24 Feb 2017 - {{hitsCtrl.values.hits}}

By Jonathan Woetzel, Richard Sellschop, Michael Chui, Sree Ramaswamy, Scott Nyquist, Harry Robinson, Occo Roelofsen, Matt Rogers and Rebecca Ross

The ways we consume energy and produce commodities are changing. This transformation could benefit the global economy, but the resource producers will have to adapt to

stay competitive.

The world of commodities over the past 15 years has been roiled by a “supercycle” that first sent the prices for oil, gas and metals soaring, only for them to come crashing back down. Now, as the resource companies and exporting countries pick up the pieces, they face a new disruptive era. Technological innovation—including the adoption of robotics, artificial intelligence, Internet of things technology, and data analytics—along with macroeconomic trends and changing consumer behaviour are transforming the way the resources are consumed and produced.

On the demand side, consumption of energy is becoming less intense and more efficient as people use less energy to live their lives and as energy-efficient technologies become more integrated in homes, businesses and transportation. In addition, technological advances are helping to bring down the cost of renewable energies, such as solar and wind energy, handing them a greater role in the global economy’s energy mix, with significant effects for both producers and consumers of fossil fuels.

On the supply side, the resource producers are increasingly able to deploy a range of technologies in their operations, putting mines and wells that were once inaccessible within reach, raising the efficiency of extraction techniques, shifting to predictive maintenance and using sophisticated data analysis to identify, extract and manage resources.

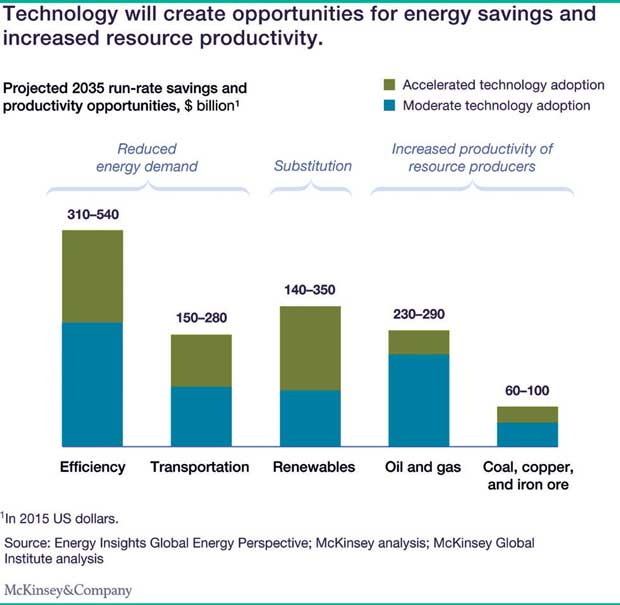

A new McKinsey Global Institute report, ‘Beyond the Supercycle: How Technology is Reshaping Resources’, focuses on these three trends and finds they have the potential to unlock around US $ 900 billion to US $ 1.6 trillion in savings throughout the global economy in 2035 (exhibit), an amount equivalent to the current gross domestic product (GDP) of Canada or Indonesia. At least two-thirds of this total value is derived from reduced demand for energy as a result of greater energy productivity, while the remaining one-third comes from productivity savings captured by resource producers.

The demand for a range of commodities, particularly oil, could peak in the next two decades and the prices may diverge widely. How large this opportunity ends up being depends not only on the rate of technological adoption but also on the way resource producers and policymakers adapt to their new environment.

The policymakers could capture the productivity benefits of this resource revolution by embracing technological change and allowing a nation’s energy mix to shift freely, even as they address the disruptive effects of the transition on employment and demand. Resource exporters whose finances rely on resource endowments will need to find alternative sources of revenue. Importers could stock up strategic reserves of commodities while prices are low, to safeguard against supply or price disruptions and invest in infrastructure and education.

For resource companies, particularly incumbents, navigating a future with more uncertainty and fewer sources of growth will require a focus on agility. Harnessing technology will be essential for unlocking productivity gains but not sufficient.

Companies that focus on the fundamentals—increasing throughput and driving down capital costs, spending and labour costs—and that look for opportunities in technology-driven areas may have an advantage. In the new commodity landscape, incumbents and attackers will race to develop viable business models and not everyone will win.

While the changes facing resource producers and policymakers are likely to be complex and numerous, the rewards of greater productivity, faster growth, and a less resource-intense economy can benefit all.

(Jonathan Woetzel is a director of the McKinsey Global Institute and Michael Chui is an MGI partner; Richard Sellschop is a partner in McKinsey’s Stamford office; Sree Ramaswamy is a partner in the Washington, DC, office; Scott Nyquist is a senior partner in the Houston office; Harry Robinson is a senior partner in the Southern California office; Occo Roelofsen is a senior partner in the Amsterdam office; Matt Rogers is a senior partner in the San Francisco office and Rebecca Ross is an associate partner in the London office)

25 Nov 2024 1 hours ago

25 Nov 2024 2 hours ago

25 Nov 2024 2 hours ago

25 Nov 2024 4 hours ago

25 Nov 2024 4 hours ago