15 Feb 2016 - {{hitsCtrl.values.hits}}

The cyclic nature of a stock market is well established. An intelligent investor should be able to maximize returns in spite of market cycles. This requires a winning spell of understanding market dynamics and adopting the correct attitude. Today’s article takes on the aforesaid approach and will enable our readers to be more resilient during the downturn of a market cycle.

Invest in stock market for your dreams

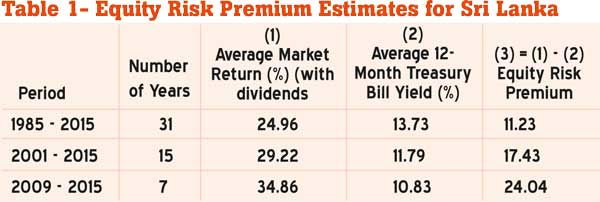

Everyone has a dream and the biggest adventure you can take is to live the life of your dreams. In a capitalist framework, it is undoubted that wealth creation is the foundation of most of our dreams. We will be able to be ahead of our dreams only if we plan our finances and manage our financial portfolio wisely. It is undoubted that equity should definitely be a component of a profitable portfolio that is geared at long-term wealth creation. Since its inception, the performance of the Colombo Stock Exchange (CSE) has been remarkable when compared to other financial instruments. As depicted in Table 1, the market has outperformed the return from treasury bills. The stock market has given a 11.23 percent higher return than treasury bills for the last 31 years (from the inception of the CSE) 17.43 percent from 2001-2015 and 24.04 percent from 2009-2015.

Bear markets are a global phenomenon

Bear markets are a global phenomenon

Equity was established as an ideal longterm investment in the previous table. However, it is important to bear in mind that the cyclic movement of stock prices might indicate a reverse of trend in the short run. According to the Elliot Wave Theory, market cycles are a result of investors’ reactions to outside influences or predominant psychology of the masses at the time. The upward and downward swings of the mass psychology always showed up in the same repetitive patterns. Accordingly, the CSE is subjected to market cycles in the short run even though it has recorded unprecedented growth in the long run. An enthusiastic and well-informed investor would be aware that global markets have left investors in the lurch during the last few months. Global equity prices have plunged down drastically and entered in to a bear market.The predicament of equity markets can be understood in the light of global economic and political conditions. The recent global political, social and economic status quo is rather fragile. The wide spread of ISIS and the outbreak of humanitarian concerns (highest since World War II) resulted in geopolitical tension among nations. The Chinese market is in an uneasy state. The situation intensified as Japan’s Nikkei index fell 950 point on Tuesday, February 9, 2016. It was the biggest loss in one day since May 2013. European and developed economies are no exception. China, which is an economic giant, is going through economic contraction as a result of the core of the economy shifting from exports to consumption. The policy decision of the USA on interest rates and Japan’s surprise shift to negative interest rates in late January was not the ideal stance for an upward movement in stocks. Further on, inflation is going down mainly due to the crash in oil prices. An unusual decrease in prices could push down global economic growth. Currently, the USA stands as a driver of global growth and any indication of the USA monetary policy tightening is likely to add to the selling pressure on global equities. Investor confidence is at stake and the credibility of the central banks is questioned.

