08 May 2024 - {{hitsCtrl.values.hits}}

The secondary market saw slight buying interest during the early trading hours yesterday, largely on the 01.06.26 maturity, which recorded trades at 10.50 percent.

However, selling interest emerged on the back of profit taking towards the latter part of the day, with interest emerging on 15.12.26 at 10.70 percent, 01.05.27 at 11.00 percent and 15.09.27 at 11.10 percent.

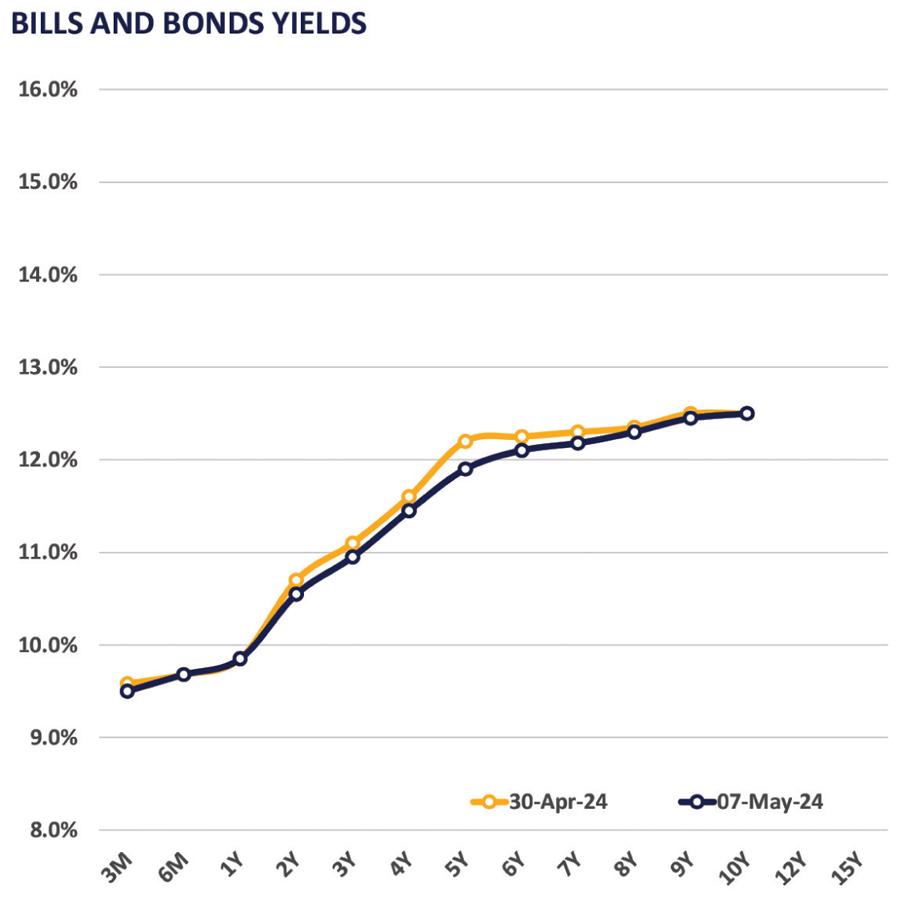

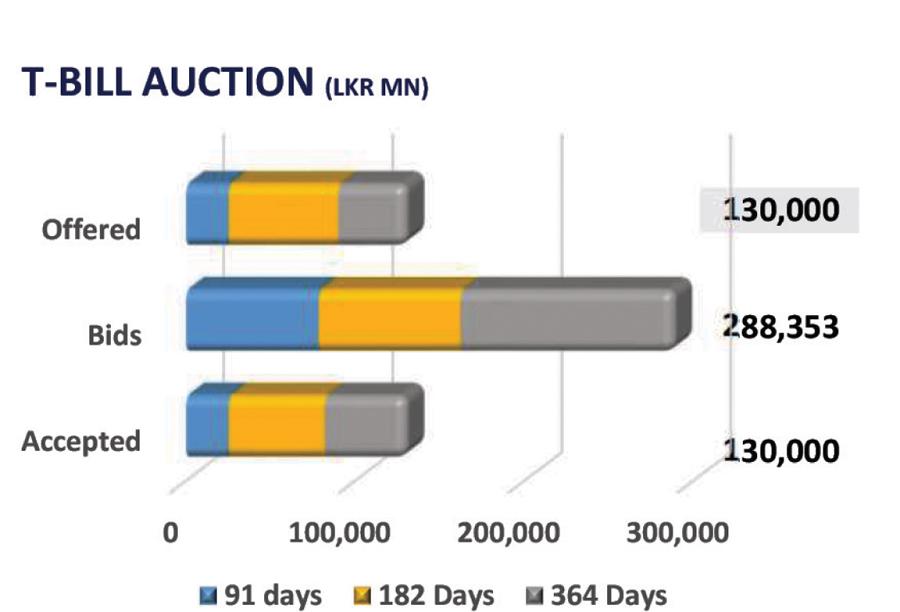

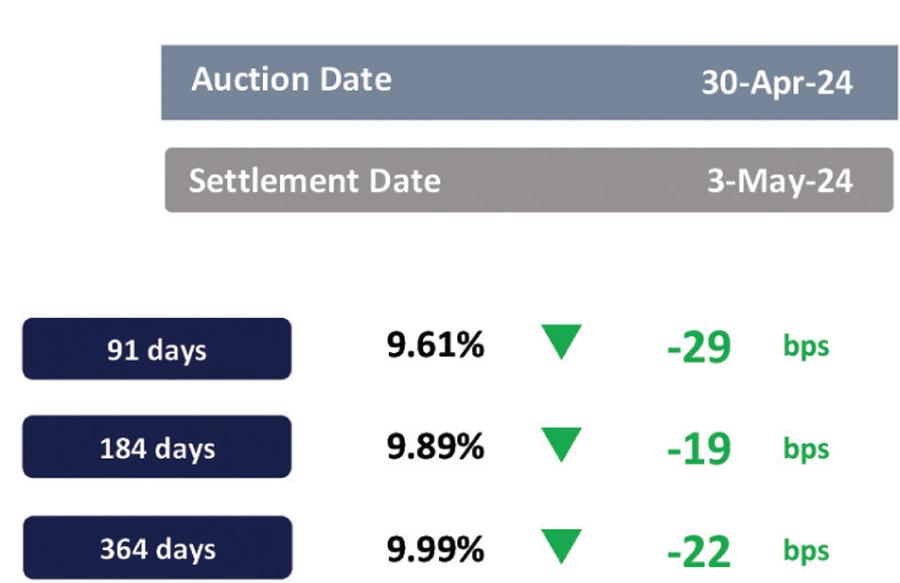

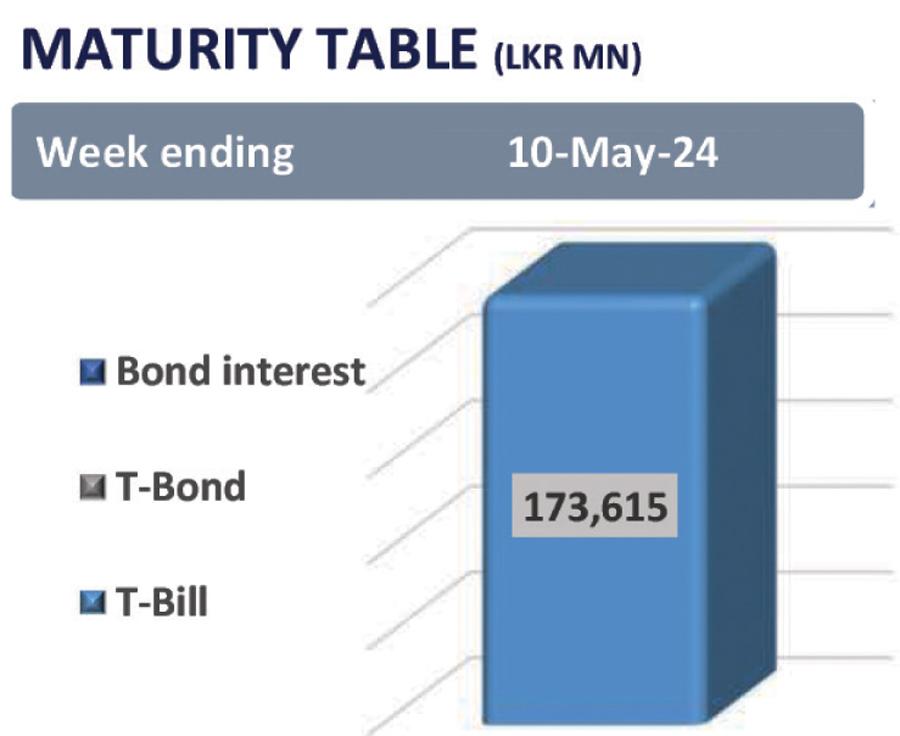

The secondary market yield curve was more or less unchanged during the day amidst thin trading volumes. Meanwhile, CBSL weekly bill auction is scheduled for tomorrow, where