28 Dec 2016 - {{hitsCtrl.values.hits}}

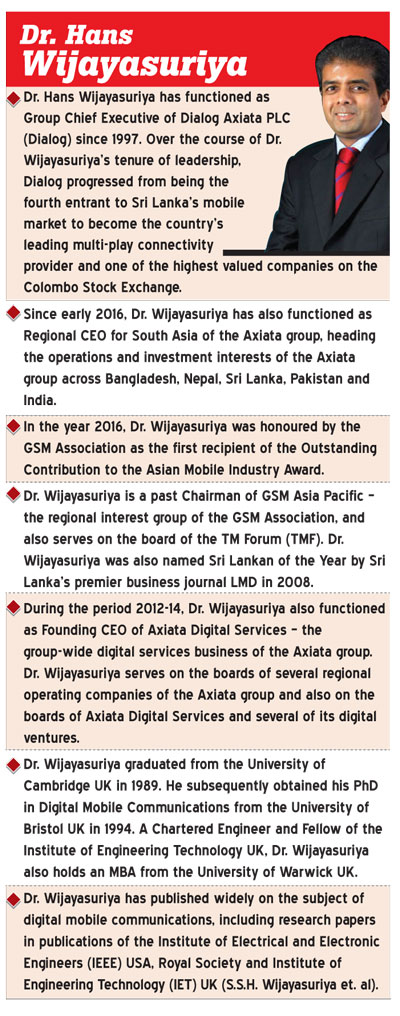

An era is set to conclude with Dr. Hans Wijayasuriya, who, in short, spearheaded Sri Lanka’s mobile revolution, stepping down from the Group CEO position at Dialog Axiata PLC to take up a full-time regional role for Dialog Axiata PLC’s parent, Malaysia’s Axiata Group, from next year. In this backdrop, Mirror Business met with Dr. Wijayasuriya to have a brief chat with him over his legacy, succession, business and the future of Sri Lanka’s telecommunication landscape. Following are the excerpts from the interview.

Let’s begin with the transition Dialog Axiata will soon see in terms of leadership. For how long has this succession plan been contemplated?

I think like any large organisation should be, we also had an orchestrated succession plan, which could be activated at any point in time. The preparation for succession both at Dialog as well as across the Axiata Group was centred on the Group Accelerated Development Programme or GADP, where the aspirants are taken through a development programme for many years – both formal training and advanced management programmes in addition to exposure in multiple disciplines and multiple markets. At the moment several Dialog people are out of Sri Lanka at senior positions at various stages of their careers as part of this programme. Supun (Weerasinghe) in particular went out in 2013 and spent one year as Chief Strategy Officer at the Axiata Group and then on to being CEO of Bangladesh operations for three years. He was also in Harvard for an advanced management programme. So the succession plan has been very well executed.

Even at the other levels similar programmes are in place. Our Axiata Group aspiration where management structures are concerned is not a hard and fast rule but the formulation that is aimed at is seven-two-one, meaning seven locals, two from within the Axiata Group and one from a completely different background, so that there is diversity as well as continuous fresh thinking. And wherever possible Axiata has tried to have a local CEO in each country they operate. This goes back to the fact that I was made CEO way back in 1997. Today there are local CEOs in Bangladesh—successor to Supun was a local—and also in Indonesia.

As a CEO I am very happy that the succession was within and also that someone who grew within the organisation. Supun has been with us for almost 16 years and has a strong knowledge of Sri Lankan operations as well as the rest of Axiata. He has also gained a lot experience as COO with Dialog previously. So operationally he is very much up to speed. What is also important is his age. Supun is just 41.

Let me interrupt. You took up the mantle much younger, if I’m not mistaken?

Yes, I was 29. But the company was very small. At 29 I was able to manage the size of the company I was given at the time but definitely not the company that it is now. So Supun taking up the job will give new energy and youthfulness to the management. In that sense, I believe it is a picture perfect transition. Of course, in any situation, where someone has been there for a long time, transition can be little more complex. We have a very good empowerment culture and even when Supun was COO here, he was pretty much running the operations. So we expect the transition to be as smooth as possible.

How much of yourself do you see in Supun?

