11 Sep 2023 - {{hitsCtrl.values.hits}}

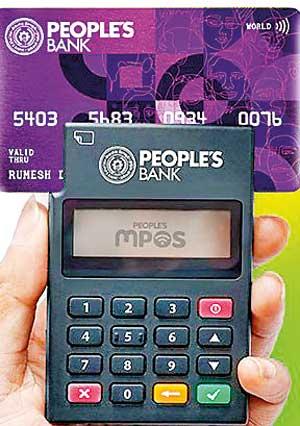

People’s Bank announced the launch of its innovative People’s Mobile Point of Sale (People’s mPOS) solution, empowering small and micro-level businesses to accept card payments on the go. With the introduction of this cutting-edge technology, merchants can now process transactions using their mPOS device, providing convenience and flexibility to their customers.

go. With the introduction of this cutting-edge technology, merchants can now process transactions using their mPOS device, providing convenience and flexibility to their customers.

People’s mPOS solution is designed to cater specifically to the needs of SMEs and micro-level businesses. It enables merchants to accept Visa, MasterCard, and Lanka Pay JCB cards, ensuring a wide range of payment options for customers.

One of the significant advantages of using People’s mPOS is the low discount/commission rate compared to traditional card terminals. Merchants can purchase this payment solution with minimum documentation & hassle. Moreover, People’s mPOS solution offers improved mobility and flexibility, enabling merchants to accept payments anywhere and at any time.

The key features of People’s Bank mPOS include a compact and portable device, weighing only 75g & Dimensions (L x W x H) - 89.7mm x 59 mm x 14.8mm allowing merchants to carry it effortlessly. The device is equipped with a rechargeable battery, ensuring uninterrupted operation. Additionally, the automatic settlement feature ensures that funds are credited to the merchant’s account on the next working day, streamlining the financial process.

People’s mPOS operates with a particular device’s Wi-Fi and SIM connectivity, ensuring reliable and uninterrupted communication. Merchants can generate SMS and email receipts for their customers, enhancing the overall customer experience. making it suitable for businesses with diverse requirements. Further, the People’s mPOS device is equipped with the latest security standards which ensure that all transactions are conducted securely and protects sensitive cardholder data.

Applying for People’s mPOS solution is a straightforward process. Interested merchants need to complete the mPOS application, sign the agreement, and provide a certified copy of their national identity card. Additionally, adevice payment receipt is required.

There are no monthly target service fees or commitments, making it a flexible and cost-effective solution. Once you purchase the deviceit’s fully owned property by the merchant.To assist merchants with the installation process, People’s Bank provides step-by-step guidance. Customers can rely on their expertise to seamlessly integrate the mPOS device into their existing systems.

As a leading mPOS solution provider, Payable Pvt Ltd has partnered with People’s Bank to deliver this groundbreaking technology. With their expertise and industry-leading services, Payable Pvt Ltd ensures seamless integration and secure transactions for merchants.

30 Oct 2024 14 minute ago

30 Oct 2024 47 minute ago

30 Oct 2024 56 minute ago

30 Oct 2024 2 hours ago

30 Oct 2024 2 hours ago