20 Mar 2023 - {{hitsCtrl.values.hits}}

Colombo-based economic think tank Verité Research said the current bout of volatility seen in Sri Lanka’s exchange rate is anathema to the economy as it increases uncertainty and risks for businesses as well as investments.

Coming up with what they called a ‘Debt Update’ after nearly two weeks of currency appreciation against the dollar, the economists at the think tank said that the local officials are missing the point in exchange rate management.

“The movement of the Sri Lankan Rupee (LKR) against the United States Dollar (US$) has been the focus of media and public attention since the onset of the economic crisis. In recent weeks the LKR appreciation against the US$ was seen as a sign of recovering economic stability,” the Debt Update noted.

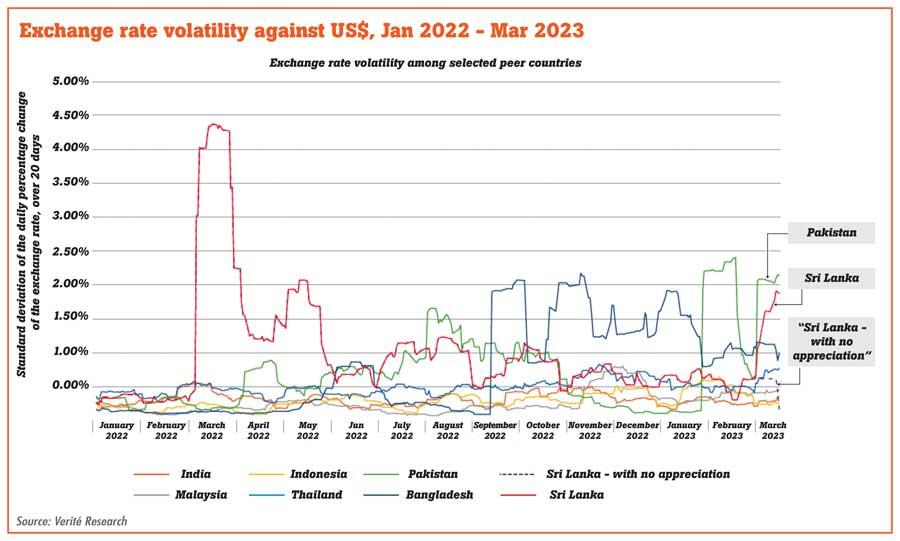

“However, Verité Research analysis shows that the more critical factor for economic stability and businesses confidence is exchange rate volatility rather than the rate or its appreciation”, they added.

Sri Lankan rupee appreciated continuously against the US dollar by about 7 percent by the end of last week to Rs.337/US dollar after the Central Bank eased the surrender rule on foreign currency before doing away with it completely a week later.

A fortnight ago the rupee appreciated by about 12 percent against the dollar before shedding some gains last week.

The optimism over fresh inflows and a quicker deal with the International Monetary Fund (IMF) also drove the rupee higher.

By using their own formula, Verite measured the volatility of the Sri Lankan rupee at 1.88 percent and only second to Pakistani Rupee in the South and South Asian region.

They put the volatility at 0.15 percent had the rupee remained unchanged at Rs.362/ US dollar.

They then said the greater volatility in exchange rates increases the uncertainty and risk for businesses and investments.

“Therefore, it can be more important for Sri Lanka to focus on minimising the volatility of the exchange rate, rather than maximising its appreciation. This will help reduce uncertainty and risk premiums that hamper growth in economic activity,” they added.

02 Nov 2024 19 minute ago

02 Nov 2024 1 hours ago

02 Nov 2024 3 hours ago

01 Nov 2024 01 Nov 2024

01 Nov 2024 01 Nov 2024