Well, I never looked for a carbon copy and he is certainly not a carbon copy of me. And that definitely was not the objective in our preparation for a successor. But there are some fundamental values, which I would have liked my successor to have, which Supun certainly has imbibed and demonstrated. One is attitude—a mix of perseverance and the never-give up approach to solving problems. He was working very closely with me along with the rest of the senior management in 2008 and 2009 when we had a tough time. And I think it really displayed, not only Supun but the rest of the team as well, how they can overcome challenging situations. Supun as COO was leading a lot of the operational challenges at the time.

He is also a very humble and a relatively understated person, which I think is important for a leader because you need to earn your leadership authority and referability. They need to come through a process of earned respect and not from a bombastic, headline-seeking or overbearing personality, which Supun is not at all.

He is also a person who takes every opportunity to learn, specially in the technical areas. I came from an engineering background with a PhD in mobile communication and Supun comes from a business and financial background. But the extent to which he had learnt the fundamentals of advanced technology and how to use them to drive business is very impressive.

Well, how excited are you about your new role as the Regional Head for South Asia?

I’ve been actually doing it part time since February when I was appointed to the region. So it will be an acceleration and full-time version of what I’ve been doing for the last 10 months. And those 10 months have been very taxing from a travel perspective because I had to be here in a serious way plus while doing the other role. So, all in all, I think it’s very exciting to oversee multiple markets, including Sri Lanka, Bangladesh, Nepal, India and Pakistan. In Pakistan, we have a broadband operation and in India we are the strategic partner for Idea Solutions—the third largest operator. It’s a joint venture with India’s Birla Group and I sit on the board there. In Nepal we are number one and in Bangladesh Supun recently completed the merger with Airtel. Robi-Airtel is a strong number two in Nepal. Each market is at a different stage of evolution and our operation is at a different stage—in some we are strong challengers and in others we are leaders. This adds a new dimension to the challenge and I’m certainly looking forward to that.

Where will you be based?

My office will be split between Colombo and Kuala Lumpur. I will have a few regional staff here because I will be looking after a few group functions and sit on the executive committee. My base office will be split but I expect to spend at least three or four days in Colombo.

Let’s move on to the industry. It’s not a question of whether the local telco industry should consolidate but a question of when we would be able to see that consolidation. What is Dialog Axiata’s approach to this?

What we have consistently stated is that we encourage consolidation. We really believe that there needs to be a consolidation in this market at the infrastructure level because that’s where wastage can occur. Five networks all rolling out all these new technologies—it doesn’t make any sense and that depresses the profitability of everybody. So we would actively participate in this consolidation process but nothing has bubbled up to a near close at least. We think the right size for this market is around three players for the mobile. As we move forward, I think it’s really important to have a strong third player. If you look at the converged telco market today, SLT and Dialog account for nearly 85 to 90 percent of the market. So it’s always good to have a strong third player. It will be good for the consumer. The only way a third player could come around is if there is consolidation.

Let me elaborate a little bit more on this idea of consolidation. When you talk of consolidation, the immediate thought is companies buying each other and certainly that is one dynamic that needs to take place. But another could be the rationalizing of various layers of the telecommunication infrastructure. This needs to be enabled by progressive regulation, which permits the industry to achieve the same costs and efficiency synergies as consolidation would but without reducing competition. For example, towers. They can easily be rationalized. To some extent, Dialog did this through a specialized business unit we set up in 2008. We started actively renting out our tours and today our tenancy ratio is 2.2, meaning 2.2 operators on every tower, which is a very high tenancy ratio regionally or even globally. But if that is done in a more organised manner and regulation permits the creation of tower companies, we might find one or two companies owning all the towers.

The next layer is the transmission—the combining of high capacity radio links, which link the towers and the fibre links, which link towers and buildings and so on. It’s good for a market of our size to have up to three players who efficiently provide what we call the transport layer of the network.

The third layer would be the radio networks—GSM, 3G, 4G, fixed 4G, Wi-Fi, etc. Recently we have seen a growing number of examples where even this layer, which we call RAN or Radio Access Network, getting shared. So one operator or two operators would be running a 4G network and many other service providers sit on their infrastructure. So why this stack would work is that at the consumer level you would still see five brands or may be more than that. If you look at the UK, there are about 10 service providers serving different customer segments. These are all competing brands and the consumer gets the benefit of competition while the industry gets the benefit from sharing and rationalizing the infrastructure. So this can happen in parallel to companies buying each other. Regulation can be evolved to a point where this is facilitated.

So are you implying that our regulators haven’t been very progressive?

