18 Jun 2024 - {{hitsCtrl.values.hits}}

Images adapted from Capital Alliance (CAL) report

Hard liquor consumption down 24.3% YoY to 24.2mn litres in 2023

Revenue collected from excise duty on liquor increases only by 3.1%

Excise tax collected from cigarettes up 13.8% YoY

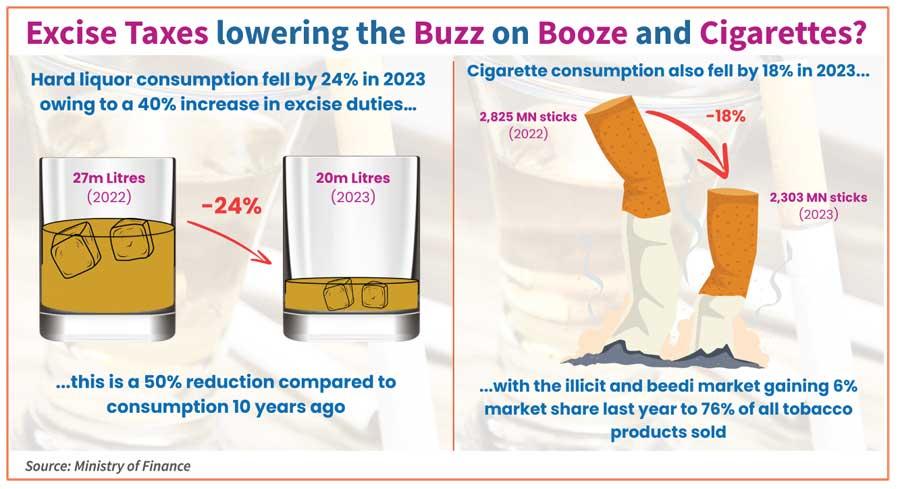

Owing to the higher taxes, hard liquor and cigarette consumption in Sri Lanka recorded a significant decline in 2023, indicating a shift in spending patterns of consumers.

In 2023, hard liquor consumption fell by 24.3 percent year-on-year (YoY) to 20.4 million litres, owing to a 40 percent increase in excise duties, which is a 50 percent reduction in consumption compared to the levels 10 years ago. However, malt liquor (beer) consumption only fell by 3.5 percent YoY to 13.6 million litres.

The revenue collected from the excise duty on liquor increased only by 3.1 percent to Rs.170.3 billion in 2023, from Rs.165.2 billion in 2022.

Meanwhile, cigarette consumption also fell by 18 percent YoY to 2,303 million sticks in 2023, with the illicit and beedi market gaining a 6 percent market share last year to 76 percent of all smoking tobacco products sold.

The excise tax collected from cigarettes grew by 13.8 percent YoY to Rs.118.5 billion.

“Despite the appeal, the recent excise increases have sparked a decline in liquor and cigarette consumption volumes. With three cigarette and four liquor tax hikes since 2022, we’re seeing a shift in spending patterns,” Capital Alliance noted.

Although the Excise Department expected to collect Rs.182 billion from excise duties from both tobacco and liquor, the actual collections stood at only Rs.171.27 billion.

With effect from January 1, this year, the government increased the excise duties on liquor and all excisable articles by 14 percent, to introduce an annual inflation adjustment for excise duty.

However, some experts such as JB Securities Limited CEO and Advocata Institute Chairman Murtaza Jafferjee was on the view that cigarette and alcohol taxation should not be simply indexed to inflation. He opined that careful consideration should be given to revenue elasticity in deciding the optimal taxation

The Finance Ministry defended the tax policy, stating it’s aimed not only to generate additional revenue but also to discourage harmful consumption patterns and promote responsible fiscal practice.

27 Nov 2024 25 minute ago

27 Nov 2024 55 minute ago

27 Nov 2024 1 hours ago

27 Nov 2024 2 hours ago

27 Nov 2024 3 hours ago