07 Dec 2022 - {{hitsCtrl.values.hits}}

Sri Lanka’s merchandise exports in October fell for the first time since March this year weighed down by the slowing garment exports as the inflationary pressures and the recessionary fears in the West had a bearing on the months-long momentum for Sri Lankan made clothing.

slowing garment exports as the inflationary pressures and the recessionary fears in the West had a bearing on the months-long momentum for Sri Lankan made clothing.

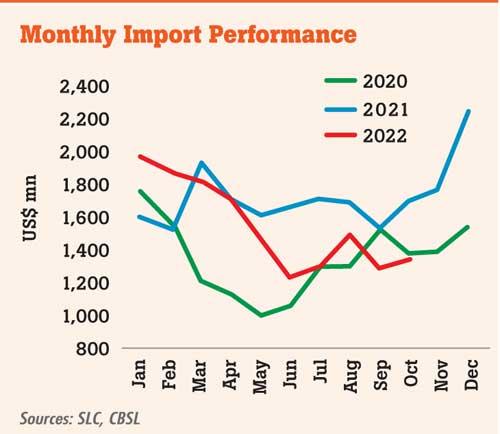

The earnings from merchandise exports fell by 11.9 percent over the same month last year to US$ 1,051 million as industrial exports fell by 13.4 percent to US$ 819.9 million, weighed down by textiles and garment exports which fell by a similar percentage to US$ 443.5 million. On a monthly basis too the exports slipped from US$ 1,079 million in September. However, merchandise imports continued its descent for the eighth consecutive month at a pace far exceeding the decline in exports, making possible for the country to continue to narrow its trade deficit.

The trade deficit in October came in at US$ 285 million, but showed some increment from US$ 206 million

in September.

On a cumulative basis, the total trade deficit for the ten months added up to US$ 4,389 million, down from US$ 6,501 million in the corresponding period in 2021.

Sri Lanka’s authorities since April this year clamped down on demand in the economy by raising interest rates, bringing in controls on certain non-essential imports and imposing restrictions on payments through open accounts. But, some relaxation in some of these controls was seen as of late.

For instance, the imports bill for October came in at US$ 1,336 million, down 21.2 percent from a year earlier period but showed an uptick from September’s US$ 1,284 million. The oil imports which typically take a bigger share in the import bill rose by 3.0 percent to US$ 396.5 million.

For instance, the imports bill for October came in at US$ 1,336 million, down 21.2 percent from a year earlier period but showed an uptick from September’s US$ 1,284 million. The oil imports which typically take a bigger share in the import bill rose by 3.0 percent to US$ 396.5 million.

Sri Lanka’s imports raced to just shy of Rs.2.0 billion levels through January this year, roughly double what it earned from merchandise exports due to a combination of factors, leading of which was the booming global commodities prices.

After banning nearly 1,500 products from importing in August as part of its broad-based measures to both cool down the economy and also to manage the acute foreign currency liquidity situation which prevailed through July, the government in two rounds relaxed such bans, first in September and then most recently in late November, lifting the controls on most of the products which were originally placed under the ban, heeding to continuous lobbying by importers.

While there has been some semblance of improved foreign currency liquidity in recent times, some cautioned the government over its rush to relax the import controls as that could reverse the progress made causing additional stress in the system in the absence of sizable foreign exchange inflows.

It now appears that the much anticipated bailout money from the International Monetary Fund could be months away as debt assurances from the country’s creditors could take longer than what officials anticipated.

away as debt assurances from the country’s creditors could take longer than what officials anticipated.

There were reports over the weekend that Paris Club creditors had agreed to provide Sri Lanka with a 10-year moratorium on its debt, while calling for equal pain sharing between the rich global north and the developing global south.

China, which holds nearly half of Sri Lanka’s outstanding debt still remains a wild card in achieving multilateral consensus on debt assurances.

Further delay in unlocking the IMF rescue package for Sri Lanka could spell further economic disaster ahead for the country and its people who had already gone through the worst by way of hyperinflation, joblessness and poverty.

05 Nov 2024 8 hours ago

05 Nov 2024 05 Nov 2024

05 Nov 2024 05 Nov 2024

05 Nov 2024 05 Nov 2024

05 Nov 2024 05 Nov 2024