21 Nov 2017 - {{hitsCtrl.values.hits}}

The budget proposals of the unity government under the theme ‘Blue Green Budget’ for the fiscal year 2018 is expected to support the achievement of the medium-term targets such as the per capita income of US $ 5,000, one million new jobs, foreign direct investment (FDI) inflows of US $ 5 billion and doubling exports to US $ 20 billion.

The budget proposals of the unity government under the theme ‘Blue Green Budget’ for the fiscal year 2018 is expected to support the achievement of the medium-term targets such as the per capita income of US $ 5,000, one million new jobs, foreign direct investment (FDI) inflows of US $ 5 billion and doubling exports to US $ 20 billion.

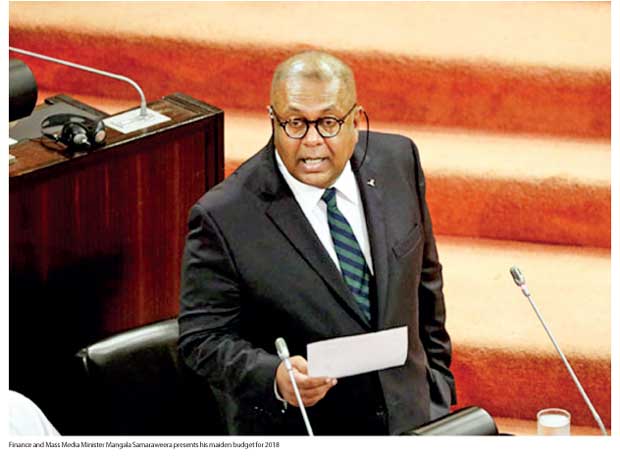

Finance and Mass Media Minister Mangala Samaraweera presenting his maiden budget for 2018 envisions to increase the economic growth rate to 6 percent by 2020 from the current 4.5 percent. Samaraweera said in 2018, we envisage a gross domestic product (GDP) growth of 5 percent, inflation of around 6 percent and we hope to achieve for the first time in almost six decades, a primary surplus of one percent of GDP and a budget deficit of 4.5 percent of GDP.

The economy is expected to grow by around 4.5 percent in 2017 and is projected to move gradually to a higher GDP growth path of around 6 percent by 2020, while containing the level of unemployment at around 4 percent level.

Budget deficit

The budget targets a fiscal deficit of 4.8 percent of GDP in 2018, which is only slightly above the 4.7 percent target agreed with the International Monetary Fund (IMF) and continues the consolidation that began in 2016. Floods, disease and drought weighed on economy and public finances during 2017 and contributed to the government missing its initial 2017 fiscal deficit target of 4.6 percent of GDP.

Nevertheless, the government still expects the 2017 deficit to fall to 5.2 percent of GDP, from 5.4 percent in 2016. The hope for stability in 2017 has been largely driven by the measures to boost tax revenue, including a hike in the value-added tax (VAT) to 15 percent in November 2016 from 11 percent. However, this push for indirect tax will certainly lead to more pressure on cost of living.

Revenue

On the revenue side, the government expects revenue to rise strongly again in 2018 – to 15.7 percent of GDP, from 14.7 percent in 2017. The revenue increase is expected to be supported by an Inland Revenue Act passed in September 2016. The act, which will come into effect from April 1, 2018, aims to simplify the tax laws and improve the efficiency of the collection.

Despite these positive reforms, there are numerous risks to the government’s revenue projections, given that they are based on a GDP growth assumption of 5-6 percent for next year and its track record in the last three years. However, Samaraweera is optimistic.

He said, “We are in the process of effecting revenue reforms in all areas including inland revenue, customs, excise and others to raise government revenue closer to 20 percent of GDP over the medium term. Samaraweera is confident that revenue will increase and that expenditure will remain well targeted and rationalized and that the overall budget deficit to reduce to 3.5 percent of GDP by 2020.

Government debt

The next three years would be crucial with debt repayments amounting to almost Rs.7,000 billion. The biggest challenge for the unity government is the repayment of international sovereign bonds, which will mature every year from now on, amounting to almost Rs.600 billion, where bunching is a severe strain on the government finances.

