02 Jul 2024 - {{hitsCtrl.values.hits}}

The secondary market exhibited scant activities and lower trading volumes, as the selling pressure that dominated last week subsided, without significant buying interest to counterbalance it.

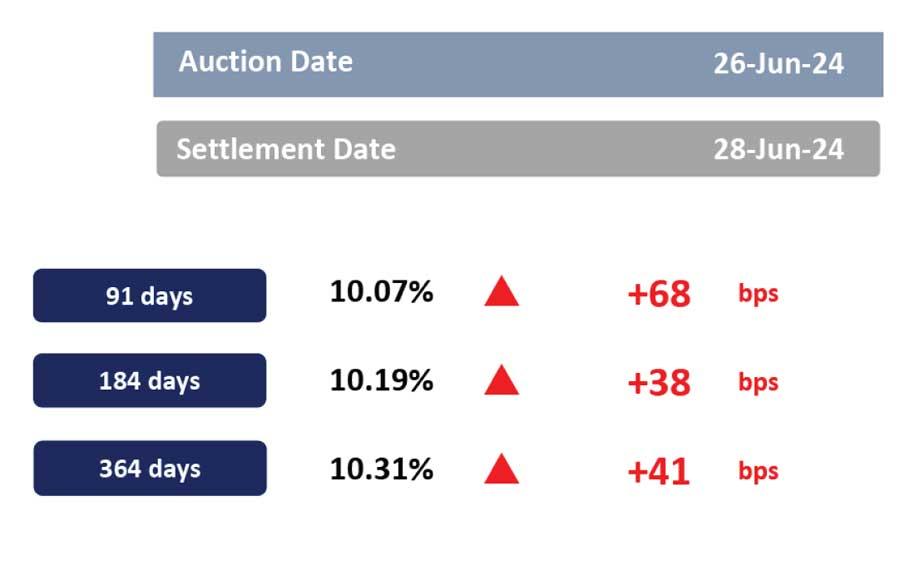

The investors adopted a wait-and-see approach amidst the escalating uncertainty, exacerbated by the lack of clear direction from the Central Bank, following the recent upsurge in auction yields.

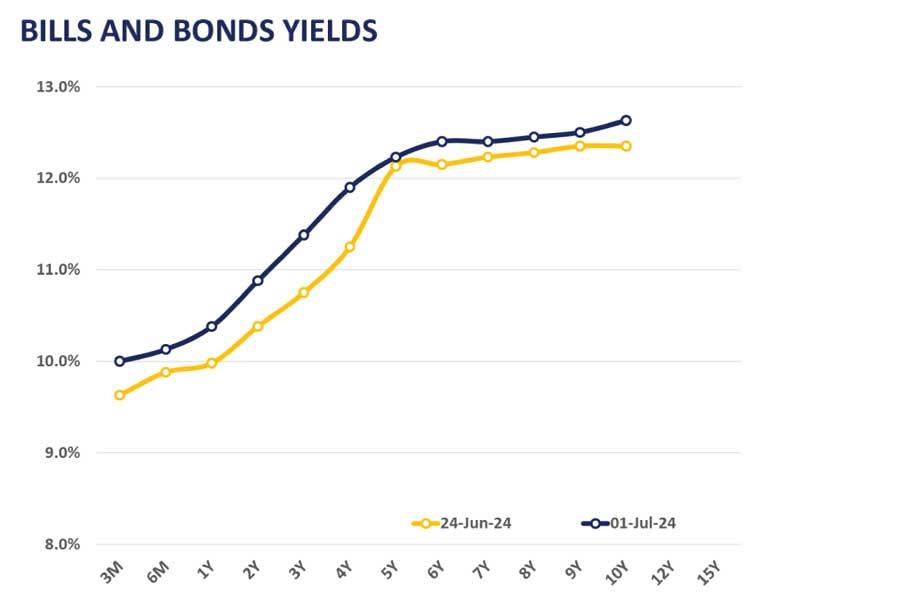

Consequently, trading predominantly centred on the short-mid end of the yield curve, with the bonds maturing on 01.06.26, 01.08.26, 15.12.26, 15.02.28 and 15.09.29 trading at 10.70 percent, 10.75 percent, 10.90 percent, 11.90 percent and 12.15 percent, respectively.

Moreover, the AWPR declined by 31 basis points to 8.78 percent for the week ending on June 28, 2024, whilst the AWDR fell to 8.38 percent in June 2024, from 9.05 percent in May 2024.

Furthermore, the trade deficit widened to US $ 2,170.4 million over the first five months of 2024, from US $ 1,925.7 million during the corresponding period of 2023, driven by a 6.6 percent year-on-year (YoY) surge in import expenditure, compared to a 4.1 percent YoY increase in export earnings.

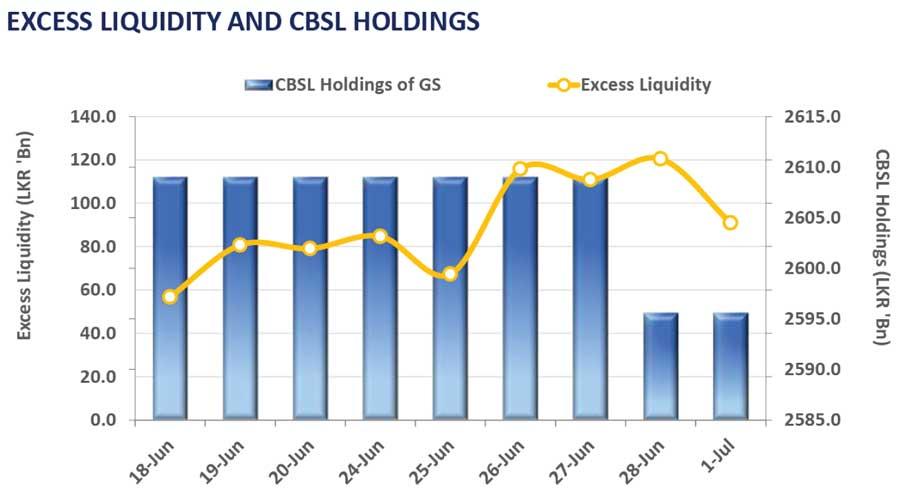

Meanwhile, overnight liquidity stood at Rs.91.0 billion, whilst the Central Bank holdings remained stagnant at Rs.2,595.6 billion. On the external front, the Sri Lankan rupee continued to depreciate against the US dollar for the second consecutive session, closing at Rs.306.0 compared to last week’s closing rate of Rs.305.7.

27 Nov 2024 20 minute ago

27 Nov 2024 59 minute ago

27 Nov 2024 1 hours ago

27 Nov 2024 1 hours ago

27 Nov 2024 2 hours ago