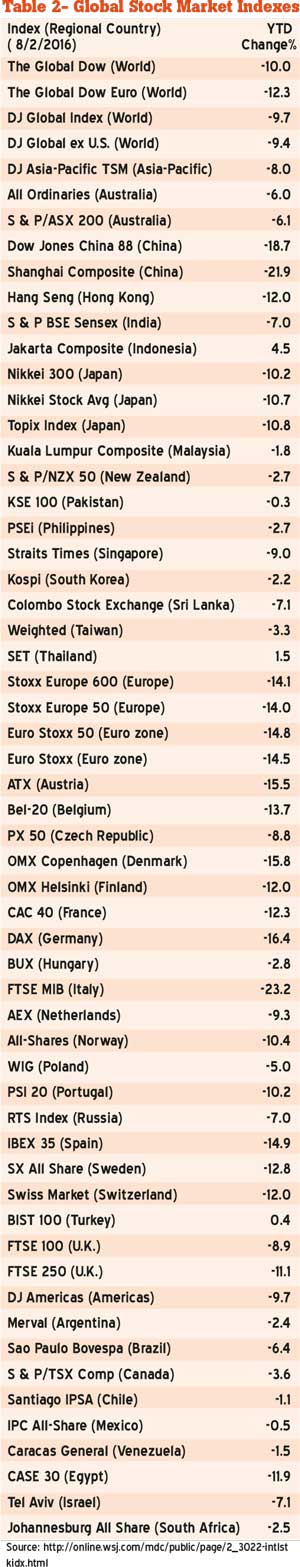

Sri Lanka is integrated with the global economic system. Hence, the ills of the global economy will definitely trickle down to our economy and market. Nevertheless, it is also important to note that the CSE has performed relatively well when compared to its counterparts. Table 2 reiterates the downward trend in prices. A relatively large basket of markets representing different categories of economies were selected with the aim of enabling our readers to obtain a detailed depiction of global equity markets. It enables our investors to independently evaluate the performance of the CSE. When most of the markets are dipping, Sri Lanka has declined only by about 7 percent (as at 8.2.16) for the current year. It is interesting note that India, the giant of South Asia, is also experiencing market turmoil. The BSE Sensex has witnessed a 23 percent fall during the past 11 months. Tata Mutual Fund CIO Ritesh Jain believes that India can’t do much about the fall as it is mostly driven by global factors and investors should continue with their investments. It could be argued that this.

Do not find political refugein stock market

Against this backdrop, certain political groups and activists are swift in overstating the status quo. These politically bankrupt individuals tend to find refuge by tarnishing the market. The nexus between politics and a stock market is well established. Yet, using the market to achieve ulterior political gains by disseminating false information cannot be tolerated. It is important for them to perceive that the government and regulator have taken many initiatives to promote efficient markets. These allegations are baseless. The national budget for 2016 provided several incentives and relevant policy guidance towards the betterment of the capital market and stock market. The proposals are as follows:

The regulator is also committed towards maintaining efficient markets. Routine surveillance and investigations are geared at safeguarding the interest of the investors. In such an environment, investors should feel confident about their investments. Unfortunately, the perception on regulation that is inculcated in society is flawed. Timely and balanced regulation is important. History stands as evidence for the lack of proper regulation. The economic crisis experienced in the USA in the recent past is a classic example. Further on, we witnessed how liquidity constraints experienced by certain local finance companies a few years ago intensified in the absence of stringent regulation and enforcement.

Think and act independently

We live in a democratic system where people are given an equal opportunity to raise their opinion. This does not imply that all that is spoken is true. In such a context, the addressees should be able to think and act independently. Critically analyse the information you get and make calculated decisions. Investors should look into avenues of maximizing returns within the prevailing market condition. Market experts believe that the existing investors should sit tight during this period. It is a great time for first time investors to enter the market. Focusing on the areas discussed in Box 1 might be very useful instead of resisting the market amidst various rumours and market slowdown. Have you heard of the herd mentality? It refers to the lack of individual decisionmaking or thoughtfulness, causing people to think and act in the same way as the majority of those around them. In finance, a herd instinct would relate to instances in which individuals gravitate to the same or similar investments, based almost solely on the fact that many others are investing in those stocks. It is disappointing to note that there is an unhealthy practice of investors blindly following high-net-worth investors or foreign retail/institutional investors. It was observed how certain individuals complained that they are unable to obtain clear investment signals from highnet- worth investors. How irrational is this statement? A chance of you obtaining the same levels of profit is unrealistic as investment objectives, risk appetite, etc., may defer drastically. It is important for investors to make their own judgments. They could always obtain help from their stockbroking firm when making their decisions. Market is not a jackpot to continue generating profits. It will have its ups and downs. Hold on to the market with vigilance and patience during a downturn and maximize your returns. The decline of the bull market is not bad news as everyone believes it to be. Declining stock prices, paves the way towards safe and sane time for wealth creation.

26 Nov 2024 14 minute ago

26 Nov 2024 52 minute ago

26 Nov 2024 2 hours ago

26 Nov 2024 2 hours ago

26 Nov 2024 3 hours ago