01 Jun 2023 - {{hitsCtrl.values.hits}}

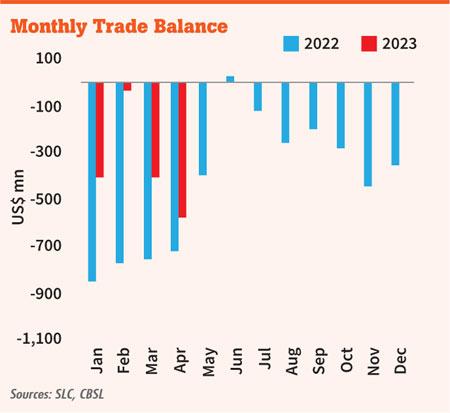

Sri Lanka’s trade deficit continued to narrow in April, as the decline in imports outpaced the decline in exports, the external sector data released by the Central Bank showed.

Sri Lanka’s trade deficit continued to narrow in April, as the decline in imports outpaced the decline in exports, the external sector data released by the Central Bank showed.

The deficit in the trade account narrowed to US $ 583 million in April 2023, from US $ 728 million a year ago.

However, the trade deficit showed an increasing trend on a monthly basis since February 2023.

The cumulative deficit in the trade account during January to April 2023 was US $ 1,444 million, a sizeable decline from US $ 3,125 million.

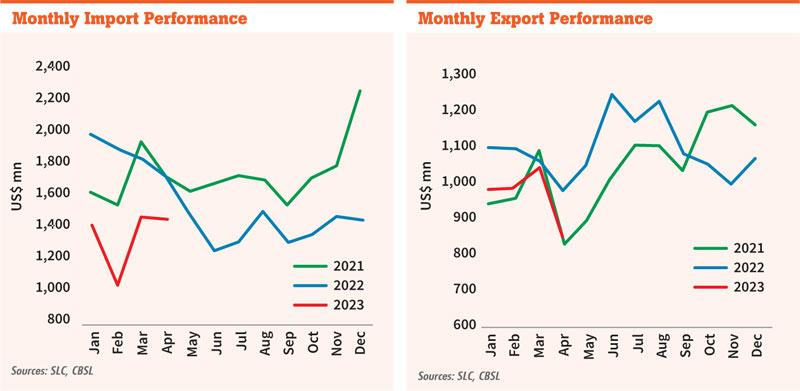

Sri Lanka’s export earnings and import expenses fell to US $ 893 million and US $ 1,431 million, respectively in April 2023, from US $ 971 million and US $ 1,699 million a year ago.

The cumulative export income of 2023 until April was US $ 3,846 million, compared to US $ 4,225 million reported for the corresponding period of 2022.

The cumulative import expenses declined to US $ 5,290 million by end-April 2023, compared to US $ 7,350 million a year ago.

The decline in April merchandise export income was mainly caused by the slowdown in apparel and textile imports, Sri Lanka’s largest industrial export.

During April 2023, earnings from tourism and workers’ remittances rose substantially compared to the previous year.

The Central Bank said the rupee during the year up to May 31, 2023, appreciated 22.9 percent against the dollar.

The country’s gross foreign reserves improved to US $ 2.8 billion by the end of April 2023, from US $ 1.8 billion at the end of April 2022. This includes the US $ 1.4 billion currency swap from China, which has conditionalities on usage.

The Central Bank said it intervened in the domestic foreign exchange market to prevent excessive appreciation of the currency and to build reserves, by purchasing US $ 148 million from the domestic foreign exchange market on gross basis in April 2023.

This resulted in a notable improvement in liquid reserves by the end of April 2023. The Central Bank absorbed US $1,235 million on gross basis during January to April 2023.

01 Nov 2024 21 minute ago

01 Nov 2024 31 minute ago

01 Nov 2024 36 minute ago

01 Nov 2024 1 hours ago

01 Nov 2024 1 hours ago