19 Aug 2016 - {{hitsCtrl.values.hits}}

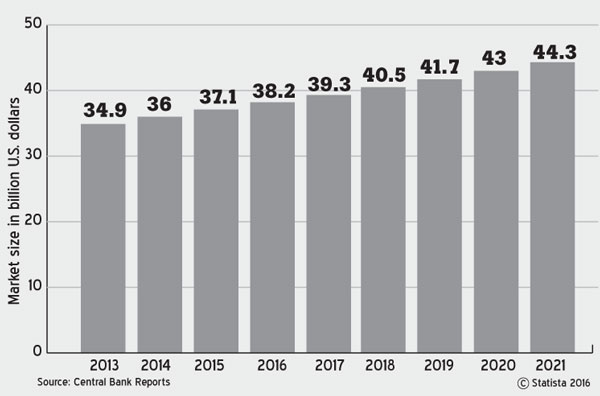

A market study on the global tea market has been recently published by Transparency Market Research (TMR), determining its value in 2015 at US $ 37 billion and estimating the compound annual growth rate (CAGR) of the market over the period from 2015 to 2020 at 3 percent. The analysts at TMR have projected the market to reach a value of US $ 43 billion in 2020.

A market study on the global tea market has been recently published by Transparency Market Research (TMR), determining its value in 2015 at US $ 37 billion and estimating the compound annual growth rate (CAGR) of the market over the period from 2015 to 2020 at 3 percent. The analysts at TMR have projected the market to reach a value of US $ 43 billion in 2020.

Tea export revenuAccording to the report, rising awareness among the consumers regarding various benefits of consuming tea is the major growth driver of the global tea market. Apart from this, the economic advantages and ample opportunities for employment presented by the tea industry are also supporting the global market to a great extent. “The increasing concern over beauty and skincare is encouraging consumers to switch to green tea, which is expected to open an opportunity-rich market for players in the global tea market,” one internationally reputed market report stated recently.

According to ‘World Tea Expo’, many tea drinkers, especially younger ones, are embracing more expensive tea brands like Teavana that has unique flavours. Howard Telford, the Euro Monitor beverage analyst, says that US tea sales are glowing due to the innovative products and flavours, loose-leaf format, various ready-to-drink options, convenience factor, etc. Unfortunately, hardly any Ceylon teas are available in those emerging markets due to a number of reasons.

Tea export revenue declined

Sri Lankan authorities were earlier targeting tea export revenue of US $ 5 billion by 2020 to become the leading global exporter in the world. Since 2014, the situation has dramatically changed from bad to worse. Sri Lanka is at present receiving only around US $ 1.4 billion from tea exports, which contributes even less than 14 percent of the total export revenue.

The textiles and garments sector’s contribution to total exports in 2015 was US $ 4.8 billion, which is 46 percent of the total exports compared to only 14 percent in tea. Sectors such as tourism, apparels and even BPO/IT exports have been progressing well in the Sri Lankan export sector.

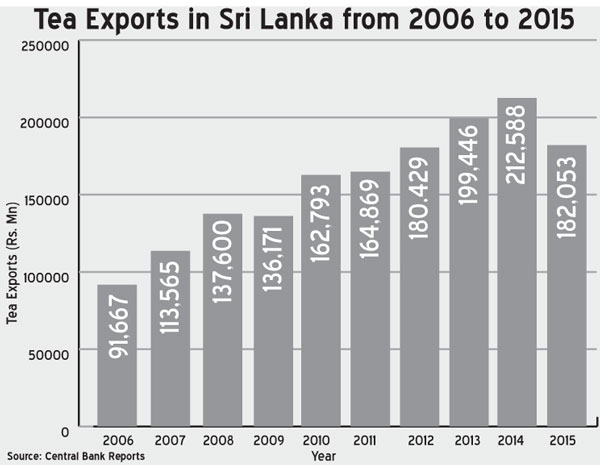

As can be seen from the graph, the tea export revenue, which was US $ 1,628 million in 2014, has drastically reduced to US $ 1,341 million in 2015. The situation remains the same during the first six months of this year too. According to our tea exporters, the problem with Ceylon tea marketing is it’s too expensive and they find it difficult to compete with multinational players who source other origin teas worldwide. The present crisis due to political and social turmoil in the Middle Eastern countries and Russia coupled with plummeting crude oil prices has adversely affected Ceylon tea exports.

