18 Jul 2023 - {{hitsCtrl.values.hits}}

Sri Lanka’s first half tax revenue in 2023 has spiked by as much as 93 percent from the same period last year, in response to the sharp increases in the tax rates and introduction of new taxes as part of the revenue-based fiscal consolidation programme with the International Monetary Fund (IMF).

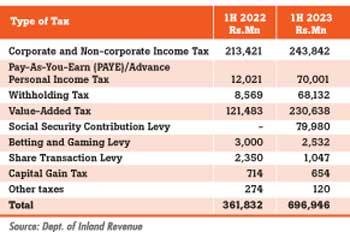

According to the data released by the Inland Revenue Department (IRD), the total taxes raked in for the first six months of 2023 was Rs.696.9 billion, compared to Rs.361.8 billion collected in the same period in 2022.

According to the data released by the Inland Revenue Department (IRD), the total taxes raked in for the first six months of 2023 was Rs.696.9 billion, compared to Rs.361.8 billion collected in the same period in 2022.

The then government, under President Gotabaya Rajapaksa and Prime Minister Ranil Wickremesinghe, had to embark on a complete reset in the tax policy when they decided to go to the IMF to fix the economy beset by the lack of foreign exchange.

Experts at the time vehemently linked the foreign exchange crisis to the budget, which ran blowout deficits in the pandemic years.

The first package of tax revisions came in from June, increasing the Value-Added Tax (VAT) from 8 percent to 12 percent, while the VAT-free threshold was cut by more than half to Rs.120 million per annum, from Rs.300 million, effective October, among a slew of other tax increases.

The standard corporate income tax rate was raised to 30 percent, from 24 percent, effective October, while the higher personal income taxes came into effect from January 2023. Meanwhile, the withholding tax was reintroduced from October on a number of incomes, including professional service fees over Rs.100,000 a month.

The second batch of tax revisions came in August, in an interim budget, when the VAT was raised further to 15 percent, effective from September, alongside a new Social Security Contribution Levy of 2.5 percent slapped on turnover through a new Act of Parliament in September.

As a result, the income from VAT almost doubled from Rs.121.5 billion to Rs.230.6 billion, while the Social Security Contribution Levy raked in Rs.79.9 billion in the first six months of 2023.

The biggest jumps in tax collections were seen in the withholding tax,

which rose from Rs.8.6 billion to Rs.68.1 billion and also in the personal income tax, which surged from Rs.12.0 billion to Rs.70.0 billion. The corporate income tax income changed a little from Rs.213.4 billion to Rs.243.8 billion, as corporate earnings remained subdued, due to a host of hostile policies instituted since April to crush business and consumer spending to tame inflation, which was getting out of control.

While these are only the taxes collected by the IRD, the Excise Department and Sri Lanka Customs also collect a substantial amount of taxes for the government coffers.

Despite the year-on-year tax collection showing a clear increase, the officials are still scrambling to meet the revenue targets they had committed to as part of the IMF deal and thus are looking at additional ways and means to raise the revenues.

31 Oct 2024 42 minute ago

31 Oct 2024 58 minute ago

31 Oct 2024 3 hours ago

31 Oct 2024 3 hours ago

31 Oct 2024 4 hours ago