03 Nov 2016 - {{hitsCtrl.values.hits}}

The forthcoming Budget 2017 is to be presented in the midst of many macroeconomic vulnerabilities manifested by persistent fiscal deficits. Revenue generation is constrained by the limitations in mobilizing direct taxes which have led to a continuous rise in the indirect tax burden making the tax system more regressive hurting the poor and further widening the income inequality.

The forthcoming Budget 2017 is to be presented in the midst of many macroeconomic vulnerabilities manifested by persistent fiscal deficits. Revenue generation is constrained by the limitations in mobilizing direct taxes which have led to a continuous rise in the indirect tax burden making the tax system more regressive hurting the poor and further widening the income inequality.

Meanwhile, the slowing down of gross domestic product (GDP) growth inhibits any autonomous increase in revenue collection. The debt stock continues to rise reflecting a high level of fiscal sustainability risks in the medium term. Given the revenue constraints and the unlikely expenditure cuts, bringing down the budget deficit as envisaged in the International Monetary Fund (IMF)-supported programme seems a daunting task.

Fiscal consolidation agenda

Fiscal consolidation agenda

The Budget 2017 needs to be framed in conjunction with the fiscal target contained in the three-year Extended Fund Facility (EFF) arrangement agreed with the IMF last June (Table). With the anticipated increase in tax revenue of about 1.2 percent of GDP annually during 2017-18, the budget deficit is expected to decline from 5.4 percent of GDP in 2016 to 4.0 percent of GDP by 2018. A corresponding decline in the primary deficit (programme’s fiscal anchor, which excludes interest payments) to near-zero levels is expected for the coming years.

Indirect tax burden on the rise

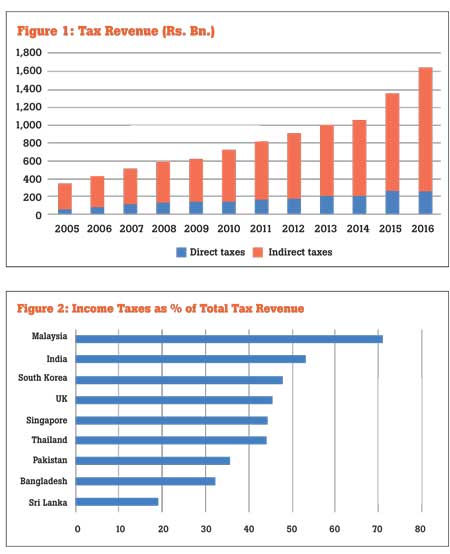

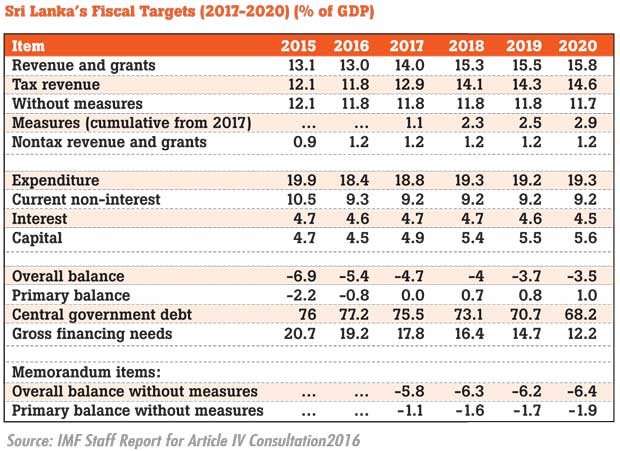

The total government expenditure for 2017 is projected to be 18.8 percent of GDP as against the total revenue of 14.0 percent, leaving a budget deficit of 4.8 percent of GDP. Around four fifths of the total revenue is generated from taxes. Dependence on indirect taxes has risen while the direct tax component remained stagnant over the last decade (Figure 1). The revenue generated from income taxes is less than 20 percent of the total tax revenue and hence, the balance 80 percent of total tax revenue has to be collected through indirect taxes. Sri Lanka’s income tax component is one of the lowest in the world (Figure 2).

