08 May 2017 - {{hitsCtrl.values.hits}}

The significance of foreign direct investment (FDI) to an economy such as Sri Lanka’s cannot be overstated. Its correlation with economic growth is well established. Typically, the benefits to the recipient economy include a reduction in budget deficit, improvement to the balance of payments, a closing of the gap between savings and investment and reduced unemployment.

The significance of foreign direct investment (FDI) to an economy such as Sri Lanka’s cannot be overstated. Its correlation with economic growth is well established. Typically, the benefits to the recipient economy include a reduction in budget deficit, improvement to the balance of payments, a closing of the gap between savings and investment and reduced unemployment.

The investment to the country is virtually risk free. It brings with it new technologies, establishes international management practices and assures markets for goods and services.

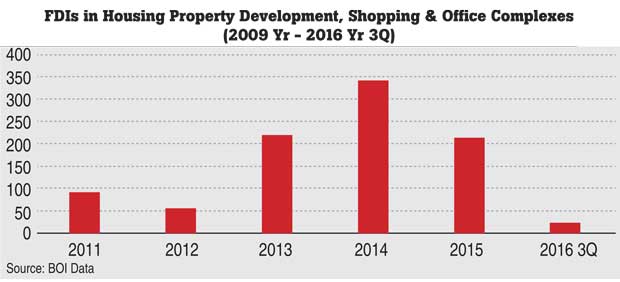

In the case of Sri Lanka and FDI inflows, since the ceasing of hostilities in 2009 and the resulting peace dividend, FDI trends have fluctuated but now show an alarming decline from 1.5 percent of GDP in 2011 to 1.26 percent in 2014. In capital terms, Sri Lankan FDI of US $ 970 million in 2015 was followed by US $ 450 million in 2016, a year-on-year reduction of 54 percent.

While peace and security are necessary conditions for the encouragement of foreign investment, they alone, are not sufficient. Additional requirements include consistent macro-economic policies, good governance, economic stability, established property rights, the rule of law and an absence

of corruption.

In order to encourage FDI, an attractive investment climate needs to be maintained and there is a general consensus of opinion that Sri Lanka still falls short when it comes to physical and technological infrastructure, labour market conditions, human capital and administrative capabilities.

With the real estate markets in particular, including the hospitality sector, there exists vast untapped potential and tremendous steps are being taken by government stakeholders to ease the regulatory framework and encourage foreign investment. Examples of this include provisions put forward in the ‘Restrictions on Alienation of Land Bill’ of 2014, easing of cash restrictions in this year’s budget and the dismantling of the complex network of overlapping regulations in the construction sector, with the enhanced re-establishment of the Urban Development Authority (UDA) mandated to “prepare development plans and to promote, implement and regulate development activities”.

On a micro level, the easing of cash restrictions, the abolition of value-added tax (VAT) on real estate transactions and proposed mortgage law reform has anecdotally increased purchase enquiries from overseas non-Sri Lankan investors, for the leading iconic real estate projects but they still only make up 5 to 10 percent of the completed deals. The uptick in enquiry levels is yet to make any significant impact on the order books.

At a corporate investor level, Jones Lang LaSalle (JLL) has recently been mandated by a leading player in the hospitality sector to source joint venture investors for a major real estate project developing a prime sea facing plot in Colombo. Interest has been quick to come from regions with established investment links with Sri Lanka, notably India, China and the Far East but the island is not a primary target on the real estate investment ‘radar’ for the Middle East, USA, Europe and Australasia, despite recent efforts made at a government level. Much more work remains to be done to raise the nation’s profile as a potential FDI location.

There is much talk of Sri Lanka’s strategic importance and attractive maritime location. In the context of the Asia Pacific region attracting 45 percent of all capital deployed globally in 2015, with India, its nearest neighbour attracting US $ 63 billion in FDI in 2016 and China, Sri Lanka’s largest FDI contributor, with over US $ 400 million invested in 2014, vying for top spot, it is apparent that there exists a clear and present opportunity to attract more FDI, an opportunity that Sri Lanka can ill afford to miss.

China continues to take the lead, partly for reasons of the well documented “one belt, one road” policy, with massive investments in mega projects like Colombo Port City (US $ 1.4 billion), Hambantota Port (US $ 1.4 billion), where the Chinese government offered to locate up to 2,000 companies, if another 15,000 acres were made available. India continues to be a significant contributor with National Thermal Power Corporation constructing coal power plants and more recently, Japan has entered the fray with an offer of a US $ 860 million grant to develop the Trincomalee port.

As part of the international airport expansion and upgrade, the Bandaranaike airport has offered leases to companies from Malaysia and Singapore to construct airport transit hotels and with State plans to spend US $ 4.2 billion on road and infrastructure projects between 2016 and 2017, there are clear signposts towards an improving FDI landscape in Sri Lanka.

Cause then for cautious optimism with many obstacles being dismantled and clearly defined opportunities in place. Although remaining challenges demand to be addressed in a coordinated fashion, not least prohibitive taxation structures, lack of economic transparency, high labour and material costs and an acute skills shortage, if Sri Lanka’s FDI ambitions are to

be achieved.

(Steven Mayes is Managing Director at JLL Lanka)

08 Jan 2025 36 minute ago

08 Jan 2025 1 hours ago

08 Jan 2025 3 hours ago

08 Jan 2025 4 hours ago