28 May 2024 - {{hitsCtrl.values.hits}}

A three-wheeler passing by the Central Bank of Sri Lanka building in Colombo.

This article is based on a panel discussion hosted by the Central Bank of Sri Lanka (CBSL) which stressed on the importance it places on being transparent and accountable to its stakeholders.

stressed on the importance it places on being transparent and accountable to its stakeholders.

Panelists included Governor of the CBSL Dr. Nandalal Weerasinghe, Senior Deputy Governor Yvette Fernando, Chairman of the Advocata Institute Murtaza Jafferjee, Managing Director and Chief Executive Officer of Standard Chartered Bank and Chairman of Sri Lanka Banks’ Association Bingumal Thewarathanthri and Senior Emeritus Professor of Economics at the University of Colombo Professor Sirimal Abeyratne.

A milestone year for CBSL

The Central Bank of Sri Lanka (CBSL), which serves as the primary authority in the nation’s financial sector, has faced growing challenges over the last few years in the wake of the unprecedented economic crisis that imposed significant hardships on the people of Sri Lanka.

faced growing challenges over the last few years in the wake of the unprecedented economic crisis that imposed significant hardships on the people of Sri Lanka.

The recently enacted Central Bank of Sri Lanka Act No. 16 of 2023, which came into law in September 2023, supersedes the Monetary Law Act No. 58 of 1949. One of the key provisions of the Act is to grant autonomy to the CBSL in formulating and implementing monetary policy. This independence is essential for ensuring that monetary policy decisions are made based on economic fundamentals rather than political considerations.

The Act also provides the legal framework for the establishment and operation of the CBSL, and clarifies its objectives of maintaining price stability, supporting the general economic policy framework of the Government, and ensuring financial system stability in the country. The Act sets out guidelines for accountability and transparency in the operations of the CBSL, requiring regular reporting to Parliament on its activities, policies, and performance indicators. This transparency helps build public trust in the institution.

As mandated by the Act, the CBSL released its inaugural Annual Economic Review detailing the macroeconomic developments and conditions of the financial system, a review of CBSL policies as well as the macroeconomic outlook for 2024 a summary of which follows.

As a result of decisive and corrective policy adjustments and structural reforms implemented by the Government and CBSL, the Sri Lankan economy progressed on the path towards restored macroeconomic stability in 2023. This has been reflected by the fact that inflation was brought down from historically high levels in 2022, to single-digit levels. While there may be short-lived deviations from the target due to tax hikes and supply side disruptions, inflation is projected to stabilise around the targeted level of 5 per cent (year-on-year) over the medium term.

The country also experienced exchange rate stabilisation and increased foreign exchange reserves. A current account surplus, new external financing and sovereign debt relief supported the cause. These improvements also allowed for the gradual relaxation of import restrictions. The resilience of the financial sector was also strengthened, despite high levels of risk, thus promoting growth and economic stability. Due to restored stability in the various sectors, including increased earnings from tourism and foreign worker remittances, the economy commenced its trajectory towards growth in 2023.

Following the restoration of price stability, the monetary policy stance was relaxed on several occasions since 2023 as inflation decelerated, interest rates softened and external sector pressures eased. Policy interest rates reduced due to decreases in inflation rates and expectations, reduced economic activity due to decline in domestic demand and easing of external sector pressure. Administrative measures taken by the CBSL to reduce lending interest rates as well the risk premium attached to Government securities helped the market interest rate structure adjust downwards. The CBSL arrived at this decision following a careful analysis of the current and expected developments in the domestic and global economy, with the aim of maintaining inflation at targeted levels and enabling the economy to stabilize.

In its message to the public, the CBSL highlighted that the recovery of the country’s economy depends on the continuity of reforms adopted so far, the successful implementation of the IMF Extended Fund Facility arrangement and completion of debt restructuring programme. Since the crisis is still ongoing, there is no room for slippages or costly mistakes or policy experiments. Building a strong institutional set up and a legal framework is essential in supporting the economy stabilise at its new normal. Political and social consensus on economic reforms is also critical in achieving sustained growth and the upliftment of public welfare.

Achievements that shaped 2023 and challenges expected in 2024

Addressing the panel discussion on ‘Sustaining Stability,’ Governor of the CBSL Dr. Nandalal Weerasinghe said that achieving significant deceleration in inflation rates has paved the way for the restoration of price stability in the country to a great extent. Supported by corrective policies and structural reforms, the benefits of reduced inflation levels were transmitted to the economy, which regained its momentum in 2023. Reduced inflation levels, coupled with a significant easing of external sector pressures also allowed for the relaxation of several monetary policies, which further bolstered domestic economic activity leading to an expansion in credit to the private sector.

Despite challenging situations faced in previous years, external sector stability in terms of the gradual rebuilding of external buffers was achieved in 2023. This helped maintain stability in the exchange rate which has had widespread implications on the economy. Improved foreign exchange inflows received from tourism and other services exports such as worker remittances have also helped the country in overcoming the severe foreign exchange crisis and building confidence.

