04 Dec 2017 - {{hitsCtrl.values.hits}}

This paper attempts to analyse the tea export revenues of Sri Lanka, value addition by tea exporters, comparative tea production between Sri Lanka and Kenya and Colombo and Mombasa auction prices. The purpose is to critically evaluate the performance of the tea exports, production, etc. in order to ascertain the constraints and provide a platform for a constructive dialogue for ‘way forward’. Let us begin with the analysis of recent media articles pertaining to this subject matter.

This paper attempts to analyse the tea export revenues of Sri Lanka, value addition by tea exporters, comparative tea production between Sri Lanka and Kenya and Colombo and Mombasa auction prices. The purpose is to critically evaluate the performance of the tea exports, production, etc. in order to ascertain the constraints and provide a platform for a constructive dialogue for ‘way forward’. Let us begin with the analysis of recent media articles pertaining to this subject matter.

Tea export value addition

“A successful branding strategy founded on a ‘Unique Selling Point’ to capture a market, is diametrically opposed to the concept of cost reduction with a cheap component and are two mutually exclusive propositions.”

The above quote is from the article under the caption ‘Tea brews toxic blend for its own survival’ by the founder of Dilmah tea.

We should be proud of our flagship tea brand Dilmah competing with multinational brands like Unilever, Tetley’s, Pickwick, Twinning’s, etc. However, it is important to critically look at the remarks made in the said article, such as “every kilo of Ceylon Tea is sold at the highest prices in the world due to (the superior) value dictated by the uniqueness of Ceylon Tea”.

Also, it was claimed that the foreign exchange earnings for the country can be increased only by increasing the export price, preferably through branding Ceylon Teas and previously it was mentioned in the media that the stagnant export earnings are mainly due to the fact that most of the exporters have been acting as mere traders, etc.

These statements or hypotheses need to be critically reviewed and tested carefully after taking into consideration the relevant and vital statistics for a considerable time period and other related factors.

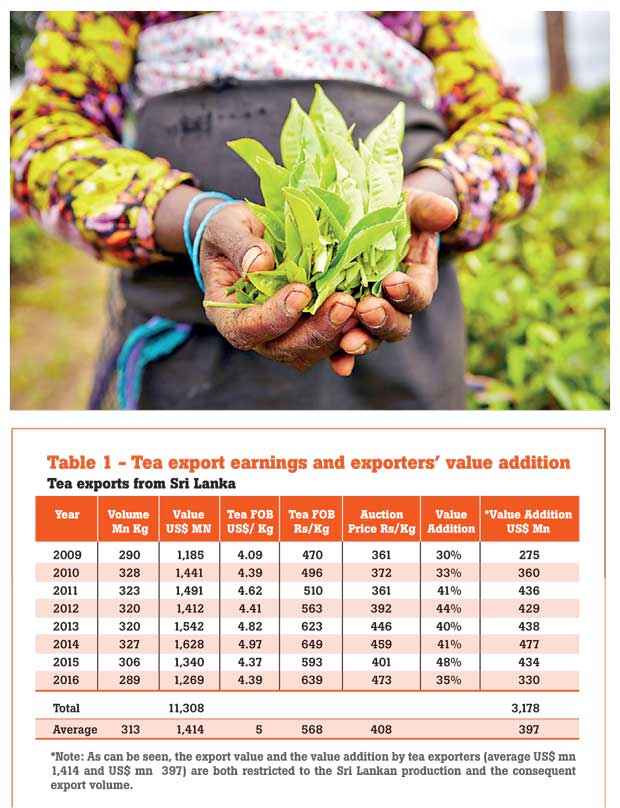

The writer has analysed the tea export figures since 2009 to date in order to arrive at the value addition created by the exporters operating at the Colombo auction.

As can be seen from Table 1, total earnings from tea exports during the last ‘eight-year’ period amounting to US $ 11,308 million (average of US $ 1,414 million per year) and the total value addition by Sri Lankan tea exporters works out to US $ 3,178 million (average per year – US $ 397 million). This reflects the export value addition as a percentage of the auction value as much as 39 percent, which is commendable.

