15 Jun 2016 - {{hitsCtrl.values.hits}}

China continues to dominate discussions about the health of the world economy. Many are concerned about China’s slowing growth and its ability to manage the difficult transition from a controlled economy dominated by manufacturing to a more open economy with greater reliance on domestic consumption. Some policy decisions last year also scared the market.

While the risks are many and real, they are manageable and well-understood by China’s policymakers. This is not the time to sell China short.

The government is determined to achieve its average 6.5 percent growth target between now and 2020 and it has the means to do so. We expect increased investment in regional development, support for production of higher value goods and improvements to infrastructure. The government also plans to reduce the cost of doing business. And it will buffer the social and economic dislocations that inevitably arise as economies evolve. Recent official figures and our bank’s experience on the ground suggest such measures are taking effect, building the foundations for a more balanced economy.

For many in the west, China is the land of export-oriented smokestacks and assembly lines, but the economy is already rebalancing. The dynamic, innovative services sector makes up more than half the economy and is growing annually at high single digit percentage. Alibaba has become the world’s biggest retailer by building an ecosystem customised for more than 400 million Chinese online consumers who increasingly shop on mobile devices.

Wanda, China’s largest commercial property company and cinema operator, has built and runs shopping malls in 100 Chinese cities and is growing a financial services business to serve the 30,000 tenants of those malls. By issuing millions of loyalty cards to retail customers, Wanda gains valuable knowledge about how its tenants are trading, allowing them to offer financial products, such as payment cards, tailored to customers’ needs. This is old economy transitioning to new economy before our eyes – and on a massive scale.

Over the next 20 years another 300 million people – roughly the population of the US – are expected to move from the countryside to Chinese cities. Alibaba, Wanda and many others are plugging directly in to this burgeoning domestic economy. We expect China to navigate its way to self-sustaining growth less dependent on exports.

The other side of China’s economic rebalancing requires the government to wind down zombie manufacturing companies that are redundant in today’s economic environment. This careful dismantling will take many years and will cause upheaval as millions of workers are required to move to new locations and jobs.

The government faces a tricky task to achieve this transition without social unrest but it is capable of doing so, including through greater social security provision. The cost of addressing dislocated labour for targeted industries may be expensive, perhaps as much as 1-2 percent of gross domestic product (GDP). But in a more centrally-planned economy, much of it state-controlled, China may manage the process better than the US and Europe did in the 1970s and 1980s.

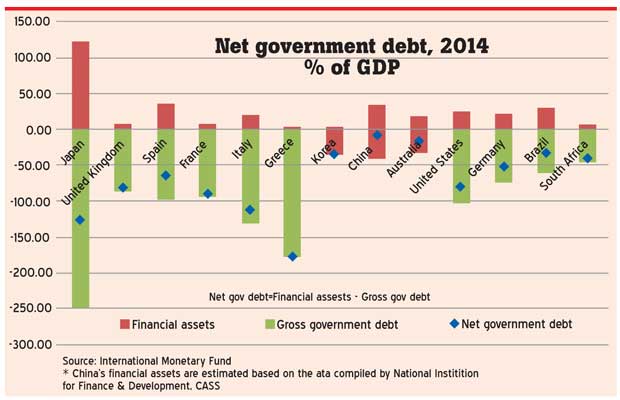

China’s gross debt has reached levels which may be uncomfortably high by international standards. The debt could well rise further, as China tries to apply counter-cyclical stimulus to give itself breathing space to drive through much-needed reforms. Whilst this stimulus is having diminishing effectiveness, I believe the transition is manageable, especially considering China’s debts are by and large domestically held and backed adequately by state and local assets. China’s net debt is comparable to levels in the US, UK and Japan, even after considering the debt of state-owned enterprises and the possible need for additional bank capital.

Many question whether the costs of rebalancing will be borne by banks via loan losses. Were the manufacturing industry to restructure quickly, and were the inherent losses to accrue to those companies’ lenders, non-performing loans could be significant. While it is not clear how this will play out, given the degree of state ownership in the banking system and the state’s available resources, we believe the country has the capacity to absorb the rebalancing costs.

Recent events have revived concerns about central control of the economy and policymakers’ willingness and ability to embrace a free market. China knows it has to loosen the reins and continue to open up its capital account.

In conversations with officials I detect a renewed sense of humility and a willingness to recognise past mistakes such as missteps over last year’s equity market bubble and poor communication around the devaluation of the renminbi. Policy communication has been clearer this year and officials accept there will be bumps on the road to a sustainable economic future, but they are committed to its success.

China’s short-term challenges are significant. We don’t expect a smooth path during its transition. But for those who are willing to invest for the long term, the end goal remains enticing.

(Bill Winters is the Group Chief Executive of Standard Chartered PLC)

10 Jan 2025 1 hours ago

10 Jan 2025 2 hours ago

10 Jan 2025 4 hours ago

10 Jan 2025 4 hours ago

10 Jan 2025 4 hours ago