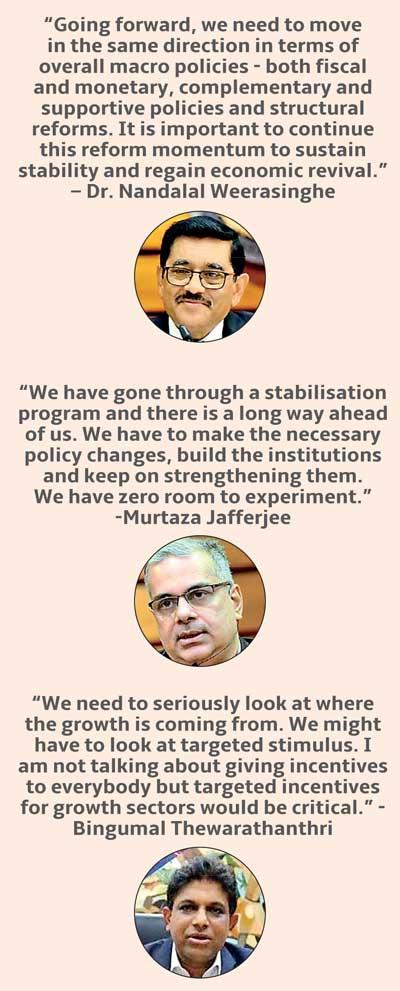

“Going forward, we need to move in the same direction in terms of overall macro policies, both fiscal and monetary, as well as complementary and supportive policies. It is important to continue this reform momentum to sustain stability and regain economic revival,” he pointed out. A few short-term goals to accomplish include the completion of the external debt restructuring process (Domestic Debt Optimisation Programme (DDO) has already been completed), securing agreements with commercial creditors, including China Development Bank and the completion of review with IMF will instill more confidence and endorsement that the nation is moving in the right direction.

No room for experimentation

In the first quarter of 2022, the population faced severe shortages of key food items, fuel, medicine, fertilizer among others, signalling that the market was not in equilibrium. There was complete market failure in almost every market in Sri Lanka - from the forex market to the money market to the real economy. Despite authorities implementing a number of intervention actions, market stability was eventually achieved through the natural forces of demand and supply. Failure to allow this process to happen would have caused prolonged shortages, triggering a domino effect that would have catalyzed through the economy. “Aggressive actions were taken, and the damage was repaired, and we came back faster.” While the country should celebrate this stabilization, Chairman of the Advocata Institute, Murtaza Jafferjee, cautioned against complacency.

Claiming to have a reputation as an alarmist and citing a report from the IMF, Jafferjee highlighted the worrying trend of repeat defaulters among emerging market economies. 58 percent of economies that defaulted once tended to default again, within a period of three years, despite attempts at restructuring. He warned Sri Lanka against becoming one such statistic.

He went on to explain how the only way to avoid a second default is through growth. In many instances growth comes through factor accumulation (an increase in the quantity of a factor, usually capital or sometimes human capital). However, Sri Lanka does not have large amounts of capital to invest in growth, and as such, needs to grow its economy without excessive factor accumulation. The only way forward is through increased productivity, the implementation of market-oriented reforms and improved competition instead.

He reiterated the importance of building on current stabilization endeavors, implementing policy changes and strengthening institutions to address economic challenges, leaving no room for trial and error. “We have gone through a stabilisation program and there is a long way ahead of us. We have to make the necessary policy changes, build the institutions and keep on strengthening them. We have zero room to experiment.” he concluded.

Impact of debt restructuring and getting the nation back on track

Standard Chartered Bank Sri Lanka’s CEO, Bingumal Thewarathanthri, discussed the effects of external debt restructuring on the financial sector, investor confidence, and the overall economy. He remains positive about the debt restructuring process and foresees a potential increase in sovereign ratings by at least one notch which could translate to a 2-3 percent improvement within 2-3 weeks following the bond exchange.

“This will change a lot of things for the banking sector. When the default happened, a lot of the agencies and banks moved away from confirming LC’s or doing trade with Sri Lanka. Sri Lanka had to work on other methods to import goods. Trade got restricted and entire trade cycles had to switch to cash basis. That whole dynamic will change. We will see more goods coming into the country, and we can expect a stronger rupee when the restructuring is over in a couple of months. For the overall business community, it will be a very big positive.” However, he too warned against complacency, pointing out the imminent increase in the import bill and the potential strain it could put on the currency.

In the global context, Thewarathanthri drew comparisons with other historic defaults and the experiences of Latin American countries post-default, stressing the importance of staying strictly on course with the IMF programme and getting it right the first time around.

He highlighted the importance of focusing on private sector productivity and administering targeted stimulus measures to bolster growth. “We need to seriously look at where the growth is coming from. We might have to look at targeted stimulus. I am not talking about giving incentives to everybody but targeted incentives for growth sectors would be critical,” he detailed.

To ease the massive brain drain currently faced by Sri Lanka, not just in the banking sector where staggering numbers have migrated, but in every industry, he asserted the need for sustainable policies regarding talent retention and employee creation. He urged policymakers to make well-thought-out data-driven decisions rather than reverting to old ways of providing irrational incentives, thus steering Sri Lanka towards sustainable productivity and growth.

Key policy reforms

Senior Deputy Governor Yvette Fernando noted that the CBSL has taken several proactive measures to ensure financial system stability including strengthened emergency liquidity assistance, resolution action and crisis preparedness and management. Increasing the empowerment of CBSL as a resolution authority and introducing new legal provisions to intervene if difficulties were faced by financial institutions further strengthened the infrastructure of the banking system.

In summary, the CBSL is committed to maintaining domestic price stability, external sector stability and financial stability, thereby enabling sustainable economic growth. While the Sri Lankan economy progressed on the path towards restored macroeconomic stability in 2023 and annual economic growth is expected to turn positive in 2024 and reach its potential over the medium-term, these forecasts hinge on the continuation of reforms and better consumer and business sentiment. Timely completion of external debt restructuring will also support Sri Lanka in its efforts towards sustainable growth.

28 Nov 2024 58 minute ago

28 Nov 2024 1 hours ago

28 Nov 2024 2 hours ago

28 Nov 2024 4 hours ago

28 Nov 2024 5 hours ago