05 Jul 2016 - {{hitsCtrl.values.hits}}

Latest Board of Investment (BOI) data confirm an emerging unhealthy trend in the Sri Lankan economy. Although there is an increase in new project/venture activities as indicated by increase in BOI project agreement signings, majority of new projects are in industries in the non-tradable sector.

This is a continuation of a trend emerging for several years. This implies that Sri Lanka may not be able to achieve expected medium term GDP growth targets unless steps are taken to channel more investments into the tradable sector.

Increase in investment into the non-tradable sector could boost GDP in the short term as experienced during post 2009 period. But it does not help economy to achieve sustainable growth in the medium to long term. Investment into non tradable sector such as infrastructure development also acts as a catalyst to develop the tradable sector.

Thus investment into non-tradable sector has to be supported by parallel increase in investment into the tradable sector to achieve a sustainable and balanced economic growth. Sri Lanka is a small country with a small population. Hence it is not possible to achieve long term growth without developing the tradable sector.

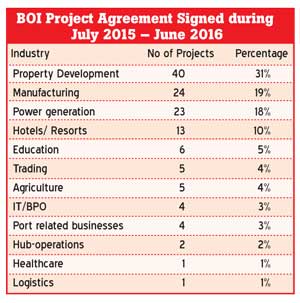

Highlighted below are some trends seen in BOI project agreement signings during the period between July 2015 to June 2016.

Property development appear to be the investors’ favourte industry

As shown in the table above, property development (mainly residential apartments) accounts for nearly third of new projects signed by the BOI. Property development is a non-tradable industry, and too much investment into property could lead to economic instability (through several transmission mechanisms). Investment into property should be done in line with the overall demographic and economic changes taking place in the country. Investments made not in line with these could lead to negative consequences.

Surge in investor interest in mini-hydro projects

BOI data show that there is significant investor interest in mini-hydro projects. There is a strong economic justification to increase renewable power-generation capacity. However, recent escalation of natural disasters such as earth slips, and flooding may require careful evaluation of new mini-hydro projects. This is because some analysts point out that environmental impact caused by mini-hydro projects increases the risk of such natural disasters. Hence potential benefits from mini-hydro projects may outweigh potential risk of natural disasters and negative environmental impact.

Few investors are interested in export businesses

Only 23 percent of projects signed during the period are in tradable sector industries (i.e., manufacturing, agriculture). If we include other service industries with foreign income potential, the percentage increases to 39 percent (i.e, hotels, BPO/IT, port related businesses). Given the industrial sector still accounts for only 26 percent of Sri Lanka’s GDP, ideally Sri Lanka should attract more projects in the industrial sector – preferably high tech and high value add industries. When we analyze new venture/project data during last few years, we could see only a few project initiatives in such industries.

Another notable trend seen is the low level of interest in high-growth service industries like BPO, IT and logistics. Healthcare which is now identified as an industry with potential for foreign earnings also had a very low level of investor interest.

Low level of interest in agribusinesses

Agriculture is an important sector for Sri Lanka because it is the largest employment generator in the country. Major agriculture industries such as tea, rubber and paddy are highly labor intensive, but their productivity remain low. Major investments are needed to upgrade and improve productivity in these industries. Lack of new ventures and investment in agriculture could lead to further deterioration of agriculture sector, and could even threat food security. Furthermore, Sri Lanka spends large amount of foreign exchange to import food items. By increasing investment into agriculture to boost production and value addition could help Sri Lanka save foreign exchange.

Targeted investment programs to develop export industries ?

Sri Lanka’s exports, measured as a percentage of GDP, have been declining steadily. Moreover, declining foreign income exert pressure on overall economic growth as Sri Lanka’s economy is highly import dependant. The only way Sri Lanka could overcome this problem is by promoting investments into industries with high net foreign earning potential. In order to achieve this Sri Lanka needs directed/targeted accelerated investment programs for selected industries. Broadly focused private sector investment promotion programs appear to be not effective. Such programs should ideally be supported by trade pacts to provide market access in order to provide support for select industries at least for an interim period (e.g., Multi Fiber Agreement’s contribution to the development of the apparel industry in Sri Lanka).

In the meantime, it may also be prudent to discourage investment into certain non-tradable industries. Because such industries do not create much value to the economy except transferring scarce capital into unproductive assets.

(Indika Hettiarachchi is the Founder/ Managing Director at Jupiter Capital Partners, a Private Equity and Venture Capital advisory firm. [email protected])

10 Jan 2025 22 minute ago

10 Jan 2025 2 hours ago

10 Jan 2025 3 hours ago

10 Jan 2025 4 hours ago

10 Jan 2025 4 hours ago