05 May 2017 - {{hitsCtrl.values.hits}}

Black pepper (Piper nigrum L.), known as the ‘king of spices’, is the most important and widely used spice in the world. Pepper production is confined to a few countries in Asia including Sri Lanka and the Pacific, Brazil and Madagascar.

Black pepper (Piper nigrum L.), known as the ‘king of spices’, is the most important and widely used spice in the world. Pepper production is confined to a few countries in Asia including Sri Lanka and the Pacific, Brazil and Madagascar.

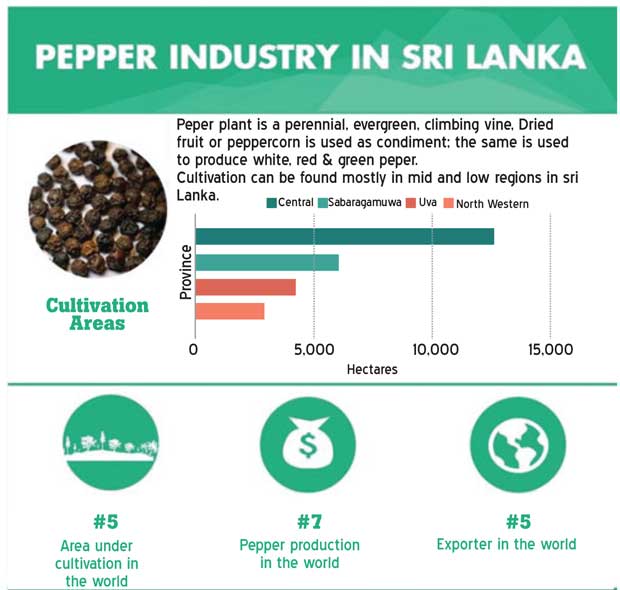

Currently, Sri Lanka ranks at the fifth place in terms of area under pepper cultivation (after India, Indonesia, Vietnam and Brazil) and seventh place in terms of production, with a world share of 5.7 percent in production. Also, Sri Lanka is the fifth largest exporter of black pepper, after Vietnam, Brazil, Indonesia and India. However, the productivity levels in the industry remain low, despite improvements seen over the years.

Sri Lankan pepper, like other spices from the island, is well-known for its superior inherent properties. For example, Sri Lankan pepper has higher piperine content, which gives it a superior quality and pungency. The piperine content in Sri Lankan black pepper is two to six times higher than in other countries.

However, the export of sub-standard products can ruin the reputation of Sri Lanka in the international market as a supplier of high-quality spices. Therefore, significant measures need to be collectively taken to upgrade the standards governing the product and production process across the pepper value chain in the country. Moreover, improving the capacity of stakeholders in the value chain to meet standards can boost pepper exports and competitiveness.

Pepper value chain

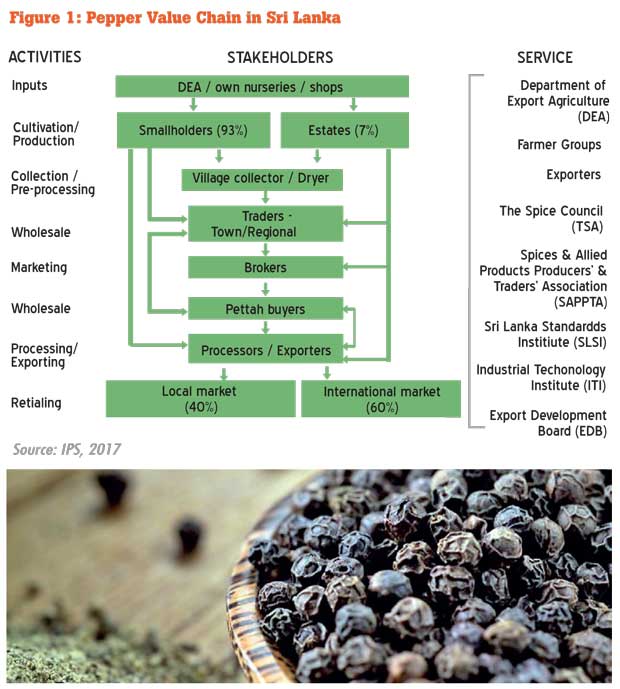

Pepper is the second most important spice grown in the country, after cinnamon. There are numerous actors performing various functions in the Sri Lankan pepper value chain, as shown in Figure 1. The figure vertically maps the functions/activities, stakeholders and supporting services in the chain from point of inputs to retail.

In Sri Lanka, pepper is cultivated in the wet and intermediate agro ecological zones, in the mid and low country regions, mostly by smallholders. Most of the smallholders grow pepper in their own small plots of land (home gardens), which are less than 20 acres or 8.1 hectares. Apart from cultivating pepper in their own lands, harvesting of pepper is also done by farmers, with the help of hired labour; some (sun/machine) dry their harvest and sell, while others dispose it in a fresh form. A majority of the farmers sell their product to village collectors or shops in the town, which are important intermediaries in the pepper value chain.