Stagnant tea production

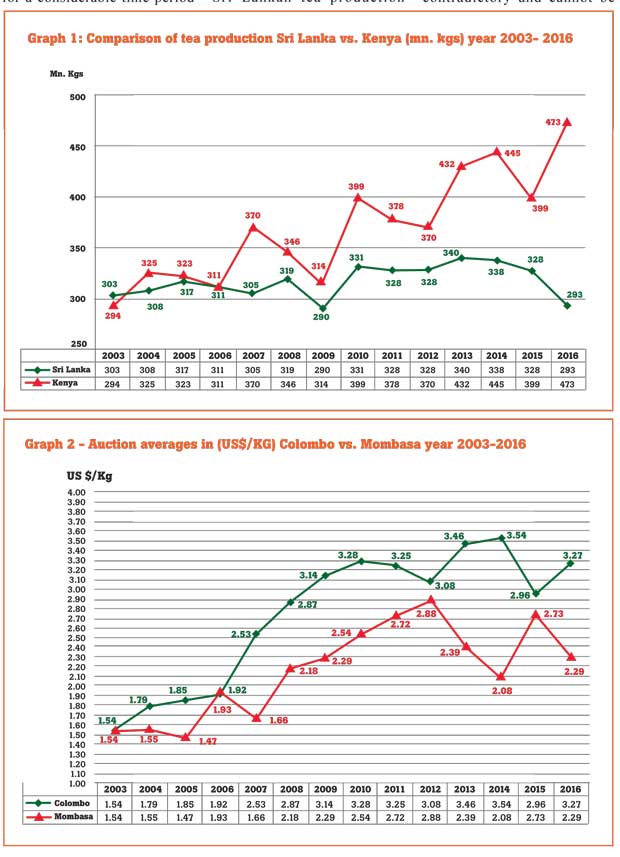

However, the biggest constraint in enhancing the foreign exchange earnings from tea exports is the volume of teas catalogued at the auction, due to the stagnant tea production in Sri Lanka. Graph 1 shows that since 2004, the Kenyans have overtaken our tea production and during the year 2016, the gap between the Kenyan and Sri Lankan tea production was as much as 180 million kilogrammes, which is 61 percent more than Sri Lankan production.

The writer has done a cost-benefit analysis on the feasibility of accelerating tea replanting (technical and financial feasibility and economic viability) to ascertain the practical adaptability of replanting as a strategy to increase tea production. It is very unlikely that the Sri Lankan tea producers are able to increase our tea production beyond 340 million kilogrammes (highest achieved so far) in the ensuing years due to supply-side constraints and inherent defects. There is a policy incongruity in the overall goals of the tea sub-sector, especially in the ‘high grown teas’.

The duel national objectives of (a) providing employment to estate worker population with higher wages without due consideration of commercial viability and (b) enhancing foreign exchange through ‘Ceylon Tea only’ marketing efforts are somewhat contradictory and cannot be achieved simultaneously. (Basically, Ceylon Teas are expensive and will continue to be expensive mainly due to high production costs.)

Further, the climate change has come to stay and only mitigating strategies could be adopted to just maintain the current production levels. It is a futile exercise to criticize the Sri Lankan tea producers by pointing a finger that they do not undertake sufficient tea replanting or not follow proper agricultural practices with a view to increasing the production to cater to the international markets thus enhancing the much-needed foreign exchange.

Comparable tea prices at Colombo and Mombasa auctions

It is true that the Sri Lankan auction price has always been high compared to the Mombasa auctions. As can be seen from Graph 2, since 2004, our Colombo auction prices have been higher than the comparable tea prices at the Mombasa auctions and this is in line (identical) with the same trends witnessed for production of Kenyan teas compared with our tea production and the resultant tea sales.

There is a direct negative correlation between the production shortfall between Sri Lanka and Kenya and the incremental tea prices at the two auction centres (even without taking into account other East-African tea production figures).

It is therefore obvious that the premium tea prices realized for ‘Ceylon Teas’ are mainly due to the supply and demand of Sri Lankan tea viz Kenyan and other East- African countries. It may also be true that there is a premium price on account of ‘Unique Ceylon Tea’ character as well.

Conclusions

From the above analysis, it is clear that the hypotheses (reproduced below) that have been tested by following some statistical analysis/studies could not be proved by the writer and hence it may be false or not significant enough in crafting future strategic direction.

(1) Every kilogramme of Ceylon Tea is sold at the highest prices in the world due to (the superior) value dictated by the uniqueness of Ceylon Tea.

(2) Claim that the national foreign exchange earnings for the country can be increased only by increasing the export price preferably through branding Ceylon Teas.

(3) The stagnant export earnings are due to the fact that most of the exporters have been acting as mere traders, etc.

However, it is interesting to note that the remaining statement from the said article, which is reproduced for clarity, gives the stakeholders a window of opportunity by way of providing a platform for a constructive dialogue for ‘way forward’.

“A successful branding strategy founded on a ‘Unique Selling Point’ is diametrically opposed to the concept of cost reduction with a cheap component and are two mutually exclusive propositions.”

If these two marketing strategies adopted/to be adopted by the tea exporters are two mutually exclusive propositions as claimed, then what is the problem?

Tea blending hubs are all over the world, except in Sri Lanka. It may be we miss the bus.

(Jayampathy Molligoda is a Fellow Member of the Institute of Chartered Accountants of Sri Lanka. He has obtained his MBA from the Postgraduate Institute of Management and has also successfully completed an Executive Strategy Programme at the Victoria University Melbourne, Australia. He counts over 37 years of executive experience in the fields of financial management, strategic planning and human resource development. At present he serves as Executive Deputy Chairman of a leading public quoted company)

04 Jan 2025 3 hours ago

04 Jan 2025 3 hours ago

04 Jan 2025 5 hours ago

04 Jan 2025 5 hours ago

04 Jan 2025 5 hours ago