01 Nov 2017 - {{hitsCtrl.values.hits}}

Indrani is a 41-year-old cinnamon oil producer living in Meetiyagoda, Ambalangoda in the Galle District, which is well-known for cinnamon production. She is a single mother and entrepreneur, owning a cinnamon oil distillery unit. Prior to this, she had worked as a day worker at the distillery unit but found balancing work and family challenging.

Indrani is a 41-year-old cinnamon oil producer living in Meetiyagoda, Ambalangoda in the Galle District, which is well-known for cinnamon production. She is a single mother and entrepreneur, owning a cinnamon oil distillery unit. Prior to this, she had worked as a day worker at the distillery unit but found balancing work and family challenging.

“When we work as day workers, we are like labourers; we have to stick to a fixed time. It was difficult for me to handle household work and work at distilleries as a day worker.”

In 2003, her husband passed away due to a tragic accident, leaving Indrani to provide for their young children. Thereafter, she went abroad to earn money to support her family. After returning in 2008, she started her own cinnamon distillery unit, with funds partly raised from her savings abroad.

However, setting up a distillery unit can be very costly; a single boiler costs Rs.100,000 and her savings were insufficient to cover the investment. Like most other women-owned and led micro, small medium enterprises (WMSEMs), she borrowed from a private money lender in her village to buy the distillery unit – a steam distillation unit used for cinnamon leaf oil production.

In Sri Lanka, cinnamon leaf oil is generally produced by steam distillation of dried leaves on rather simple but

effective equipment.

Constraints to finance

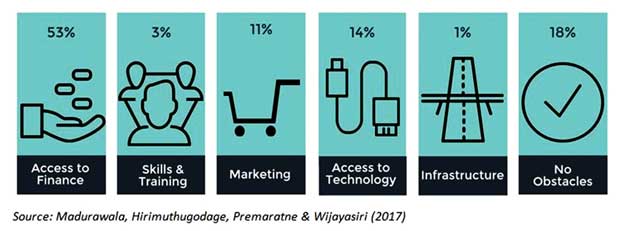

According to a study by the Institute of Policy Studies (IPS) on WMSMEs in spice and coir sectors of Sri Lanka, it was found that more than half of the women surveyed, ranked ‘financial concerns’ as the biggest barrier to operating and expanding their businesses. While they have access to formal institutions, WMSMEs prefer to use informal arrangements to fulfil their financial needs.

High interest rates, difficulty in meeting loan requirements (such as providing suitable guarantors and collaterals), lengthy loan processing time and low outreach of financial institutions are some of the problems encountered by women entrepreneurs in accessing financial institutions in the country.

Informal money lenders, ‘seettu’ (a rotating savings and credit association also known as ROSCA, where a group of individuals agree to meet for a defined period to save and borrow together) and loan arrangements with buyers are preferred over the formal financial institutes despite the higher interest rates, mainly because of the flexibility and speedy loan disbursements without much formal paper work. Moreover, cinnamon producers are confronted by the uncertainty of making repayments due to the seasonality of the income. According to Indrani, cinnamon oil producers earn an income for half a year, as cinnamon trees are chopped during a selected period in a year. During the six months, where oil cannot be produced, they have to look for other work. Therefore, they are unable to obtain loans from banks.

“When we do not have work, it is difficult to pay interest during that period,” she said.

Once, when she failed to settle a loan, she decided to go abroad as a housemaid again.

“I went abroad in 2008 once more to settle my bank loans and returned in 2011.”

Indrani is thinking of obtaining a loan from a bank to expand her business but is cautious.

“We can repay any amount but we need support during the off season or relief from making the full monthly repayment, when we do not earn from our business.”

Better access to finance

An important avenue to promote inclusive and sustainable development outcomes includes accelerating gainful participation of WMSMEs. They are known to be an important source of employment and poverty reduction, especially for women.

WMSMEs have been identified as the backbone of developing economies and constitute a major source of formal and informal sector employment of women. Therefore, it is important to strengthen this sector and improve the participation of these enterprises through easy and affordable access to finance. It is crucial to design loans to cater to the needs of WMSMEs, improve outreach of the formal institutions, increase commitment by banks to assist WMSMEs, reduce administrative procedures and provide alternative ways to build credit with institutions.

It is especially important to design loan schemes that cater to the needs of WMSMEs. The IPS study identified two agro-processed products with high potential for women’s economic participation. Due to the seasonality in harvesting and processing of these goods, loan schemes should be shortened from one year to a few months to reduce entrepreneurs’ burden in repayment.

To overcome the low outreach of formal financial institutions, mobile services should be introduced that can disseminate available loan programmes, particularly for those who reside in remote areas. Eventually, mobile banking would be useful for the repayment of loans.

There is a need to scale up lending and commitment to assisting WMSMEs across all branches amongst the financial institutions. While the services such as SME banking are set up at head offices, if the local branch managers of financial institutions find lending to MSMEs unprofitable, they tend to serve other customers, namely larger companies and entrepreneurs. Such situations can be avoided by close monitoring and supervision to assess the progress of special programmes targeting micro and small enterprises in Sri Lanka, while strengthening the capacity and skills of managers for SME-focused lending and appraise methods. These efforts need to be complemented by providing training on financial management to WMSMEs.

In addition, there is a need to incentivize lending to WMSMEs. For small amounts that MSMEs seek, the administrative procedures, including paper work, can be reduced. The formal financial institutions try to reduce lending risks by securing collateral or guarantors, which itself is a big hurdle for WMSMEs. Alternative ways to allow WMSMEs to build credit within the institution are needed, such as gradually increasing the amount of small loans, as proved in microfinance.

Although Indrani is single-handedly running her business, she is happy, as she is able to balance her housework while working at the distillery, which she wants to expand with time.

“I can look after my family while working in my hut. Sometimes, I keep the boiler on and go to school to pick-up my children. My expectations are to upgrade and expand my business and be a good mother to my children and a caring daughter to my old-age parents. I’m sure I can fulfil my responsibilities as a mother and as a daughter while doing my business.”

However, WMSMEs like hers need better access to finance to invest, expand and operate their businesses, which are the backbone of Sri Lanka’s economy.

*To find out more about the study and other constraints affecting WMSMEs in the spice and coir sectors in Sri Lanka, visit: http://www.ips.lk/women-owned-led-micro-small-medium-enterprises-spice-coir-sectors-sri-lanka-constraints-policy-options/

(Janaka Wijayasiri is a Research Fellow and Dilani Hirimuthugodage is a Research Officer at the Institute of Policy Studies of Sri Lanka (IPS). They can be reached at [email protected] and [email protected]. To view this article online and to share your comments, visit the IPS Blog ‘Talking Economics’ - http://www.ips.lk/talkingeconomics/)

04 Jan 2025 4 hours ago

04 Jan 2025 4 hours ago

04 Jan 2025 5 hours ago

04 Jan 2025 5 hours ago

04 Jan 2025 5 hours ago