Unfortunately, Sri Lanka has become number four in tea exports, behind Kenya, China and India. The experts’ view is that the premium prices hitherto realised for Ceylon teas are not sustainable in the global markets which will eventually reflect the demand and supply of teas, although there is a small niche market for premium Ceylon teas.

Linking labour wages to productivity

The industry players are well aware that at present, the Sri Lankan tea industry is facing many challenges. Regional plantation companies (RPCs), which account for only 33 percent of the tea production of this country, are at cross roads and faced with severe cash flow crisis. The cost of production of Ceylon tea has always been very high, as both land and labour productivity of Sri Lankan tea estates are the lowest compared with other competing countries.

The costs are ever increasing more than 10 percent annually mainly due to low productivity thus, making negative producer margins. Unless corrective measures are taken based on an integrated approach by all the stakeholders of this vital industry, the situation would further aggravate.

They are also well aware that the estate worker ‘daily wage model’ is not linked to productivity. In fact, the daily wage in 2004 was only Rs.200 and now it has gradually increased to Rs.687.50 per day, whereas the tea price at the Colombo auction was Rs.181 in 2004 and now it is Rs.403. This price increase is only 223 percent over the 10-year period, whereas the wage increase is 343 percent more during the period under review. On the other hand, the productivity has not increased at all. It goes without saying that these challenges need to be addressed through consultation by all the stakeholders.

It was recommended by industry experts sometime back that the current daily wages be changed to productivity-linked (piece rate) wage models. The positive feature is that the RPCs have already proposed two optional wage models and the three unions who are signatories to the existing collective agreement are currently studying these proposals. Unions could take this as a basis for negotiation in order to arrive at a reasonable, yet commercially viable model.

The prime minister, plantation industry and labour ministers, all have undertaken to facilitate the process of wage negotiations between the RPCs and the unions. Towards this end, an interim allowance of Rs.100 per day has already been paid to the workers for June and July by the RPCs with the Tea Board loan scheme to demonstrate goodwill and solidarity. The three stakeholders, namely, the government, RPCs and the trade unions, could reach a consensus in arriving at a reasonable wage based on productivity without any further delay.

They could also take into consideration and draw attention to the ‘Ramani Gunatilleke report (which was initiated by RPCs/EFC three years back) on new approaches to estate worker wage models. According to her report, the wage negotiations need to be decentralized based on either agro climatic level or even “an enterprise bargaining” level. It may not be possible to convince the workers and the trade unions to migrate into a revenue share model, without having an intermediate arrangement based on a hybrid model - green leaf rate coupled with a guaranteed minimum daily rate.

It is in that context, only the RPCs have put forward the new proposal to the unions. In the meantime, the tea producers need to adopt an integrated quality and productivity drive and ensure teas are sold at the auction based on the specifications, quality as per the typed samples and the needs of the potential buyers. Further, the Sri Lankan tea traders and producers must demonstrate their sustainability credentials to differentiate pure Ceylon tea products.

Conclusion

Let us hope that the three stakeholders follow the ‘expert recommendations’. The writer is of the view that the social wellbeing and the environmental sustainability stem from the economic viability of the tea industry as a beverage and toward this end, the companies could undertake more corporate social responsibility (CSR) projects aimed at worker welfare in the estate sector.

The ultimate success depends on the commitment shown by the three stakeholders together with the tea marketers. This is on the assumption that the global tea beverage market is expected to grow in the near future.

(Jayampathy Molligoda is a Fellow member of the Institute of Chartered Accountants of Sri Lanka and holds a Master of Business Administration (MBA) from the University of Sri Jayewardenepura. He is currently Director/CEO of a leading Regional Plantation Company in Sri Lanka and can be contacted through [email protected])

10 Jan 2025 1 hours ago

10 Jan 2025 2 hours ago

10 Jan 2025 3 hours ago

10 Jan 2025 3 hours ago

10 Jan 2025 3 hours ago