18 Dec 2023 - {{hitsCtrl.values.hits}}

The manufacturing sector, which has for a long time been struggling to stage a comeback after back-to-back shocks and demand destruction policies instituted with the economic stabilisation programme last year has finally turned a corner, recording an expansion last month.

According to the Purchasing Managers’ Index (PMI), the manufacturing sector PMI has registered an index value of 57.0 for November with a positive contribution from all sub-indices, indicating a strong expansion from an index value of 49.5 recorded in October.

This is the first time since March the manufacturing sector PMI returned to expansion after the index returned briefly to the expansionary territory when it recorded a value of 51.4 assisted by the March-April New Year season.

In the PMI, an index value of 50 serves as the threshold, distinguishing between expansion and contraction. A value above 50.0 signifies expansion, while a value below it indicates a decline. A value precisely at 50 denotes a neutral level where neither expansion nor contraction is observed.

However, the sector could not sustain the momentum in activities thereafter due to petering out of the festive demand, prolonged weakness seen in the demand for textile and apparel, rising costs and higher taxes, which together dampened any prospects the sector had.

November expansion in manufacturing activities was supported again by the seasonal pop seen in the demand for food and beverage sector and also what appears to be a sustained recovery in the demand for textiles and apparel from its key markets in the West.

The textiles and apparel manufacturing sector underwent a months-long decline in both demand and production, weighing heavily on the PMI as Sri Lanka’s key markets in the US and Europe including the UK were expecting to go into a recession due to higher inflation and the record scale of interest rate increases to tame such price increases.

However, it is now expected that these economies would most likely avoid a recession as they showed continuous resilience on the back of higher interest rates as consumer spending and jobs growth have remained continuously strong despite some slowdown.

During their policy meeting held last week, the Federal Reserve provided sufficient indications that they had concluded their series of rate hikes.

Convinced that their prior rate increases were adequate to bring inflation back to their 2.0 percent target, they projected at least three rate cuts for the upcoming year. This promptly elevated the values of stocks, bonds, and other assets tied to interest rates, triggering what is referred to as an ‘everything rally.’

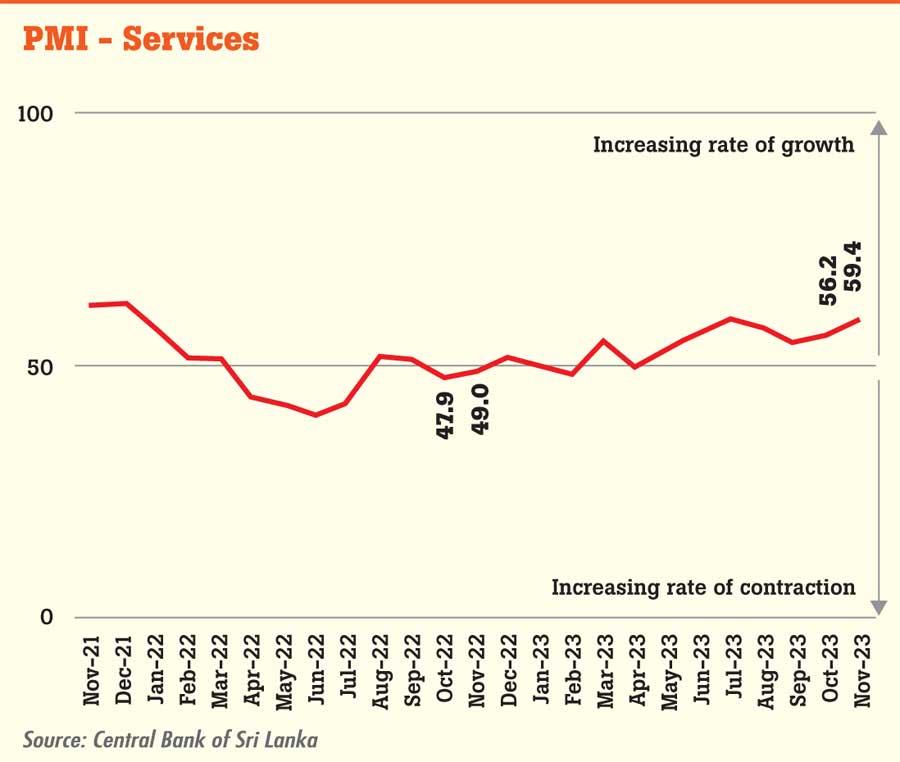

Meanwhile, the services sector PMI recorded an index value of 59.4, continuing its months-long expansion in activities.The November services activities were assisted by financial services, professional services, accommodation and food and beverage sub-sectors.

The survey indicated that the wholesale and retail trade sustained its growth, propelled by festive demand, which experienced an additional boost from seasonal discounts offered.

Respondents in both manufacturing and services sectors remained positive over the next three months outlook of their respective businesses, but showed apprehension over the upcoming increase in Value-Added Tax from January 2024.

28 Oct 2024 55 minute ago

28 Oct 2024 1 hours ago

28 Oct 2024 3 hours ago

28 Oct 2024 5 hours ago

28 Oct 2024 5 hours ago