The burden of indirect taxes is usually passed on to individuals who consume the goods and services subject to such taxes irrespective of their income levels. Indirect taxes are considered as a regressive form of taxation since the low-income earners are overburdened by indirect taxes imposed on essential consumer goods and services such as food, medical care, clothing and public utilities. Given the difficulties in collecting income taxes, which are a direct form of taxation, the goods and services consumed by the masses have been increasingly subject to various forms of indirect taxes, thus, exerting enormous pressures on the cost of living of the poor. As a result, the equity objective of taxation has been significantly undermined over the years.

VAT takes the brunt

An immediate challenge faced by the fiscal authorities is to bring down the budget deficit to 4.7 percent of GDP in 2017 from 5.4 percent this year in compliance with the EFF arrangement. This is to be achieved by raising the tax revenue from 11.8 percent of GDP this year to 12.9 percent of GDP in 2017. For this purpose, broadening the tax base for income tax and value-added tax (VAT) and tax administration reforms are planned. The government has already taken action to raise the VAT rate and to broaden its base while the other envisaged tax reforms are yet to see the light of day. This move contrasts with the government’s declared policy stance to reduce the indirect to direct tax ratio from the present level of 80:20 to 60:40.

The VAT rate has been raised from 11 percent to 15 percent effective from November 1. The VAT base has been broadened to cover certain previously exempted items including milk powder, electric and electronic items, cigarettes, liquor, perfumes, jewellery and coal. Lease or rent of residential accommodation, telecommunication services and healthcare services will also be subject to VAT. These tax changes will have ripple effects on the cost of living of the ordinary people.

The government anticipates that the VAT revisions will bring about a revenue boost of around Rs.100 billion from the present level of Rs.280 billion to Rs.380 billion by next year. However, it is not easy to generate VAT revenue as expected due to its complexities in the refunding process and other administrative challenges. A significant number of businessmen and manufacturers evade paying VAT and nation building tax (NBT). There are only 15,000 VAT payers and 23,000 NBT payers, according to the Inland Revenue Department. Sri Lanka also has experience in huge VAT refunding frauds in the past.

Revenue loss from tax incentives

The government has granted various forms of tax incentives with a view to attract foreign direct investments (FDIs) over the last several decades. They include corporate tax holidays, import duty exemptions and tax concessions for dividends. Both the Board of Investment (BOI) and Inland Revenue Department grant such concessions. The revenue loss on account of tax incentives is estimated to be around 1.35 percent of GDP in 2012-13, which is approximately equal to corporate tax collection. This is a major factor that has led to reduce the direct tax component of the country.

The effectiveness of these tax incentives is questionable in the context of low FDI inflows, which are still less than US $ 1 billion per annum. There is no mechanism to assess the benefits of the tax incentives or to estimate the foregone revenue losses. The low mobilization of corporate taxes reflects that the incentive receiving sectors do not contribute sufficiently to government coffers to offset the revenue losses.

Expenditure cuts unlikely

The space for cutting down expenditure is extremely limited as most of such outlays are already committed or cannot be curtailed for social and economic implications. The government will have to spend almost the entirety of its revenue for interest payments and amortization payments on public debt in 2017. Hence, it is compelled to borrow to meet other recurrent and capital expenditure.

The major current expenditure items include salaries and subsidies, apart from interest payments, which account for around one third of recurrent expenditure. The expansion of the public sector staff mostly for political reasons has become a severe burden on the budget, costing the government one fifths of its current expenditure for paying salaries. The transfers made to loss-making public enterprises year after year too balloon expenditure without generating adequate returns.

Fiscal sustainability risks imminent

The projected fiscal outlook for 2017 onwards reflects vulnerabilities in the areas of financing needs and debt sustainability. The envisaged fiscal consolidation to overcome the sustainability risks entirely depends on increased revenue mobilization as no expenditure cuts are earmarked. In the background of the lack of an effective programme to raise income tax collection or to rationalize the widespread income tax incentives, the total burden of revenue increase falls on indirect taxes, mainly on VAT. This leads to make the tax system further regressive hurting the poor. The downward effect of the tax revisions on GDP growth is inevitable further restraining revenue mobilization.

(Prof. Sirimevan Colombage, an economist, academic and former central banker, can be contacted at [email protected])

10 Jan 2025 2 minute ago

10 Jan 2025 18 minute ago

10 Jan 2025 33 minute ago

10 Jan 2025 38 minute ago

10 Jan 2025 1 hours ago