13 Feb 2017 - {{hitsCtrl.values.hits}}

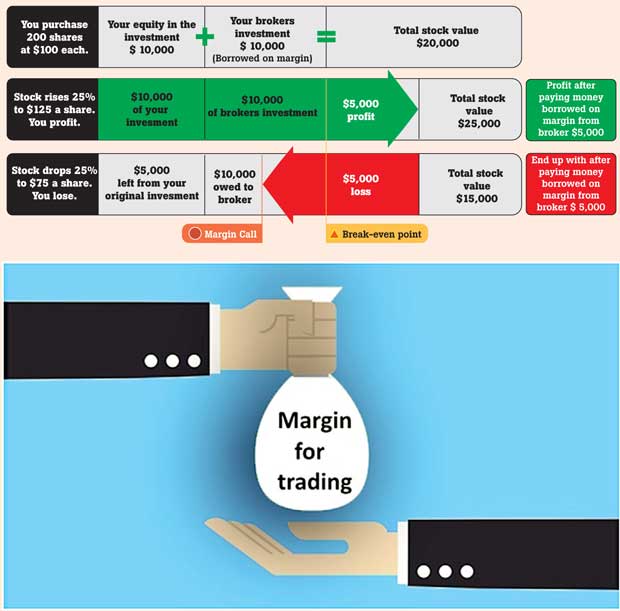

Margin trading is a popular form of investing in the stock market. What do we mean by margin trading? Buying on margin is borrowing money to purchase stocks. You can think of it as a loan. Margin trading allows you to buy more stocks than you’d be able to purchase with the money at hand.

Margin trading is a popular form of investing in the stock market. What do we mean by margin trading? Buying on margin is borrowing money to purchase stocks. You can think of it as a loan. Margin trading allows you to buy more stocks than you’d be able to purchase with the money at hand.

Many refer to it as a double-edged sword. Investors would be able to maximize returns and mitigate the risks of investing on credit if they invest wisely. Therefore, the article is expected to discuss a few tips for successful margin trading.

Know your risk.

As stated above, margin trading is a double-edged sword, amplifying losses and gains to the same degree. Margin trading is a great form of leverage when investing in the stock market. However, borrowing money isn’t without its costs. Regrettably, marginable securities in the account are collateral.

You’ll also have to pay the interest on your loan. The interest charges are applied to your account unless you decide to make payments. Over time, your debt level increases as interest charges accrue against you. As debt increases, the interest charges increase, and so on.

Therefore, buying on margin is mainly used for short-term investments. The longer you hold an investment, the greater the return that is needed to break even. If you hold an investment on margin for a long period of time, the odds that you will make a profit are stacked against you.

If you are new to investing, we strongly recommend that you stay away from margin. Even if you feel ready for margin trading, only invest in margin with your risk capital - that is, money you can afford to lose.

Know the interest rate.

Just like every loan, there is an interest rate for what is borrowed. By understanding the interest rates there is a stronger chance for investment success. It will enable you to evaluate if it is worth investing on credit.

Buy over time, not in one shot.

Depending on the portfolio size more often than not investors should buy into a position over time and not with one large order. Try taking half the position at first, find some headway (1 – 3 percent) to the upside and then add to it from there. This will keep your risk to a minimized level until you have a stronger chance of an overall profitable trade.

Margin calls are not good.

In volatile markets, prices can fall very quickly. If equity in your account falls below the maintained margin, the brokerage will issue a ‘margin call’. A margin call forces the investor to either liquidate his/her position in the stock or add more cash to the account.

If for any reason you do not meet a margin call, the brokerage has the right to sell your securities to increase your account equity until you are above the stipulated margin. Even scarier is the fact that your broker may not be required to consult you before selling! In such cases you can’t even control which stock is sold to cover the margin call.

Because of this, it is imperative that you read your margin agreement very carefully before investing. This agreement explains the terms and conditions of the margin account, including: how interest is calculated, your responsibilities for repaying the loan and how the securities you purchase serve as collateral for the loan.

Be extra cautious of any upcoming news.

Caution should be applied when dealing with upcoming news such as earnings reports. Some investors may be buying extra stock on margin for the very reason that they think positive news is around the corner, but like any investment they should be prepared in case the news does not go their way.

Have backup funding in cash.

The worst scenario for any investor is to risk it all, then lose it all, and then proceed to go into heavy debt because of it. By keeping cash on the sidelines to serve as backup funding some of these “worst of” situations can be prevented. Portfolio cash can be used to recover from a margin call or purchase another position to hedge the risk.

Stay away from speculating.

Speculating with money is never a smart thing to do, so don’t do it with a margined position. Utilize margin trading in conjunction with a well defined profit vs. loss ratio. Maintain investing discipline at all times.

Stick to your game.

Just like Warren Buffet focuses solely on fundamentals to make sound decisions when investing, every investor should stick to their own set strategy. New investors should read several investment books before pursuing any trading on margin.

In conclusion, it could be reiterated that the article provides a basic foundation for understanding margin and investors are advised to adopt a cautious approach when investing on credit.

09 Jan 2025 3 hours ago

09 Jan 2025 4 hours ago

09 Jan 2025 6 hours ago

09 Jan 2025 7 hours ago

09 Jan 2025 8 hours ago