22 Jun 2017 - {{hitsCtrl.values.hits}}

By Jayani Ratnayake

Ceylon Tea has come a long way since the first tea field was planted in Sri Lanka in 1867. This week’s TIPS column looks at the export performance of this mature export product during 2016, during the first four months of 2017 and the outlook for the near term.

2017 also marks the achievement of a significant milestone – the 150th anniversary of Ceylon Tea. So, it is indeed a good time for us to critically review the performance of the tea industry and make strategic decisions to make Ceylon Tea relevant in the global market for the future.

Auction prices on the rise, but volumes down

The average auction prices recorded a positive year-on-year (YoY) growth for the 12th consecutive month in April 2017. The sharp pick up in average auction prices recorded in September 2016 sustained its momentum, recording double-digit growth (YoY) in each subsequent month up to April 2017, driven by the low volume coming in to the auctions.

In terms of tea production, however, 2016 saw contraction for the third consecutive year, reaching a seven-year low of 292.6 million kilogrammes. The cumulative auction volumes recorded during the three months of February, March and April 2017 were the lowest levels recorded for the same period since 2012.

The upbeat auction prices have been largely driven by a supply-side slowdown, on account of the drop in field production due to the government policy banning the importation of certain weedicides and drought conditions during the last 4Q 2016 and early 2017.

Global tea demand and SL exports

Global tea demand has been subdued over the past three years with global tea imports contracting for a third consecutive year; the sharpest YoY decline of 16.6 percent was recorded in 2016. Sri Lanka’s tea exports amounted to US $ 1.27 billion in 2016, with the export value contracting by 5.3 percent on YoY terms, the second consecutive year of negative exports. Macroeconomic instabilities and structurally lower oil prices in key export markets were the main contributors to this trend.

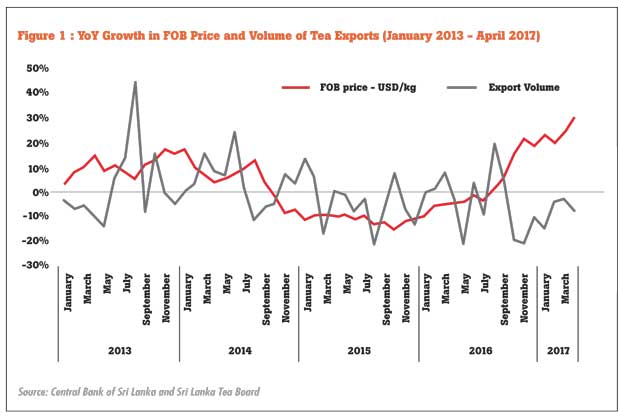

The good news, however, is that tea export earnings have recovered lately. Cumulative export earnings during the first four months of 2017 have rebounded strongly recording the highest export value since 2012. Export price quoted in US dollars (FOB price per kg) reached US $ 5 during this period for the first time since the highly successful export year in 2014. This price hike has been driven by supply shortages in export quantities, which recorded negative YoY growth rates for seven consecutive months since October 2016 (refer Figure 1).

Export performance in key tea markets

It would be useful to highlight some trends and drivers in Sri Lanka’s key tea markets. The lifting of sanctions on Iran gave a much-needed boost to Sri Lankan tea exports in 2016, recording a YoY growth of 16.8 percent and an export value of US $ 154 million. This also resulted in Iran overtaking Russia as the top export destination for Sri Lankan tea.

Exports to the Middle Eastern region contracted by 8.2 percent on a YoY basis in 2016, a continuation of the negative growth of 16.6 percent recorded in 2015. Sharp YoY contraction in exports was recorded in export destinations such as Turkey (27.7 percent), the UAE (23.7 percent), Jordan (24.1 percent) and Kuwait (46.7 percent).

Meanwhile, exports to Syria recorded a positive YoY growth of 14.9 percent in 2016, after being in a negative growth territory since the beginning of the Syrian civil war in 2012. However, tea export earnings from Syria in 2016 were half of what they were in the pre-war period (US $ 125 million in 2011).

Exports to Russia contracted for the third convective year, in YoY terms. Sri Lanka’s share in Russian tea has been on a secular declining trend since it peaked at 50.9 percent in 2006. By last year, it had fallen to 29.3 percent, with India at a very close second of 26 percent.

The economic sanctions imposed on Russia in 2014 worsened the impact of this long-term decline. However, in 2016 Sri Lanka managed to secure its position as the number one exporter to Russia last year – an important gain in what is the world’s largest tea importing nation accounting for 9 percent of global tea demand.

According to EIU calculations, the decline in Russia’s import of Sri Lankan tea was 6.3 times more than the overall decline in total Russian tea imports (in 2015). Sri Lanka’s biggest competitors in the Russian market - India and Kenya - have steadily established their presence in the market over the years. India has made a strong comeback recording positive YoY export growth in both 2015 (19.7 percent) and 2016 (6.3 percent).

Commenting on Sri Lanka’s export performance in Russia, an industry expert stated that price is a crucial factor in the Russian economy, as buyers there are faced with difficult economic conditions. Consumers have shifted towards tea that is cheaper in price but not necessarily poorer in quality than Ceylon Tea. Moreover, major Russian and international brands use international blends, making it difficult for smaller brands from Sri Lanka to compete due to their ability to maintain low prices for their products by leveraging economies of scale.

There has been some improvement in exports to non-traditional markets such as China lately, where exports have grown significantly over the five-year period between 2012 and 2016 pushing the country rank from the 21st to the 10th position. Growth has topped 113 percent during this period.

Outlook for medium-term

Raising the export volumes beyond the current levels is severely constrained by rigidities on the supply side. Supply shortages have also made the auction prices to grow at double digit levels hurting the export competitiveness in already weak export markets. The ability to increase production beyond current levels will depend to a great extent on favourable climatic conditions as well as reversing the government policy restricting the use of certain weedicides.

On the demand side, it is difficult to foresee buoyant market conditions in Sri Lanka’s main export regions of Russia and the Middle East, which account for 55.2 percent total tea exports). Global oil prices seem unlikely to reach the levels anticipated by OPEC, due to high inventory and production while the United States of America (USA) have recently voted for legislation to impose new sanctions on Russia.

The only relief for exporters has been the relative stability achieved by the Russian rouble over the past 18 months - a gain of approximately 38 percent against the US dollar (from the January 2016 low of USD/RUB: 82.5 to the June 2017 level of just below USD/RUB: 60).

Sri Lanka’s tea industry needs to evolve and transform to be resilient and strong amidst rapid changes and market headwinds that are happening globally. Consumption habits are evolving at a rapid pace and tea has already gone beyond being a traditional beverage to offering a variety of new formats such as medicated teas, flavoured teas, jellies, sorbets, etc.

These changing preferences increasingly demand for greater innovation in the production and marketing sphere. It is time to make strategic decisions to take Sri Lankan tea to the next level and there is no better time to embark on these than now – when Ceylon Tea proudly celebrates 150 years.

(Jayani Ratnayake is a Research Economist with the Economic Intelligence Unit of the Ceylon Chamber of Commerce. This article is part of the chamber’s ‘Trade Intelligence for the Private Sector’ (TIPS) initiative. Write to [email protected] to engage. To know more about the 150-year celebrations of Ceylon Tea and International Tea Convention in August, visit www.ceylonteaevents.com)

07 Jan 2025 7 hours ago

07 Jan 2025 7 hours ago

07 Jan 2025 8 hours ago

07 Jan 2025 07 Jan 2025

07 Jan 2025 07 Jan 2025