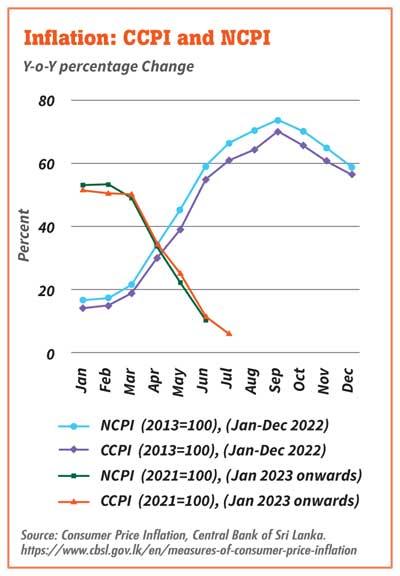

The unsustainable fiscal, monetary and exchange rate policies contributed to growing inflation in Sri Lanka as well. The National Consumer Price Index (NCPI, 2013 = 100), which measures headline inflation, climbed from 70.2 percent in August 2022 to 73.7 percent in September 2022. However, since September 2022, the inflation rate in Sri Lanka has been dropping and in July 2023, the CCPI fell to 6.3 percent, indicating a path

toward disinflation.

A slowdown or fall in the annual pace of price inflation is referred to as disinflation. In Sri Lanka, several factors contributed to the disinflationary process. The contractionary monetary and fiscal measures were extremely important in reducing inflationary pressure. The Central Bank of Sri Lanka increased its key interest rates in July 2022 to their highest levels in more than 20 years. Up until June 2023, these higher policy rates remained in effect.

fiscal measures were extremely important in reducing inflationary pressure. The Central Bank of Sri Lanka increased its key interest rates in July 2022 to their highest levels in more than 20 years. Up until June 2023, these higher policy rates remained in effect.

The contractionary monetary policy aimed to restore inflation to the desired level and maintain it going forward. Additionally, Sri Lanka’s expectations for disinflation were aided by improvements on the supply side and a global easing of oil and food inflation.

There have been numerous occurrences of disinflation when observed in a global context. The United States went through two recessions in the 1970s and early 1980s, which cost 1.1 million jobs. To combat the negative effects of the recession, the Federal Reserve under Paul Volcker launched an aggressive monetary policy over three years. As a result, by 1983, the annual inflation rate had decreased from its 1980 peak of 13.5 percent to 3.25 percent. The US’ long-term economic expansion and recovery were aided by this disinflationary path. Due to strict fiscal and monetary policies, Germany and Japan also experienced periods of disinflation in the early 1970s.

Examining the effects of disinflation on the Sri Lankan economy is urgent, given the country’s proclivity toward it. Until inflation reaches the intended level and price stability is restored, a process known as disinflation normally occurs throughout the short to medium term. It’s crucial to understand that deflation, which describes a continuous drop in the level of prices overall, differs from disinflation, which occurs after a period of strong inflation.

A reduced level of inflation, where the prices are still rising but more slowly, is the result of disinflation. Therefore, at this time, we cannot anticipate a major drop in the cost of products and services. However, the disinflationary route might have some advantageous implications for consumers because it might make it easier to protect the value of money.

Additionally, Sri Lanka’s disinflation process will assist a post-pandemic economic recovery path and prevent the economy from overheating. The current disinflation, however, is mainly reliant on tightening fiscal and monetary policies, not productivity growth, which is something we should keep in mind. As a result, after the policies are relaxed, inflationary pressures may once again increase. Sri Lanka should therefore concentrate its efforts on supply-side measures that encourage productivity growth. It will make greater room for long-term economic sustainability and post-pandemic economic recovery.

(Tharindu Udayanga Kamburawala is a Lecturer (Probationary) at the Economics Department of the University of

Sri Jayewardenepura https://www.linkedin.com/in/tharindu-udayanga-kamburawala-ab067788/)

31 Oct 2024 9 minute ago

31 Oct 2024 1 hours ago

31 Oct 2024 3 hours ago

31 Oct 2024 5 hours ago

31 Oct 2024 6 hours ago