30 Jun 2016 - {{hitsCtrl.values.hits}}

A s the veritable ‘pearl of the Indian ocean’, Sri Lanka’s biodiversity, cuisine and hospitality have long been its claim to fame. Moving forward though, a burgeoning reputation for medical tourism may also serve to whet the appetites of foreign visitors.

s the veritable ‘pearl of the Indian ocean’, Sri Lanka’s biodiversity, cuisine and hospitality have long been its claim to fame. Moving forward though, a burgeoning reputation for medical tourism may also serve to whet the appetites of foreign visitors.

If the November 2015 convening of the Council for the Promotion of Medical Tourism was any indicator, key thought leadersin healthcare increasingly see value in piggybacking off positive tailwinds in thepost-war tourism sector.With the Sri Lankan Tourism Development Authority targeting 2.5 million inbound tourists by 2016-end, healthcare providershave been jostling to satisfy individual healthneeds on a spectrum from medical treatment to wellness tourism.

On one end, there are service offerings aimed at treating or altogether curing a medical condition; ranging from extremely high-tech surgeries like transplants to relatively standard procedures such as hip replacements.

Most of the major private sector hospitals have been making strides in this area. Lanka Hospitals has focused on building expertise in cochlear implant surgeries; completing their 100th successful surgery on a Maldivian national in 2014.Having likewisegarnered a robust share of Maldivian medical tourists, the Asiri Group introduced bariatric surgery at the Surgical Hospital in 2014–15—a popular procedure seen as a means of diversifying source markets for medical tourists. Meanwhile, Nawaloka has focused on cultivating a regional hospital in Negombo to serve as their medical tourism hub.On the other end of the spectrum, Sri Lanka offers a palette of ‘fringe medical’ treatments such as Ayurveda, acupuncture and wellness spas for tourists who merely wish to maintain their health or prevent future medical problems. Heritance Ayurveda Maha Gedara is an interesting example of hotel chain that has developed a 64-room health resort dedicated to the practice of authentic Ayurveda.

Offering both curative and preventive benefits, Ayurvedic wellness programmes at the resort are managed by resident Ayurveda doctors and include everything from ‘pancha karma’ cleansing – a five-action detoxification process for body and mind – to stress management programs that incorporate yoga and meditation. Prevention may be better than cure, as the adage goes, but the prospect of both is infinitely better.

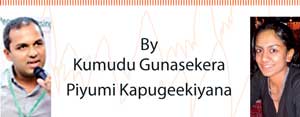

While domestic healthcare and hospitality providers have proven eager to push the envelope on quality and cost-effectiveness, Sri Lanka represents only a fraction of the 9 percent slice held by Asia in the global market for medical tourism.In 2008, the global medical tourism industry encompassed at least 35 countries; serving over a million medical tourists annually.

Each of these ‘tourists’ coughed up a tidy US$7,500–US$16,000 per medical visit. By 2011, the medical tourism market served at least 3 million tourists. While some revenue estimates remain conservative, the market is set to expand significantly in the years leading to 2020.

Unless Sri Lankan providers become progressively savvy, making real inroads in this dynamic landscape of healthcare service provision and consumption may well be untenable.

A looming co mpetitive threat

It is all the more important for Sri Lankan providers to gain traction in this space, given the competitive threat posed by other Asian destinations for medical tourism.

Amongst the region’s most highly demanded service offerings are cardiology, urology, gastroenterology, dermatology, orthopedic surgery, neurosurgery, dental and cosmetic surgery.