The exchange rate depreciation could also push up the local currency value of government debt, given that around 40 percent of the total was denominated in foreign currency at end-2016. In 2018 alone, the debt repayment amounts to Rs.1970 billion. The government may be forced to compromise on the investments to be made in 2018, given the huge debt burden.

The government debt/GDP ratio rose to 79.3 percent of GDP in 2016 – well above the 60.9 percent median for sovereigns rated ‘B’ or lower. Fortunately, the foreign exchange reserves have risen to US $ 7.5 billion at end-October from US $ 6.1 billion at end-2016 and the reserves could be sufficient to cover 3.5 months of the current account payment by end-2017. This certainly needs to improve further.

2018 proposals

The government will introduce the Enterprise Sri Lanka Credit Scheme with the objective of encouraging the small and medium enterprise (SME) sector to strengthen entrepreneurs. During 2018-2020, the government will support the formation of 50 agro and fishery companies, 25 majority women-owned companies and 150 youth- centric start-ups.

To encourage women entrepreneurs, the ‘Enterprise Sri Lanka Credit Scheme’ will make available credit facilities with the interest subsidy being at least 10 percent more for women entrepreneurs relative to others.

Rs.2,000 million has been allocated to further strengthen the skills development programmes undertaken by the National Youth Corps. The government plans to implement a programme where youth groups will undergo three to six-month training courses in a specific skill as demanded by the private sector. To fund this an ‘Employment Preparation Fund’ at the National Policies and Economic Affairs Ministry will be set up with an allocation of Rs.2,500 million.

With the aim of promoting direct foreign investments and simplifying business registration, a one-stop shop for business registration through a single identification system and introducing a system to scan and digitize company records, create a database of trademarks, using the Registrar of Companies Department funds.

With the aim of fostering reconciliation, a large number of proposals have been made, including the construction of 50,000 brick and mortar houses for the North and East and introducing irrigation systems and construction of a home for differently abled women in the North, introduction of low interest loans and provision of a stable livelihood for 12,600 rehabilitated ex-combatants.

In addition, Rs.2500 million will be allocated to provide housing and infrastructure for the Muslims who were forcibly evicted from the North by the Liberation Tigers of Tamil Eelam (LTTE) in the early 1990s.

Other highlights

Rs.500 million allocated to offer loans under the ‘Entrepreneurs Sri Lanka’ programme.

Anti-dumping and countervailing laws to support local industries.

Government will remove up to 1800 para tariffs in 2018.

Loans for SME industries, without guarantors.

Rs.10,000 million allocated to establish an EXIM bank, specially to provide long-term loans to SMEs.

Rs.800 million for the Export Market Access Programme to be introduced for companies with less than US $ 10 million in earnings and for potential new entrants to the export market.

Restrictions on foreign ownership of shipping and freight forwarding agencies will be lifted.

All tourism service providers will be required to register with the Sri Lanka Tourism Board to bring the informal sector under the broader tax net and a VAT refund scheme for foreign passport holders at airports and seaports from May 1, 2018.

Conclusion

This budget is significant because of the government’s efforts to make the country green by enforcing the policies which are obviously aligned with international agreements over climate change.

This could attract new money into the country.

Then on the expenditure side, the government expects public investment spending to rise by 20 percent in 2018, while recurring spending is forecast to decline. Interest payments are expected to account for more than one-third of total revenue, which is a key weakness in the fiscal profile.

High government debt and the large cost of debt servicing weigh heavily on Sri Lanka’s credit rating and managing that will require sustained fiscal consolidation over the long term with strong leadership.

The new tax on bank debt and basing the duty tax on engine capacity of vehicles instead of the cost, insurance and freight (CIF) needs a rethink very quickly.

Proposals must make political and economic sense. However, to implement the 2018 proposals of the budget, parliament would firstly need to approve it after the final reading and secondly the green blue government will have to work together as a team to implement them. Finally, the proof of the budget proposals would be in their implementation and realization.

(Dinesh Weerakkody is a thought leader)

25 Nov 2024 14 minute ago

25 Nov 2024 1 hours ago

25 Nov 2024 1 hours ago

25 Nov 2024 3 hours ago

25 Nov 2024 4 hours ago