16 Jan 2023 - {{hitsCtrl.values.hits}}

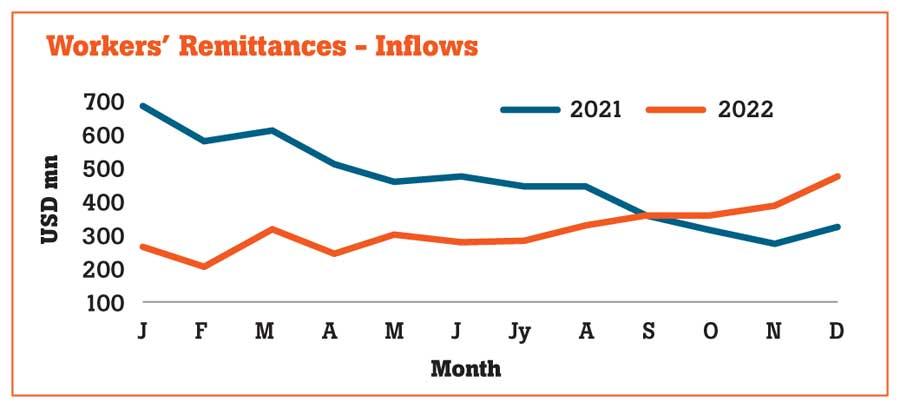

Worker remittance income received the typical seasonal pop in December to reach the highest level in eighteen months, continuing the months-long growth streak in Sri Lanka’s key foreign exchange income, but what the country could muster for the year was still sharply down from its previous year’s levels.

The data showed that Sri Lanka’s migrant workers had sent US$ 475.6 million as remittances in December, up from US$ 384.4 million received in November.

This also marked an increase from US$ 325.2 million repatriated back in December 2021 before which time Sri Lanka began confronting a prolonged slowdown in remittances mainly due to the heightened level of grey market activity which undermined the foreign currency received via official channels.

The last time Sri Lanka had a higher monthly remittances income than in December 2022 was back in June 2021, where remittance income stood at US$ 478.4 million. With the December income, Sri Lanka received US$ 3,789.5 million in total from remittances in 2022, down 31 percent from 2021 and 46 percent from 2020 when the country received US$ 7.1 billion. December typically brings higher worker remittances due to the year-end festive season as migrant workers tend to send more money to support their families back home.

The higher number of labour migrations may also have added a fillip to recent worker remittance figures as Sri Lanka saw over 300,000 people migrating for foreign employment in 2022, the most for any year. Given the delay in getting Board approval for the International Monetary Fund bail-out package, increase in remittances along with the recovery in the tourism income amid the debt standstill will help the country to spend for its imports, alleviating the difficulties faced by the people.

Sri Lanka recently relaxed controls on certain imported items which were banned in August in line with the slight improvement seen in foreign currency liquidity conditions in the domestic market.

Standard Chartered Global Research last week said unlocking the US $ 2.9 billion IMF stabilisation package is likely to happen towards the second quarter of this year due to the protracted negotiations in obtaining creditor assurances from Sr Lanka’s official crditors.

President Ranil Wickremesighe last week met with envoys from Japan and China while the Indian Minister of External Affairs is due later this week to take up the issue of debt restructuring. China, India and Japan remain as Sri Lanka’s largest official creditors.

05 Nov 2024 15 minute ago

05 Nov 2024 21 minute ago

05 Nov 2024 52 minute ago

05 Nov 2024 1 hours ago

05 Nov 2024 1 hours ago