27 Dec 2016 - {{hitsCtrl.values.hits}}

“A good leader takes a little more than his share of the blame, a little less than his share of the credit -Arnold Glasgow”

“A good leader takes a little more than his share of the blame, a little less than his share of the credit -Arnold Glasgow”

President Maithripala Sirisena has once said at a seminar attended by some government servants in Polonnaruwa that he would not allow the ‘government economists’ to levy higher taxes thus burdening the masses. He was referring to the VAT increases recommended by the Cabinet in July this year.

It is the Ministry of Finance (MOF) that has announced the ‘updates’ on Value Added Tax, Nation and Share Transaction Levy. The MOF has informed the general public its decision through circulars, obviously after obtaining Cabinet approval, the President was a party to that decision.

This is because the President is the Head of the Cabinet under the Constitution. My view is he could only review the decisions taken by the government rather than saying in public that he wouldn’t allow the “government economists’ to implement the VAT increases.

Lack of clear understanding of functions at top

As for the separation of power at the top, there seems to be a misunderstanding in interpreting the present constitutional provisions by the political authority.Our Constitution has empowered the Parliament to have full control over public finance and the taxes shall be imposed under the authority of a law passed in parliament(Article 148).

Under Article 4(b), only the executive powers of the people shall be exercised by the President.In- terms of the amended article 33(A), the President is responsible to parliament for the discharge of his powers and duties. These two arms, legislature and the Executive, are accountable to the people for their responsibilities as it is done to establish the doctrine of ‘separation of power’. This problem does not arise under Westminster style of governance, as the entire Cabinet including the Head is accountable to the people through Parliament.

This issue needs to be resolved through a proper consultative process between the President (Executive arm) and the Prime Minister representing the Parliament (Legislative arm). Some opposition members talk about an awful scenario arguing that the two parties, UNP, SLFP in the present National government are playing the famous game: ‘good cop- bad cop’ in the eyes of people, as they are under pressure from the ‘real opposition’ led by the former President. How long can we allow the members of the national government and the opposition to play this game at the expense of the people?

Despite having differences at the top, the positive side of the ‘fiscal consolidation’ management of the present government is that there has been an improvement in the revenue collection as a percentage of GDP. It is imperative that the treasury authorities increase the tax revenue as a percentage of GDP under the IMF standby arrangement in order to manage the economy. It is true that these measures will further burden the general masses.

That’s why the tax authorities must focus on collecting more revenue by increasing the direct taxes rather than increasing the indirect taxes such as VAT, NBT etc.In addition, the policy makers must try & avoid a further deterioration of the ‘balance of payments’ situation and the external reserves of the country. The country’s balance of payments account records all the flows of money between residents of that country and the rest of the world. Despite arranging the IMF package and additional borrowings from the World Bank and ADB in the recent past, the external financial situation of the country has not improved and one can argue that it’s deteriorating further.

Can debt burden be lifted?

Perhaps the most serious problem faced by the developing countries in the world today is the massive financial outflows experiencing year after year as a result of having to ‘service debts’ which include interest and capital re-payment of the loans obtained. As in the case of Sri Lanka, much of this debt has been incurred in their attempts to undertake many development projects.

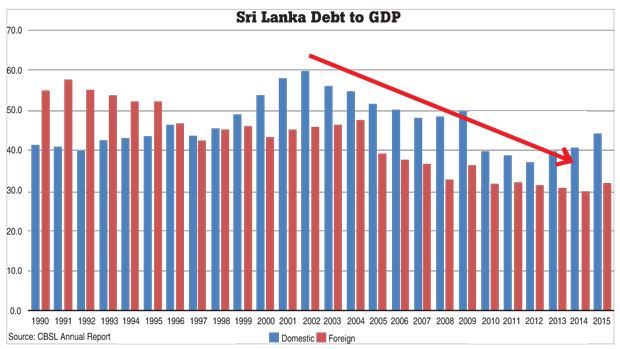

In Sri Lanka, the debt to GDP as reported by the Ministry of Finance and the Central Bank stood at 76.3 percent by end 2015. Since then it has further deteriorated. Sri Lanka’s debts comprise of both domestic and foreign. Domestic debt accounts for 60 percent of the total debt stock, while the remainder is foreign. Domestic debt as at 2015 accounted for 44 percent while foreign debt accounted for 32 percent of the total of 76 percent of GDP.

When analysing the sustainability of the government budget, we need to look at the balance needed between spending and revenues necessary to prevent the ratio of debt to annual GDP from rising. A “primary surplus” is needed to maintain the debt-to GDP ratio. If receipts are greater than the expenditure excluding interest payments, then a primary surplus occurs. This is needed if the effective real rate of interest payable on debt (the nominal interest rate less the inflation rate) is greater than the GDP growth rate.

It is therefore important to balance the macro- economic fundamentals by focussing on (a) curtailing the inflation; (b) keep a close tab on the real interest rates of the banking sector; (c) whilst improving the real economic growth rates. The fiscal consolidation alone is not sufficient to improve the economic welfare of the people.

Riding the dragon

We live in an interdependent world. Countries are affected by the economic health of others and as a result the problems in one part of the world can spread to other parts of the world. There was a saying: If America sneezes, the rest of the world catches a cold. Just look at what happened when the US sub-prime mortgage market collapsed. The USA illness turned into the world’s flu.