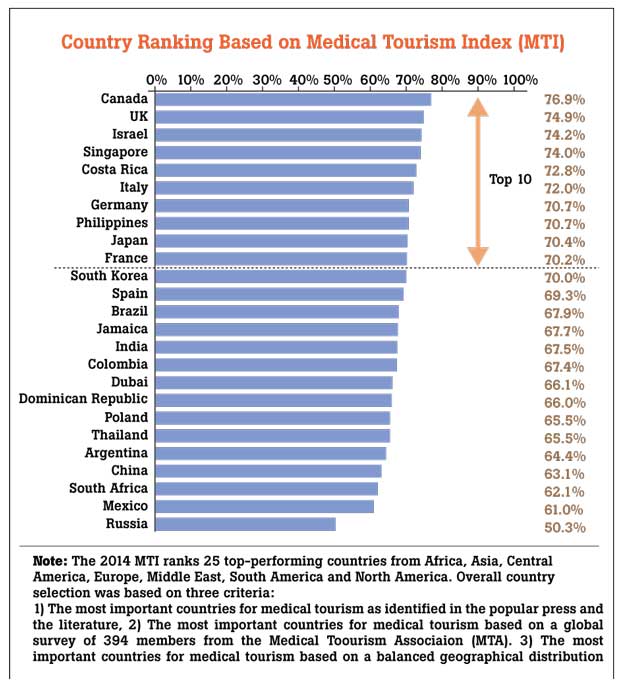

In 2014, the International Healthcare Research Center (IHRC) developed the Medical Tourism Index (MTI) which quantifies the attractiveness of a country for medical tourism based on its local environment, healthcare and tourism potential and infrastructure, and availability and quality of medical facilities and services. Seven of the destinations featured in the IHRC’s list of 25 top-performers—Singapore, Philippines, China, Japan, South Korea, India, and Thailand—represent a host of promising hospital contenders, in terms of geographic proximity, quality, range of procedures and cost-effectiveness.

According to Patients Beyond Borders, individuals traveling to one of these providers in India, for instance, can expect a discount of 65 percent–90 percent on the cost of a comparable medical procedure in the U.S.

In Thailand, a patient can expect a potential discount of 50–70 percent. Even in Singapore, where the cost of living is measurably higher, medical tourists are offered a discount of 30–45 percent on the cost of comparable procedures in the U.S.

Promising Demand Drivers

On the plus side, Sri Lanka’s top 10 source countries for tourism—India, UK, China, Germany, Russia, France, Maldives, Australia, Indonesia and USA—represent a lucrative pool for any healthcareprovider that can develop a cohesive strategy to tap into underlying demographic and socioeconomic trends.

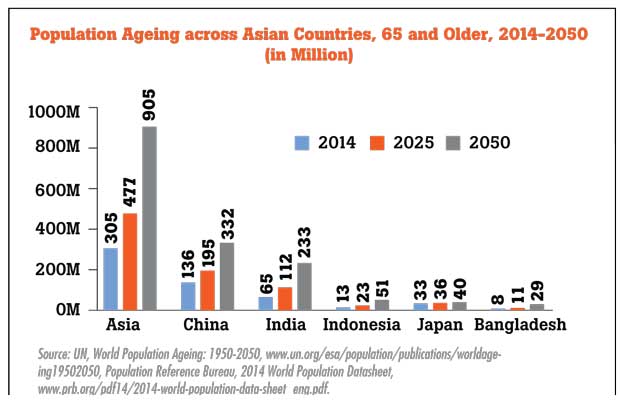

All across the Asian region, the number of people aged 65 and above is expected to grow—from a figure of 305 million in 2014 to 905 million in 2050.

Even as the region ages, rising income thresholds bode well for the market. The ASEAN countries—Indonesia, Thailand, Malaysia, Singapore, Philippines, Vietnam, Myanmar, Brunei, Cambodia and Laos—currently make up the second-fastest growing economy in the region.

Between ASEAN’s consumer base of 626 million and the trillion dollar economies of China, India, Japan and South Korea, the Asian regionprovides the best prospects in terms of demand.

The rapidly aging American population also represents a promising market. An estimated 16 million Americans plan to travel abroad for medical care by 2017; representing a potential US$ 30–US$ 80 billion in spending. Currently, these customers are looking towards geographically proximate locations like Canada, Mexico, Costa Rica, and Brazil.

For the most part, the costs of trans-pacific travel and patient concerns regarding the quality of procedures are the headwinds in an otherwise promising regional market—especially given the challenges of establishing culpability in the event of medical malpractice.

Stax’s recommendations for capturing the market

Capitalizing on the substantial runway in medical tourism will require healthcare providers to synthesize diverse strategies for patient outreach, both within the region itself and outside.

Stax brings both experience and expertise to healthcare providers attempting to navigate the medical tourism market. Having completed over 150 engagements globally across the healthcare delivery ecosystem in the last 5 years alone, our experience covers the spectrum from growth strategy to due diligence.

