05 Jun 2017 - {{hitsCtrl.values.hits}}

You have probably heard the terms ‘bull’ and ‘bear’ markets to describe stock market conditions. Simply put, a bull market refers to a market that is on the rise and a bear market is one that is in decline.

You have probably heard the terms ‘bull’ and ‘bear’ markets to describe stock market conditions. Simply put, a bull market refers to a market that is on the rise and a bear market is one that is in decline.

Markets do not only move in cycles but their direction/trends may be sudden or prolonged. For an example, the sluggish performance of the Colombo Stock Exchange (CSE) experienced a drastic shift during the last few months. The All Share Price Index witnessed a growth of 7.47 percent for the current year while the S&P SL 20 Index recorded an impressive growth of 9.64 percent.

Furthermore, the net foreign inflow for the current year stands at Rs.19.4 billion. Market volatility is inevitable as the length of a rise or decline is highly dependent on the changing investor attitudes. Thus, there is no sure way to accurately predict market trends. Therefore, investments should be based on your personal objectives and investing with a long-term growth prospects.

At the same time, knowing the kind of market we are in (bull/bear) will influence what you should pay for a security. A wise investor will maximize returns during both, bull and bear markets.

Market gyrations

Market gyrations can test not only your investment portfolio but your internal fortitude. It’s hard to be confident in your strategy when volatility means it might see ups and downs. An intelligent investor is seen as an all-season investor who would profit between both bull and bear markets.

In such situations investors should consider a broader range of investment opportunities – select stocks that can offer both growth potential and downside protection. To achieve your goals, you need to stick with your chosen strategies long enough to see the benefits — even amidst inevitable market fluctuations. Assess your readiness to invest by asking yourself these key questions:

Do your emotions lead you astray?

Has fear driven you to cash?

...Or led you to time the market?

Do you maintain a long-term perspective?

Do your emotions lead you astray?

You may not be surprised to know that equity market volatility is a common phenomenon even in global markets. An inevitable return to ‘normal’ may feel quite uncomfortable as you watch your portfolio’s value move up and down. But such an inflection point in volatility can be a good time to reflect on your risk tolerance and past investing patterns.

Have your emotions been known to compromise your investment decision-making? In volatile times, emotional instincts often drive investors to take actions that may feel justified but do not necessarily make rational sense. Fear too often translates into poor timing of buys and sells, violating a cardinal rule of investing: buy low and sell high.

Partially as a result of overzealous buying and selling, the average investor has actually underperformed most asset classes (and even inflation) over the past due to their inability to abide by the cardinal rule of buying low and selling high. Remember that opportunity is often greatest when you feel the most defeated. Don’t follow the crowd. Be willing to be critical even when times are good.

Has fear driven you to cash?

It’s a good idea to keep some portion of your assets in cash. You need it for liquidity, emergencies and to balance out your riskier investments.But know this: Too much cash comes with a cost.

Cash has produced negative returns after factoring in inflation and taxes — making it a sure way to lose purchasing power in the long run. If you’ve been sidelined in cash, it may be time to reassess where you are and explore the possibilities for making that cash work harder for you.

... Or led you to time the market?

Whereas fear may send some investors into cash, it may prompt others to engage in what is actually risky business: market timing. They sell stocks when they think the market is about to decline and buy when they think the market will rise. But consistently predicting which days a market will move in which direction is virtually impossible and can be very costly.

Challenge your definition of diversification

In an environment of rising volatility and interest rate uncertainty, you need to have confidence that your portfolio is ready to weather even the worst days.

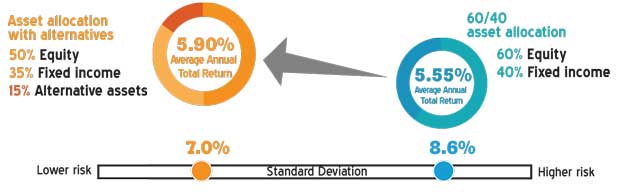

Investors tend to believe they have sufficiently spread out their risks by owning a mix of stocks. During times of stress, however, the returns of these traditional asset classes can easily move closer together. It’s important to cast a wider net today, to protect your investments and better take advantage of all the financial markets have to offer. Even enhanced diversification does not ensure a profit or protection against a loss but it does expand your sources of risk and return.

Invest in quality, dividend-paying stocks

In a slow-growth environment characterized by rising volatility, it can be a challenge to stay invested amid the inevitable market ups and downs. An investment in quality, dividend-paying companies, however, can offer a less volatile way to reap the rewards of holding equities. Dividend-paying stocks can help provide much-needed downside protection in difficult environments. Although there is no guarantee that companies will continue to pay dividends, this income can help smooth volatility in unpredictable markets. Dividend growers have weathered diverse markets.

Remove emotion, invest systematically

If uncertainty has you sidelined waiting for the right moment to re-enter markets, consider unloading that burden by establishing a systematic investing plan. Investing a fixed amount of money at regular intervals (averaging) might allow you to purchase more shares of an investment when prices are low and fewer when prices are high. Ultimately, a lower average cost translates to a higher return when the market swings back up.

So what do I do with my money?

You can’t invest for the future in the future. Now is the time to assess the landscape and position your portfolio to take advantage of what the stock has to offer.

This may require seeking opportunity in places you have never looked before. It also warrants the use of a wider variety of active, index and multi-asset strategies, as well as non-traditional investments.

Investing over the long term has always been challenging and recent market cycles have again tested investors’ fortitude. Remember, ensuring your portfolio is equipped to weather difficult times is a key factor in long-term success. Prepare for the future by:

Establishing and sticking with a long-term investment plan.

Staying in contact with your financial professional.

Remaining prepared: Be informed, invested, resolute, opportunistic and diversified.

08 Jan 2025 35 minute ago

08 Jan 2025 1 hours ago

08 Jan 2025 3 hours ago

08 Jan 2025 4 hours ago