One example is worth mentioning. Greece has been struggling for the last seven to eight years with the burden of huge budget deficits for some years, high unemployment rates, high cost of debt-servicing etc. We have seen how the IMF has been helping Greece to finance rescue packages without success. Greece was finally unable to meet some US $ 2 billion repayment to IMF by 2015.

It is likely that either India or China will assume economic dominance on the world stage. Who will eventually emerge as the top economic power by the year 2030? On the basis of several economic indicators, China’s economic performance is extra-ordinary. By the end of last year, China has overtaken USA to become the world’s largest economy when measured in terms of purchasing power parity(PPP) However, it is expected that the Chinese economic growth will also come down to around 6.5% in the year 2017. Nevertheless, Sri Lanka can rely on the Chinese investments to propel our troubled economy. The credit goes to the former President having realised the importance of aligning towards China for assistance.However, it is now clear that MR administration has failed to dispel India’s concerns about growing tie up between Sri Lanka and China and how it impacts India’s national security.

The writer has previously (two to three years back) published in ‘Mirror business’a number of articles, drawing reference to the importance of aligning with the ‘One road - one belt’ Chinese strategy. Recently, Professor Cheng Enfu, Chairman of the World association of Political Economy, in a symposium held in Sri Lanka said that with the Indian Ocean being the lifeline of China’s foreign trade, energy and raw material transportation, Sri Lanka will undoubtedly play a crucial role in the strategy of the 21st century maritime silk road with its unique geographic advantage. However, the critical issue here is the ‘Indian interests’.

The Indian foreign policy is based on a fundamental principle of “In diplomacy, there were no permanent friendships, but permanent interests.” Sri Lanka is compelled to follow this principle, governing Indian foreign policy to further strengthen bi-lateral relationship with India. Sri Lanka needs to emphasize the importance of forming a strategic alliance with China and come to some kind of a tri-partite agreement to safeguard the Indian Ocean forward defence line and promoting ‘maritime silk route’ strategy for greater economic benefits for the three nations. Already India and Sri Lanka have a free trade agreement (FTA). The writer has argued previously that the proposed FTA between China and Sri Lanka will allow Chinese companies to set up large scale Industries in Sri Lanka so that they could make use of the Indian FTA to accelerate trade with India and at the same time re-export products back to China. Here we are talking about tapping 2.5 billion target market customers in both countries. Sri Lanka will stand to gain more. During the former President MR’s visit to China in 2013, both countries agreed to a strategic cooperative partnership and in September 2014 the Chinese President Xi Jinping visited Sri Lanka and announced the FTA negotiations. It seems that the present government has now realised the importance of this three-pronged approach and is so keen to finalise the proposed FTA with China. The government is now keen to develop ‘port city’ in Colombo and a strategic partnership in developing Hambantota port,allowing more concessions to Chinese companies whilst promoting trade and investments with India through ECTA.

However, the writer was of the opinion that Hambantota port project could be done through a joint venture company having, say 40 percent shares be owned by SLPA. Unfortunately the government has agreed to a 99 year lease to a ‘SPV’ with 80:20 shareholding with China Merchants port Holdings Co Ltd merely to obtainan up-front payment/s of US $ 1,080 million next year.We at ‘RTD forum’, a network of Professionals have undertaken a study in November and written to the Minister of Ports & Shipping requesting to consider an alternative option without alienating Hambantota port from SLPA. My view is, it is still not late to re-negotiate under more favourable terms and conditions (either with China Merchants or even with China Harbour) as the net present value of the future revenue accrues to Sri Lanka from Hambantota port project would be much more than US$ 1,080 Million. There seems to be no unanimous decision at the cabinet as the Minister in charge and the Prime Minister are reported to be at loggerhead as to the final modalities in the proposed Joint venture to further develop the Hambantota port as well as the east terminal of the Colombo port.

Conclusion

As stated above, the positive side in relation to the ‘fiscal consolidation’ of the government is that there has been an improvement in the revenue collection as a percentage of GDP. Also, the present government has realised the importance of the ‘three-pronged approach’ and is so keen to finalise the proposed FTA with Chinawhilst working closely with India. This is a step in the right direction. The negative side of the current state of affairs is the decline of the country’s economic growth rates down to 4.0-4.5 percentand increasing the inflationary tendencies mainly due to policy incongruities.Also the government has not been able to negotiate from the position of strength with the said countries, whilst avoiding social unrest among the affected people.

It is high time the policy makers focus on creating a conducive environment for the private sector entrepreneurs and the local & foreign investors to create more businesses and employment. The government must work hard to improve the ‘doing business index’. It seems that the national government concept doesn’t work in Sri Lanka to drive the economic growthon a sustainable basis.

(Jayampathi Molligoda is a Fellow Member of the Institute of Chartered Accountants of Sri Lanka and he holds a FMIC Masters of Business Administration from the Post Graduate Institute of Management, University of Sri Jayawardenepura. He can be contacted through [email protected])

10 Jan 2025 20 minute ago

10 Jan 2025 40 minute ago

10 Jan 2025 2 hours ago

10 Jan 2025 2 hours ago

10 Jan 2025 3 hours ago