11 Jun 2024 - {{hitsCtrl.values.hits}}

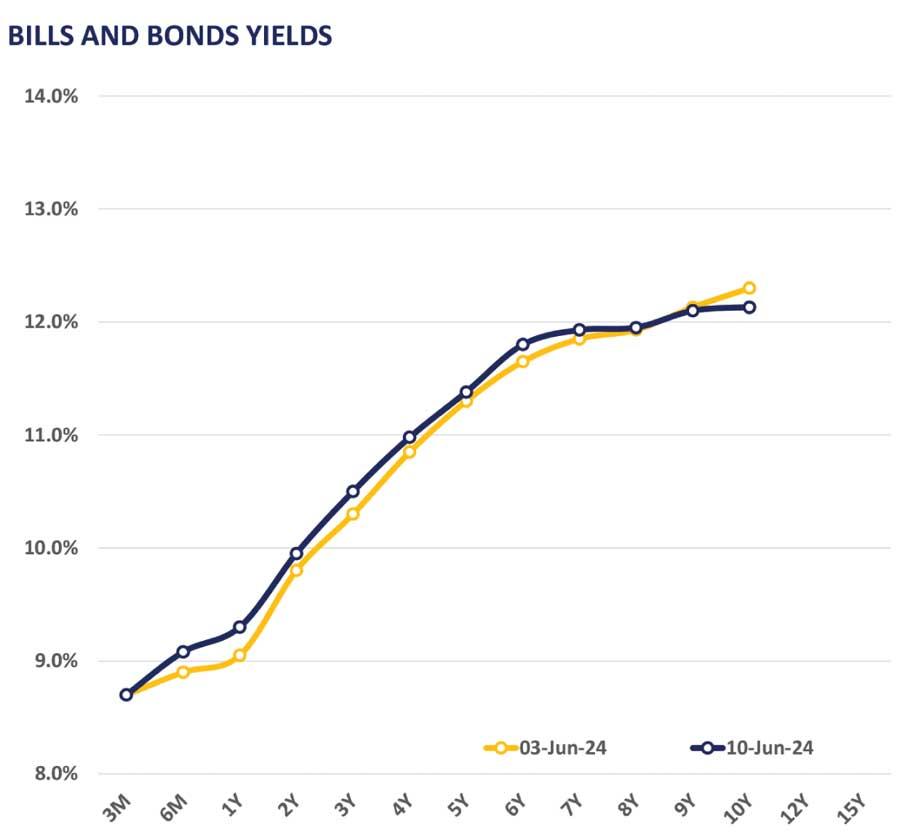

The secondary market yield curve remained broadly stable, as the investors adopted a wait-and-see approach, primarily due to the lingering uncertainty ahead of the International Monetary Fund (IMF) board meeting scheduled for June 12, June, 2024, regarding the disbursement of the IMF third tranche coupled with the anticipation surrounding this week’s auction.

Moreover, at the tail end of the curve, the 01.10.32 maturity traded at 11.95 percent during the day.

