09 Aug 2023 - {{hitsCtrl.values.hits}}

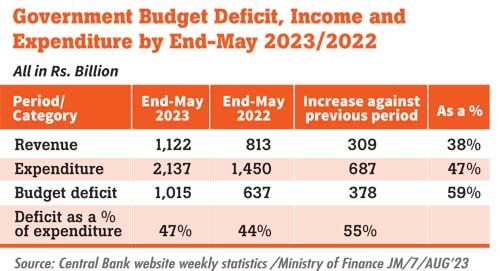

Despite imposing heavy taxes and increased tax collection, the government budget deficit for the period end-May 2023 has increased to Rs.1,015 billion, which is a 59 percent increase against the 2022 end-May figures.

against the 2022 end-May figures.

Another negative feature is, due to the heavy taxes imposed and still very high bank interest rates, the economy has not grown and the gross domestic product (GDP) growth rates have been negative. Although inflation – point-to-point – has reduced, the cost of living has gone up. These have been predicted by the writer’s previous articles published

in newspapers.

Despite the domestic debt restructuring efforts concluded successfully, it’s unlikely the government budget deficit will reduce in the near future. The government policymakers are targeting a strategy of ‘primary surplus’ – meaning before charging debt servicing- interest payments in the fiscal consolidation as a first step.

This International Monetary Fund (IMF)/Central Bank of Sri Lanka strategy of trying to achieve primary surplus is being challenged by many eminent economists. As these economists have been advocating, the government must focus on the GDP growth rate increase – meaning real economics, not financial numbers (transfer payments), etc. only.

In simple terms, the fundamental solution lies in making one thing to happen, “economic and business activities must be

happening everywhere”.

GDP growth = C + I + G + (exports-imports): Where, C – consumption and I – investment, G – government spending.

It is true that no country has experienced rapid growth without adherence to sound economic principles such as market-oriented incentives, property rights and sound monetary and fiscal policies. But these can be implemented via policy arrangements that are quite unconventional. Also, any attempts to emulate successful policies elsewhere in other countries often fail.

The empirical studies conducted by eminent economists revealed that successful policy reforms are those that package sound economic principles around local capabilities, constraints and opportunities. It does not take a whole lot of reforms to stimulate economic growth. However, it may be difficult to identify where the binding constraints lie.

The government should slowly and steadily do everything possible and allow the private sector, including SMEs, to produce everything possible to a level that some surplus (after consuming locally) is being first created and then exported.

consuming locally) is being first created and then exported.

In addition, we must try and increase the services sector, non-merchandise – tourism, travel and inward remittances – do everything to keep (without migration) the skilled and professional staff/people, including doctors, engineers, ICT and finance professionals, academics, teachers and highly skilled technicians, etc. and prevent businesses/factories to be relocated outside Sri Lanka.

Let us try and export unskilled labour as much as possible, with multilateral agencies backing, if they are sincere in their advice. Further, the government must synchronise everything between (i) business activities, SMEs producing goods, growing crops and other services and (ii) government departments to facilitate smooth functioning – for example – release water to farmers in a timely manner. It is not only fertiliser that is needed – water and sunlight also more important – H, O, C and then make correction to N, P, K deficiencies.

Empirical studies have revealed that reforms are necessary but the impact of these is heavily dependent on circumstances. In short, growth strategies require considerable local knowledge. It seems the policymakers, including the IMF have not undertaken a serious diagnostic study to identify the real causes of economic downturn and select few, relevant structural reforms first to put into practice, focussing GDP growth. Initial recovery and sustained growth strategies are two different aspects. Let us concentrate on simple things such as how to make businesses and people work, in order to increase GDP growth.

The most important question is how to get entrepreneurs excited about investing – meaning all their activities such as expanding capacities, producing new products, bringing new technologies, etc. Local conditions matter not because economic principles change from country to country but because it requires

local knowledge.

(Jayampathy Molligoda is a company Director and a former Sri Lanka Tea

Board Chairman)

31 Oct 2024 4 hours ago

30 Oct 2024 8 hours ago

30 Oct 2024 8 hours ago

30 Oct 2024 8 hours ago

30 Oct 2024 30 Oct 2024