I wouldn’t say that. Actually I’ve gone on record many times saying we have one of the most progressive regulatory regimes in the region, which I still stand by. That is the reason why Sri Lanka’s telecommunication sector stands tall among regional counterparts in terms of penetration, affordability and technology. That’s because the regulators have been fairly progressive and haven’t been out there to suck money out of the industry.

Some of these concepts I talked about, such as the layering of the industry, require bringing in fairly sophisticated open competition mechanisms. For example, local loop unbundling—or can you have scenario where Dialog’s connection to a customer can be used by another operator to provide service to a customer? Is there regulation to support that and enforce free and fair competition? I think we are not there. Likewise many regional countries are not there either. So I think it’s just a gentle wakeup call that I’m giving if we want to conserve capital while increasing competition and benefitting the customer. For that, a few enabling regulations need to come into place. I believe a lot of this is incorporated in the new draft telecommunications bill.

This draft bill you mentioned—have the policymakers consulted the industry before preparing such proposed law?

Yes, we were consulted last in 2014. Over the last five years I have seen everything that needs to go into a good telecommunication act being incorporated in the draft. But when that will actually come out is the issue.

Globally it is said that data is the future for the telco industry. How true is this claim to the Lankan market?

That’s very true. It is very important the fact that data reaches the consumer in the form of video. When you say data, what do you do with data? To most people the real game changer now is on a mobile device or even at home on a computing device, you can access video in good quality. Browsing a website was there five or 10 years ago. But today the real change is the quality of the video and all high capacity networks have given that to you. Video is a game changer in consumer experience and video is a language that applies across any level of education, literacy, etc. That makes 4G or any high-speed networks relevant to any single citizen, finally. So you don’t need to be computer literate to watch news on your mobile. That will be a game changer.

Now where is Sri Lanka placed in this whole episode? Like I said the enabling environment had made it possible for Sri Lanka to have the most advanced technologies. The point you brought up on returns and efficiency and the need to consolidate—that is a threat. If you talk to any operator or look at their balance sheets, returns are below the weighted average of capital because the tariffs are so low and the investments in data infrastructure are in dollars and are becoming more and more expensive. So with most operators today, I think their incremental investment is forced to be below the weighted average cost of capital. So, in the long run, this means there is value destruction.

So, one route to cure this problem is consolidation and the efficient collaboration. Another route would be that there is restructuring of the value chain itself. Increasingly many new services are created by app developers, which bring in new revenue streams through digital services through the providers of

these services.

So that’s why you’d see Dialog itself moving into e-commerce, digital health digital education and quite a bit into video. We are verticalzing because the revenue streams are in the vertical segment as opposed to the core transport of bits and bytes. But no telco can boil the ocean. We can only trigger this wave. How we intend to do that is, we plan to open up our networks to enable app creators to use our technology and create a large number of services. That’s where Dialog ideamart comes in. It today has over 6,000 apps running on it— all created by Sri Lankan app developers. This has started creating a big revolution in the wider community—creating applications and placing them on our network, which I suspect is a longer-term source of revenue that could compensate for data being somewhat underpriced.

But it appears data is being targeted by the authorities to make money via higher taxes?

What the industry is hoping for is, since the rates are so low, data consumption would be inelastic at this level. But I think the next three months will tell us, after it’s (tax amendments) enacted. It takes around three months to actually stabilize. It’s only at that point we’ll be able to really comment, whether the consumption has dropped. One thing for sure is tariffs in Sri Lanka are very low. The ITU (International Telecommunication Union) has slated them as the lowest in the world for data. But whether a hike of taxes by 25 percent or so will change the consumption pattern, we don’t know yet.

I believe the acquisition of Suntel back in 2007 was also targeted at augmenting your capacity over data?

When we went an acquired Suntel in 2007 it was a very unfashionable thing to do. The world was saying it’s mobile only and forget about fixed. Some of the big players in the world even sold their fixed assets. Our thinking at that time was someday—we are actually talking 10 years hence—that fixed will come back but in a different form. Our projection was that the bandwidths would continue to increase and therefore the fixed network would be able to carry more high power data than a wireless network.

What has died is fixed voice – the POTS or the plain old telephone sets. But data to the home is growing very fast and as a result, our fixed LTE network is penetrating throughout the country. The fixed LET network also can provide voice over the LTE network so you could connect a normal handset. That will have relevance because it comes with broadband, Wi-Fi and so on. Hence, having both the mobile network and a fixed capability and both put together give a consumer proposition that covers the life—from the time you wake up to the time you go to bed.