We cater to service providers in a number of areas, including: Healthcare Service and Facilities, Healthcare Technology, Pharmaceuticals & Dietary, Medical Services & Managed Care, and Healthcare Information & Exchange. To capture the medical tourism market, we recommend:

1.Knowing where to compete: The choice of geographic market is a key decision. In order to know how and where to compete, healthcare providers must understand their target customer and the ease of travel between regions. Patient outreach and marketing efforts will differ based upon whether the target customer is an uninsured/underinsured American looking for a cost-effective elective procedure coupled with a leisure trip or an Asian traveler seeking a quality surgical procedure unavailable within the geographic confines of their own country.

2.Developing clarity about the offering: Rather than a Jack-of-trades approach towards capturing the market, healthcare providers should circle back to basics and develop clarity concerning the main offering. Primarily, providers need to focus on an area where they have a comparative advantage in terms of performance. India, for instance, is an emerging leader in the area of cardiovascular care, owing to providers like the Fortis Escorts Heart Institute and Research Institute. Initially founded by US-trained cardiac surgeon NareshTrehan, Fortis Escorts is staffed by a team of Western-trained specialists who perform 4,000 heart operations annually, with a mortality rate of 0.8 percent and an infection rate of 0.3 percent. The provider’s post-op statistics comfortably outperform the first-world averages of 1.2 percent and 1 percent, respectively. An open-heart surgery that might cost US$ 60,000 in the U.S. is priced at US$ 4,500 at Fortis Escorts. Like most other hospitals in the medical tourism industry, Fortis Escorts is also given to hospitality. To expedite the arrival and stay of overseas patients and their attendants, the provider supplies visa assistance in coordination with the Indian Foreign office, makes lodging and travel arrangements, provides airport pickup and even facilitates sight-seeing.

3.Increasing transparency: Patients have real concerns about the quality of medical care received in foreign destinations, as well as attendant medical risks. The only solution is for providers to increase transparency by collecting, curating and sharing quality, comparative performance metrics in patient outreach. In our experience working with Healthgrades—the U.S. provider of information about physicians and hospitals to consumers—we discovered that the three most important things patients consider when selecting a doctor are experience (accuracy of diagnosis and frequency with which procedures of interest are performed), hospital quality (clinical outcomes of the hospital in question) and patient satisfaction (whether other patients recommend this doctor). As in the case of Fortis Escorts in India, countries and providers with well-documented registries of procedures, patient testimonies, accreditations and performance data stand the best chance of showcasing their specialties and competing in the global market.

4.Being forward-thinking about partnerships: An important strategy is for medical providers to think ahead about partnering with government and other institutions in building a healthcare ecosystem that enhances innovation. Singapore, in particular, has been successful in this area; emerging as a test-bed for partnerships leading to sophisticated new medical offerings. A noteworthy example is the Tan Tock Seng Hospital’s (TTSH) partnership with Swiss medical technology company Hocoma AG to develop and optimize equipment for robotic rehabilitation therapy in neurological movement disorders. By becoming the first regional centre to adopt the latest version of the LokomatPro—a robot-assisted walking therapy device – TTSH is now positioned to offer robotics and virtual reality programs alongside conventional rehabilitation therapies.

5.Planning for aftercare: Aftercare is a vital component of the overall healthcare experience delivered to a patient. While providers must convince prospective customers about their experience and hospital quality, broader patient satisfaction also derives from what happens after a procedure. For the most part, the aftercare horizon will change based on the type of procedure sought. Compared to patients who receive a dental treatment or minor elective procedure, Asian providers will need to be proactive about associated patient follow-up and hospitality arrangements for medical travelers who undergo surgeries requiring a long recuperation period. For the customer, one of the perks of receiving healthcare in an Asian holiday destination is the prospect of convalescence in a resort environment.

For the healthcare provider, it means exploring untapped opportunities with the hospitality sector.

(Kumudu Gunasekera, Ph.D., is a Director in the Stax Singapore office. Kumudu works with our global teams to deliver actionable insights to clients worldwide. Prior to joining Stax, Kumudu was a Principal Economist with Parsons Brinckerhoff (Washington D.C.). He could be contacted via: [email protected]. Piyumi Kapugeekiyana, Ph.D., is a Consultant at the Stax Colombo office, involved in the end-to-end delivery of projects across verticals, from developing market sizing models to client relationship management. She also serves as a Relationship Manager for the Stax Boston office.She could be contacted via: [email protected])

10 Jan 2025 6 minute ago

10 Jan 2025 2 hours ago

10 Jan 2025 2 hours ago

10 Jan 2025 3 hours ago

10 Jan 2025 4 hours ago