04 Jun 2024 - {{hitsCtrl.values.hits}}

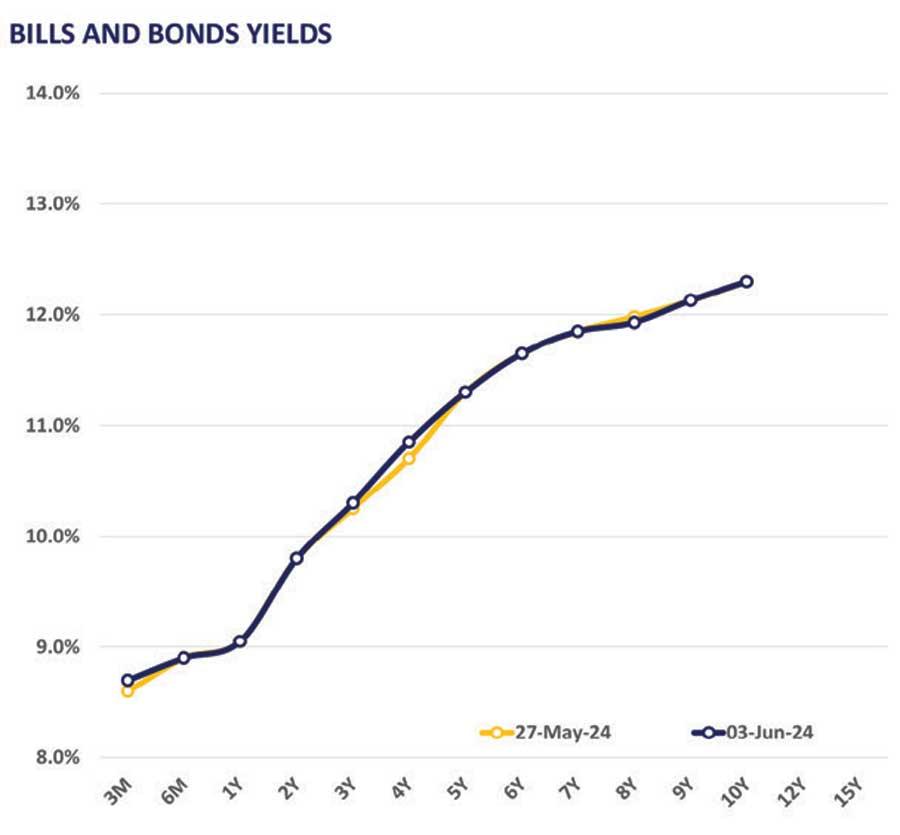

The secondary market yield curve remained broadly stable, reflecting subdued activity and thin trading volumes across the market.

across the market.

Among the traded maturities, 15.09.27 was seen trading at 10.40 percent while on the mid end, the 2028 maturities, including 15.03.28, 01.05.28 and 01.07.28, changed hands at 10.75 percent, 10.85 percent and 10.80 percent, respectively.

Meanwhile, on the long end of the curve, 01.10.32 traded at 11.85 percent.