Dialog came into the devices market a few years back. How is it faring?

Let’s approach it this way. Why did we get into the devices market? One was to be a reference point in the market so that for the health of the entire industry device pricing incrementally was brought to very affordable levels. If a player like us goes out and sets market with quality devices—whether it be dialog devices or branded devices—that will bring the smartphone prices down and I think we have succeeded in doing that.

The second reason we went for it was to create an experience around device. So that with our experience centres across the country we create a reliable shop front where customers can come and play with the most recent technology.

How’s your e-commerce business wow.lk faring and its contribution to the group bottom line?

Well it’s contributing negatively to the bottom line at the moment as most e-commerce companies do. A lot of the digital businesses have completely different P&L and even objectives. Amazon is a good example. Wow.lk’s growth is good as we are seeing an increasing e-commerce habit. And with some of the payment evolutions Dialog is planning, we should see further growth. We are also taking wow.lk into the regions where consumers can benefit from the supply chain advantages of e-commerce.

The Axiata Group has similar e-commerce ventures in each country they operate. In Indonesia we are number two and in Malaysia we are almost number one. The objective there is to draw synergies between the telco and the fact that the customer relationship is often with the telco.

A specific case for Sri Lanka is that the white goods incumbents are also very strong. Because of that, the Sri Lankan consumers have a wide choice today. They have the e-commerce players and they also have the very reliable brick and mortar players. This creates an environment where consumers get a very good deal.

Dialog’s parent in Malaysia certainly is one of the largest foreign investors in Sri Lanka. Going forward, what kind of investments are we looking at?

We have been investing US $ 150 to 200 million per year and I expect similar investments to continue, provided an enabling environment where pro-competition regulation is present. Up to 2016 we have made investments in Sri Lanka to the tune of little over US $ 2 billion.

Going forward, how do you project the Sri Lankan telco landscape?

I think we are on a very good wicket given the infrastructure we have. I believe the fundamentals are strong. So there is no reason why Sri Lanka cannot continue to be number one in the region.

But I would say that we should not forget the advantages of competition. Though Dialog is today the market leader, I still go back to the past where we were number four. Along the way we catalyzed a revolution and our competitors did their fair share as well. Overall it was the energy and the dynamism of a competitive market, where the shackles of monopolistic behaviour had been diluted or gradually broken down—starting with the telecommunication sector liberalization in 1996 and I would go even further to 1988, where Celltel was brought into the country, which was very progressive at that time. That was the first cellular network in the whole of South Asia. So, if you look at the success story of Sri Lanka’s telecommunications industry, one key paradigm, which gave boost from time to time, was the introduction of competition. I think we should never discount the value of that. One request I would make from policymakers is not to go back to a monopolistic thinking. It’s very important to have as much competition as possible. As the competitive landscape becomes complex, the regulators may need to look at the new digital world and adjust the regulation. But they need to always keep in mind that competition is very important.

In terms of consumer behaviour, do you see any drastic change?

I think even the last five years have been very eye-awe. If you take the OTT (over-the-top content) services for example, they came out and gave a lot of things to customers for free. At the start of that cycle it appeared that these were consumer-friendly, consumer-oriented and pro-choice services – whether it be Facebook or the ability go on the Internet and search anything you want for free other than paying for a few bits of data. Fantastic isn’t it?

But if you look at the last five years, the consumers themselves have created global monopolies. There are a few giants in the OTT world, who I think are bigger than any monopoly that we have ever seen. That is why you see administrations around the world are now reacting. Increasingly regulators are asking these OTTs to locate their business in the countries they operate and pay taxes and be accountable. It needs to be done but the way you have to do it may not be traditional. It needs to be thought through and done soon because otherwise you won’t have a level playing field to do business.

The consumers have definitely changed. They have created Uber for example, which is a near global monopoly. While them being very disruptive, they benefit the customers. So what’s the trend? Global monopolies, which benefit the customers. But nevertheless, they are monopolies. So you probably need benign and friendly regulation, which protects consumers as well as underline service infrastructure, which make those services possible. For example, if all the ISPs (Internet service providers) in the world go bust, Google can’t exist. These are concepts thought ahead of time and put in place nationally as well as globally.

Blurb

10 Jan 2025 20 minute ago

10 Jan 2025 37 minute ago

10 Jan 2025 57 minute ago

10 Jan 2025 2 hours ago

10 Jan 2025 3 hours ago