a total of Rs. 155.0 billion is expected to be raised, with Rs. 30.0 billion expected to be raised from the 91-day maturity whilst Rs. 60.0 billion and Rs. 65.0 billion is expected to be raised from 182-day and 364-day maturities, respectively.

Meanwhile, on the external front, LKR depreciated against the greenback for the second consecutive day, as CBSL published mid-rate was recorded at LKR 297.75/dollar.

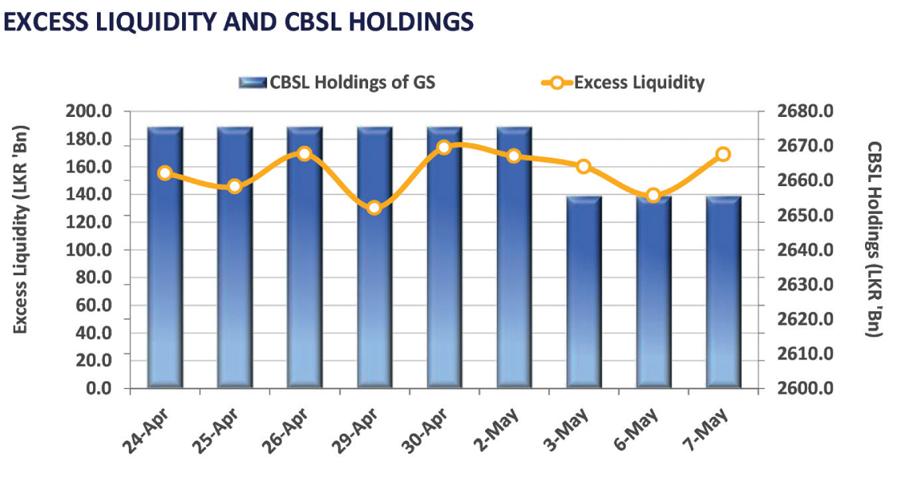

Moreover, face value of the CBSL owned securities portfolio declined slightly during the week in concern to Rs. 2,655.6 billion from Rs. 2,675.6 billion from the previous week.

28 Nov 2024 2 hours ago

28 Nov 2024 3 hours ago

28 Nov 2024 4 hours ago

28 Nov 2024 6 hours ago

28 Nov 2024 7 hours ago