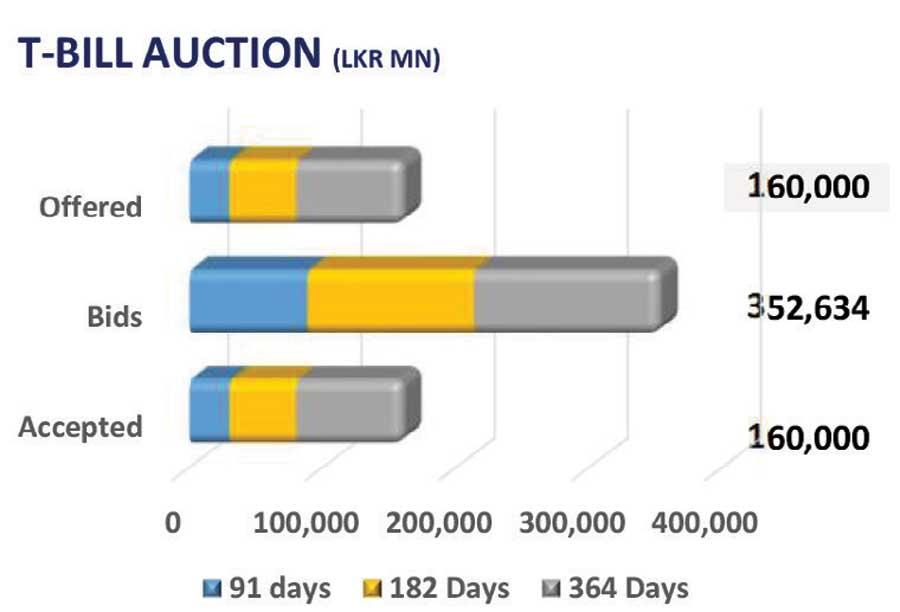

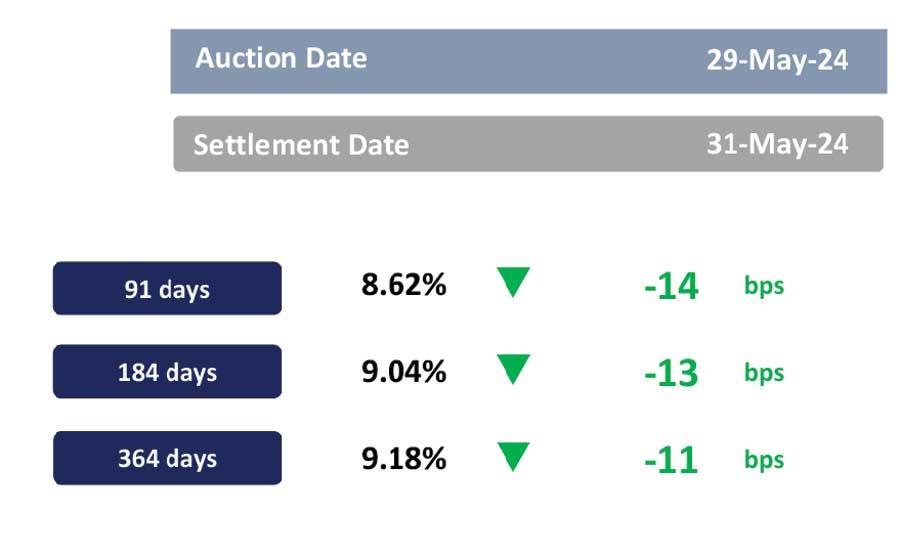

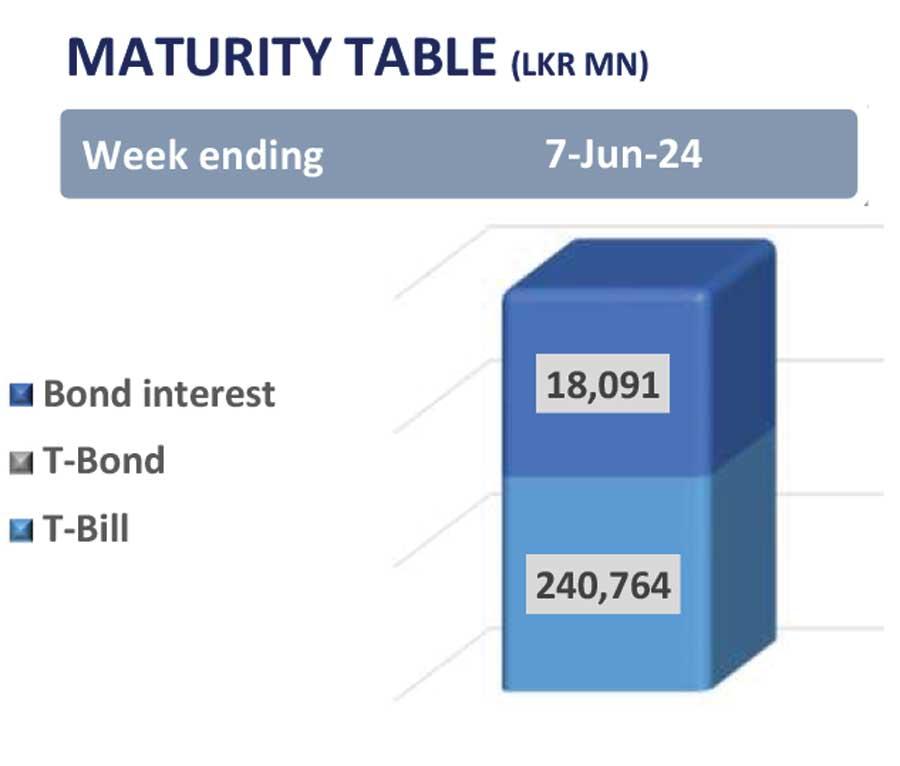

Moreover, the Central Bank announced an issue of Rs.235.0 billion T-bills through an auction to be held on June 5, 2024, out of which Rs.40.0 billion is to be raised from the 91-day maturity, Rs.75.0 billion is expected to be raised from the 182-day maturity while Rs.120.0 billion is to be raised from the 364-day maturity.

On the external front, the Sri Lankan rupee remained steady against the US dollar, closing at Rs.301.9/USD. During the week ending on May 31, 2024, the AWPLR declined by 32 basis points and concluded the week at 9.36 percent.

Moreover, foreign holdings in government securities decreased by 4.1 percent week-on-week and registered at Rs.71.5 billion as of May 30, 2024.

28 Nov 2024 1 hours ago

28 Nov 2024 1 hours ago

28 Nov 2024 2 hours ago

28 Nov 2024 3 hours ago

28 Nov 2024 6 hours ago