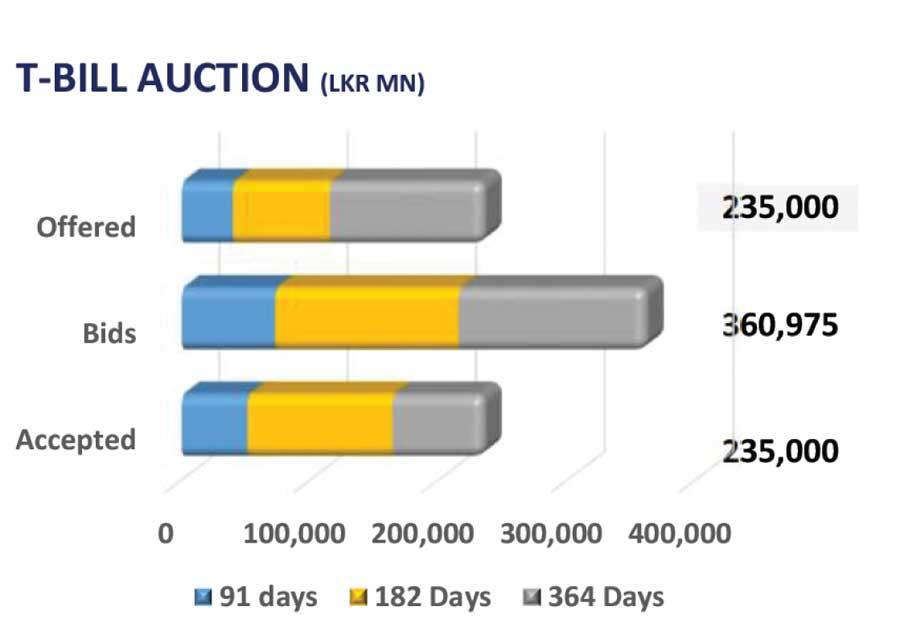

Furthermore, the Central Bank has announced the issuance of Rs.295.0 billion worth of T-bonds through an auction scheduled for June 13, 2024. This issuance includes Rs.60.0 billion, Rs.125.0 billion and Rs.110.0 billion T-bonds to be issued under the maturities of 15.10.27, 15.09.29 and 01.12.31, respectively.

On the external front, the Sri Lankan rupee remained steady against the US dollar, closing at Rs.302.7/US dollar for the day.

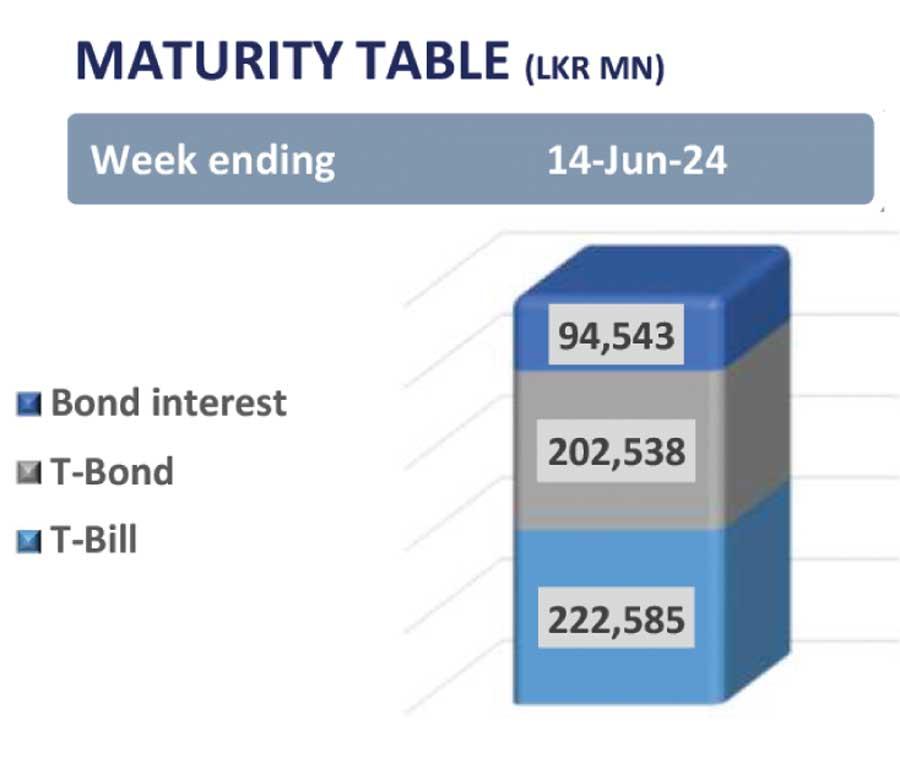

During the week ended June 7, 2024, the AWPLR declined by 08 basis points and concluded the week at 9.28 percent. Moreover, foreign holdings in government securities decreased by 5.1 percent week-on-week and registered at Rs.67.8 billion as of June 6, 2024.

Furthermore, overnight liquidity was recorded at Rs.162.7 billion, whilst the Central Bank holdings remained stagnant at Rs.2,615.6 billion during the day.

27 Nov 2024 5 hours ago

27 Nov 2024 6 hours ago

27 Nov 2024 7 hours ago

27 Nov 2024 7 hours ago

27 Nov 2024 7 hours ago