Local collectors are sometimes farmers themselves or rural entrepreneurs who purchase pepper directly from farmers. Other than being involved in the spice wholesale trade, operating from stores based in town bordering spice growing areas, traders also purchase pepper from collectors/farmers/estates/lessees, after which they clean, dry, store, pack and transport the pepper to buyers, mostly in Colombo. Buyers include spice exporters, low local spice manufacturers and marketers, Pettah buyers and hotels/restaurants/households. Currently about 60 percent of pepper production of the country is exported, while the remainder is consumed domestically according to government sources. Pepper bought by exporters is then dried, cleaned, graded and packed to meet the requirements of the international buyers.

Currently, India alone buys 62 percent of pepper exports from Sri Lanka to the world followed by Germany, Pakistan, Egypt, the USA, UAE, UK, Vietnam, Saudi Arabia and Spain. Together, the top 10 countries account for 91 percent of total pepper exports from Sri Lanka.

Given that majority of black pepper from Sri Lanka is exported to the low end of the market (India), Sri Lanka should explore high-end markets elsewhere (the USA and European Union (EU)), which are yet to be fully exploited. At the same time, stringent standards in the developed countries can act as a trade barrier to entering those markets and therefore, Sri Lanka needs to upgrade its standards.

Lack of supply of quality black pepper

Currently, there is an inadequate supply of black pepper throughout the year to meet the international demand. Moreover, the quality of black pepper production is inconsistent due to the fragmented production and absence of standards governing the pepper value chain.

Quality characteristics in pepper include appearance of the pepper, its maturity, bulk density, moisture content and presence of extraneous matter (dust, stones, leaves) in the product. Unlike the tea industry, no compulsory system to control quality by the government exists at the moment. As a result, exporters depend on the requirements prescribed by importers and usually request quality-certifying bodies to certify the pepper.

There are Sri Lanka standards for black pepper (SLS 105 Part 1: 2008) and white pepper (SLS 105 Part 2: 2008); however, neither of these product standards is required for export at the moment. Systems certifications are increasingly obtained by the pepper industry at the exporter level and these include, ISO22000 Food Safety Standards, Hazard Analysis and Critical Control Points (HACCP) and Good Manufacturing Practices (GMP). Few exporters have also obtained organic and fair trade certifications. However, these standards have been voluntarily adopted by the exporters. Quality needs to be adhered across the value chain from the point of harvest and onwards not just at the point of export. Unfortunately, this does not always happen. For example, collectors/shops buy any supply of pepper produced by farmers, regardless of the quality of pepper produced by smallholders. This is due to weaknesses in the coordination in a fragment chain, lack of awareness/regulations and poor infrastructure in terms of proper drying/storage, etc.

Moving forward together

Towards improving quality standards of pepper supplies in Sri Lanka, a number of measures can be collectively taken by the government and stakeholders in the pepper value chain:

Improve attitudes of the agents in the value chain towards adopting good agricultural and manufacturing practices not only to increase the productivity but the quality of pepper by organising field trips and constructing model farms in each village to educate farmers about proper agronomical practices include drying and storage

of pepper.

Provide assistance to build/upgrade process facilities like steam sterilization treatment plants and buy equipment like dryers. The Primary Industries Ministry will be providing a 50 percent grant for entrepreneurs to upgrade/add value to their product/production and such assistance could be made use for this end.

Establish central collecting/processing/storage centres to improve quality of pepper at the intermediary stages of the value chain.

Improve efficiency and reach of extension services by increasing resources to the Export Agriculture Department to carry out their activities.

Encourage exporters to integrate backwards in the value chain by providing land or to purchase directly from farmers/farmer organisations to ensure a consistent quality.

Implement mandatory standards at the point of exports to ensure quality of Sri Lankan pepper exports whilst encouraging the adoption of quality systems such as HAACP/ISO22000 as well as good agricultural and manufacturing practices in the value chain.

Improve awareness of farmers, collectors, traders and processors of quality requirements of export markets.

Invest in advanced testing equipment, which can detect lower limits of pesticides, aflatoxins, ochratoxins, etc.; test that are necessary to export to more

developed markets.

(Janaka Wijayasiri is a Research Fellow at the Institute of Policy Studies of Sri Lanka and can be contacted at [email protected]. This article is based on a JICA study on ‘Analysis of Cinnamon, Pepper and Cardamom Value Chains in Sri Lanka’, which was conducted by the IPS. To view this article online and to share your comments, visit the IPS Blog ‘Talking Economics’ - http://www.ips.lk/talkingeconomics/)

25 Nov 2024 1 hours ago

25 Nov 2024 1 hours ago

25 Nov 2024 2 hours ago

25 Nov 2024 2 hours ago

25 Nov 2024 3 hours ago