07 Jul 2017 - {{hitsCtrl.values.hits}}

Nearly 60 years ago, a little-known band called the Beatles arrived in Hamburg, got a haircut, recorded their first song and found their sound.

Nearly 60 years ago, a little-known band called the Beatles arrived in Hamburg, got a haircut, recorded their first song and found their sound.

Taking a cue from the Fab Four, world leaders gathering for the Group of Twenty Summit (G20) this week can make the most of their time in Hamburg—and leave Germany with a sound plan to strengthen global growth.

Recovery on track

This summit opens with a sense of optimism. The upbeat mood stems from a global recovery that is now one year old and represents a welcome change from previous G20 meetings, where unsteady growth and downward revisions regularly cast a shadow.

But it should be cautious optimism that prevails—policy efforts are still needed to strengthen the recovery and build more inclusive economies.

What’s behind this growth momentum?

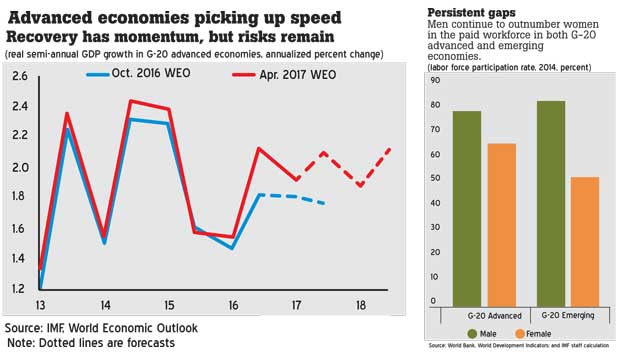

A recent pickup in global manufacturing and investment activity signals that the recovery we projected in April remains on track. Our new forecast will be published in late July but we expect global growth to be around three-and-a-half percent this year and next.

However, as our most recent G20 Surveillance Note explains, the regional composition of growth has shifted.

In the United States—where the expansion is in its ninth year and cyclical unemployment has all but disappeared—a soft patch in early 2017 and policy uncertainty have tempered our outlook.

The euro area—led by monetary stimulus and domestic demand—has exceeded expectations and conditions in emerging economies have been boosted by robust growth in China and stabilizing conditions in Russia and Brazil.

So yes, we have momentum. But we cannot rest easy—both old and new risks threaten our goal of creating higher growth that is shared by all.

Clouds on the horizon

The risks are not limited to one region or one type of economy and, in some cases, reflect the downside of forces that are driving the recovery.

Financial vulnerabilities present an immediate concern. After a long period of favourable financial conditions, including low-interest rates and easier access to credit, corporate leverage in many emerging economies is too high. In Europe, bank balance sheets still need repair following the crisis. In China, a faster-than-projected expansion—if it continues to be fuelled by rapid credit and increased spending—would potentially lead to unsustainable public and private debt in the future.

Left alone, this constellation of concerns could be a recipe for sudden financial distress, when the world’s economies also continue to struggle with several longer-term problems.

Think of excessively high economic inequality, low productivity growth, population aging and gender gaps. As our research shows, these challenges put a ceiling on potential growth, making it harder to raise incomes and living standards.

How should the G20 respond?

A call to action

The best place to start is by sustaining the current economic momentum. Monetary and fiscal policies can be used to support demand where needed and feasible.

In Japan, for example, while output remains below potential, fiscal and monetary support, combined with favourable global economic conditions, has contributed to particularly strong growth in recent quarters.

Yet these measures will only go so far. Countries need to look for ways to guard against risk, accelerate growth and leverage the power of international cooperation. No country is an island and policies taken by any nation can resonate stronger and last longer with coordination from the other G20 members. Our priorities should include:

Reinvigorating productivity growth. In many economies, increased resources for education, training and incentives that encourage research and development (R&D) would stimulate investment and unleash entrepreneurial energy. This would give a much-needed boost to how fast economies can sustainably grow.

Safeguarding the financial sector. The current period of growth can be used to address corporate and bank vulnerabilities by building up capital and strengthening balance sheets. Sustained growth also means that now is the time to improve — not roll back — oversight and regulatory systems implemented in the aftermath of the crisis.

Addressing excessive current account imbalances. Both surplus and deficit countries should confront this problem now to avoid larger corrections down the road. This summit is also a chance to strengthen the global trading system and reaffirm our commitment to well-enforced rules that promote competition while creating a level playing field.

Above all, we need to focus on building inclusive economies. This calls for structural reforms to lift incomes and for more support to those who face disadvantages from technological changes and global economic integration.

It also calls for new efforts to empower women and close gender gaps.In the G20 advanced economies, the difference between the number of men and women in the paid workforce is about 15 percentage points. The gap is even wider in the G20

emerging economies.

If the G20 nations can meet their target of increasing female labour participation by 25 percent by the year 2025, it could create an estimated 100 million new jobs for the global economy.

The substantial gains from closing the gender gap are just one example of what can be achieved if we act together.

Another example, the Compact with Africa, initiated under Germany’s leadership of the G20 and designed primarily to boost private investment, can serve as a blueprint for stronger growth and economic diversification across the continent.

I would also emphasize the coordination required to tackle global humanitarian crises—whether it is epidemics, natural disasters or famines. The G20 has taken a significant step by committing over US $ 1 billion in aid to the millions facing famine in Somalia, South Sudan, Yemen and North-East Nigeria. In the months ahead, we must do more to address the underlying causes behind these devastating events. Taken together, these challenges underscore the bottom line: the global recovery remains on track, but it will take tangible policy actions and stronger international cooperation to sustain and broaden the momentum.

Like the band from Liverpool that went on to change the world, I hope that the G20 finds its groove in Hamburg. It should use this moment to come together—not only to achieve higher growth but also to ensure that the benefits of growth can be shared by all.

(Courtesy the International Monetary Fund)

(Christine Lagarde is Managing Director of the International Monetary Fund)

07 Jan 2025 6 hours ago

07 Jan 2025 7 hours ago

07 Jan 2025 8 hours ago

07 Jan 2025 07 Jan 2025

07 Jan 2025 07 Jan 2025