13 May 2024 - {{hitsCtrl.values.hits}}

Worker remittance in April expands 19.7% YoY to US$ 543.8 mn

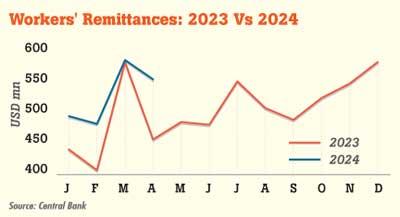

Worker remittances continued to remain strong through April despite some softening from March levels which typically gets the most in a year due to the traditional Sinhala and Tamil New Year.

According to the data, Sri Lankans working abroad sent back US$ 543.8 million in April, slightly eased from US$ 572.4 million in March but substantially higher from US$ 454.0 million a year ago.

With the April inflows, Sri Lanka has now received US$ 2,079.9 million from remittances in the first four months, up 11.4 percent from a year ago.

The restoration of the inflows from remittances and tourism flows helped the Sri Lankan economy’s return to normality quickly starting from around the latter part of 2022, but the higher taxes and interest rates became a drag on the economy which wasn’t warranted at the time.

Sri Lanka lost momentum in remittance flows starting from the second half of 2021 due to a substantial chunk being diverted through the informal money changers and migrant workers choosing to not send money home after having lost faith in the government in their ability and intentions on using the funds for the betterment of the people and the economy.

There were many sweeteners offered from the second half of 2021 onwards to get people to send their hard earned money back to their country and send them via the formal banking channels to alleviate the brewing crisis at the time.

But the false propaganda that made rounds were much louder than the facts.

The Colombo based think-tanks also joined the chorus to say the government was robbing the money sent by the migrants by keeping the dollar fixed at Rs.200, when in fact they should be offering a higher rate.

Little did the public know that devaluing the rupee could have sent inflation through the roof at a time when the global commodities prices were rising. And it did in fact happen when the Central Bank floated the currency in March 2022.

28 Nov 2024 1 hours ago

28 Nov 2024 2 hours ago

28 Nov 2024 2 hours ago

28 Nov 2024 4 hours ago

28 Nov 2024 4 hours ago