19 May 2017 - {{hitsCtrl.values.hits}}

“As the water shapes itself to the vessel that contains it, so a wise man adapts himself to circumstances,” Chinese philosopher Confucius once advised. As the West, led by no less than the United States, succumbs to bouts of protectionism, China (the world’s largest trading nation) has found itself in a precarious situation.

“As the water shapes itself to the vessel that contains it, so a wise man adapts himself to circumstances,” Chinese philosopher Confucius once advised. As the West, led by no less than the United States, succumbs to bouts of protectionism, China (the world’s largest trading nation) has found itself in a precarious situation.

Amid a slowing economy, the Chinese leaders are deeply worried about losing easy access to overseas consumer markets, which fuelled the country’s turbo-charged industrialisation in recent decades. The latest data show that global trade has actually stagnated.

In response, China has launched an ambitious mega-infrastructure project aimed at reviving the ancient Silk Road with 21st century technology. In a strange twist of events, China, led by a self-described communist regime, has suddenly emerged as an unlikely vanguard of globalisation.

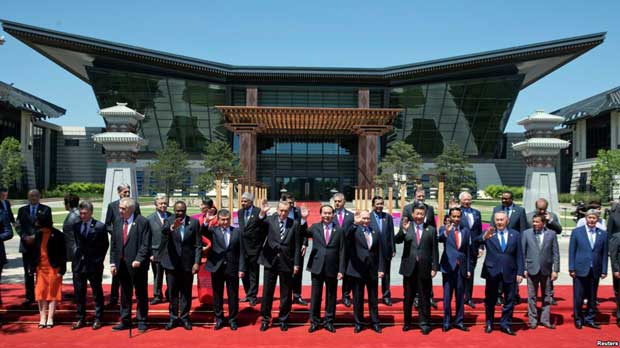

On May 14, Beijing launched the so-called ‘One Belt, One Road (OBOR)’ initiative, better known as the New Silk Road project, during a summit of global leaders. Chinese President Xi Jinping, who led the opening ceremony as the keynote speaker, hosted the leaders of 28 nations, who were more than eager to benefit from Beijing’s grand ambitions and largesse.

New capitalists

Earlier this year, Xi became the first Chinese head of state to attend the World Economic Forum in Davos, an annual gathering of the global liberal elite. More shocking than his mere attendance at the event was his full-hearted endorsement of a liberal economic order.

“Just blaming economic globalisation for the world’s problems is inconsistent with reality,” declared Xi in an implicit rebuke of protectionist rhetoric deployed by the likes of US President Donald Trump.

The leader of the world’s largest communist nation described globalisation as a “big ocean that you cannot escape from”, while criticising protectionism as “locking oneself in a dark room”.

Xi’s surreal endorsement of values that run counter to communist dogma was grounded in a sound calculation of Chinese national interest. As the world’s leading trading nation, the country desperately needs the wheels of globalisation to grind on. Thus, China is willing to commit huge resources to fulfil that outcome.

Under the OBOR initiative, China is expected to invest up to US $ 1.3 trillion in infrastructure projects, which will connect China’s industrial heartland to Western Europe via both land-based as well as maritime transportation and communication networks.

The ‘belt’ refers to the ‘Silk Road Economic Belt’, which runs through Central Asia, Iran, Turkey and Eastern Europe, while the ‘road’ refers to ‘Maritime Silk Road’, which runs through Southeast Asia, South Asia, Africa and the Mediterranean. They both end in Western Europe, the terminus of the ancient Silk Road, which connected China to Rome via the

Middle East.

Economic rebalancing

Chinese state-owned banks as well as China-led international financial institutions such as the Asian Infrastructure Investment Bank (AIIB) and New Development Bank are expected to shoulder much of the cost of this ambitious plan. China has already set up an initial US $ 40 billion Silk Road Fund, while the AIIB is allocating an additional US $ 50 billion. More than 60 countries have expressed interest in joining along.

On the surface, the project makes perfect economic sense, since it allows China to overcome excessive infrastructure overcapacity at home, while more fruitfully channelling its huge savings.

There are simply too many highways, airports and ghost towns across China, while Beijing is eager to divest from low-interest US treasury bills.

Funding big-ticket infrastructure projects overseas allows China to hit four birds with one stone. First of all, it prevents massive layoffs in and aids the survival of major state-owned enterprises and affiliated companies, which are running out of lucrative projects at home. Moreover, it allows China to expand its supply chains beyond the Pearl River Delta and East Asia by incorporating untapped labour markets overseas. Improving the infrastructure of trading partners also facilitates Chinese exports owing to reduced transaction costs.

Geopolitical anxieties

Above all, however, it allows China to lock in precious mineral resources and transform nations across the Eurasian land mass and Indian Ocean into

long-term debtors.

A leading credit rating agency recently warned that the OBOR is “driven primarily by China’s efforts to extend its global influence”, where “genuine infrastructure needs and commercial logic might be secondary to political motivations”.

The result is what one observer aptly described as “debt-trap diplomacy”, since some nations end up piling up unsustainable debts to China. This is particularly the case in small developing nations such as Sri Lanka, which has been forced to make huge economic and geopolitical concessions as it struggled to payback for Chinese projects.

Meanwhile, larger nations such as India have raised concerns over China’s geopolitical intensions, since the project runs through the disputed Kashmir region.

Other countries, from Indonesia to the Philippines and Nigeria, have raised concerns over the quality of Chinese infrastructure investments, their compliance with good governance and environmental regulations and Beijing’s tendency to employ not only Chinese technology and engineers but also Chinese labourers for overseas projects.

Ultimately, many are concerned about a ‘One Road, One Way’ outcome, where China keeps on exporting, while others are stuck as importers. Nonetheless, most developing nations have cautiously welcomed the modern Silk Road initiative, since, as one Asian diplomat bluntly put it, “Everyone wants to be China’s friend now with Trump in office.”

(Courtesy Al Jazeera)

(Richard Javad Heydarian is a specialist in Asian geopolitical/economic affairs and author of Asia’s New Battlefield: The USA, China and the Struggle for the Western Pacific)

08 Jan 2025 50 minute ago

08 Jan 2025 2 hours ago

08 Jan 2025 3 hours ago

08 Jan 2025 4 hours ago