20 Feb 2017 - {{hitsCtrl.values.hits}}

I had the pleasure of travelling to Sri Lanka during Vietnam’s Tet Holiday, to meet with two brokerages and a research institution to discuss Sri Lanka’s future economic outlook and opportunities that can be found in Sri Lanka’s stock market. Overall, I see a lot of opportunities here for stocks in certain sectors, although my optimism for portions of the stock market is coupled with an ambivalent view regarding the country’s challenges that are ahead.

I had the pleasure of travelling to Sri Lanka during Vietnam’s Tet Holiday, to meet with two brokerages and a research institution to discuss Sri Lanka’s future economic outlook and opportunities that can be found in Sri Lanka’s stock market. Overall, I see a lot of opportunities here for stocks in certain sectors, although my optimism for portions of the stock market is coupled with an ambivalent view regarding the country’s challenges that are ahead.

Having spent a year living in India, Sri Lanka struck me as a mellower version of India and there are certainly cultural and economic similarities that can be noted. Specific similarities can be found between Sri Lanka and Tamil Nadu in India and there is actually a significant Tamil population living in Sri Lanka. Colombo gave off a much more relaxed vibe, as compared to the hustle and chaotic traffic of Ho Chi Minh City.

Some of the main economic headwinds facing Sri Lanka include the impact of a hike in VAT, the looming issue of its debt and slowdown of its exports, which can easily be classified as underdiversified. Sri Lanka’s economy presents a unique growth story, although it is not as straightforward and safe as Vietnam’s manufacturing-oriented growth that is ahead. Sri Lanka’s economy is heavily dominated by SMEs, has been struggling with achieving export growth akin to its frontier Asian peers and is heavily reliant on domestic consumption.

My hotel was on Borella Cross Road, an area roughly three to four kilometres away from the centre of Colombo where my meetings were. This was a simple area dominated by small retail shops and the occasional vendor sending products on the street.

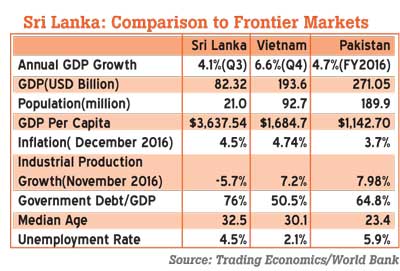

Sri Lanka: Comparison to frontier markets

A large part of my decision to come to Sri Lanka was a response to what has been happening in the markets of Vietnam and Pakistan, which were among the top-performing markets in Asia (Pakistan trounced them all). Meanwhile, Sri Lanka’s market performance was dull last year and the country’s  minute stock market coupled with the perceived economic insignificance has somewhat relegated its place in frontier Asia. While I am continuing to optimistically watch Vietnam and Pakistan, I still find it worthwhile to point out some opportunities in Sri Lanka, particularly because it can be more profitable to enter when things are boring/dark and the perceived risk is perhaps greater than the actual risk.

minute stock market coupled with the perceived economic insignificance has somewhat relegated its place in frontier Asia. While I am continuing to optimistically watch Vietnam and Pakistan, I still find it worthwhile to point out some opportunities in Sri Lanka, particularly because it can be more profitable to enter when things are boring/dark and the perceived risk is perhaps greater than the actual risk.

I will, therefore, use recently upgraded Pakistan and frontier Vietnam as two of the most relevant benchmarks, in order to portray Sri Lanka’s position in frontier Asia.

Population: As I noted in a previous insight, ‘The Fortune at the Bottom of the Pyramid (Part 1):  Golden Opportunity for Frontier Asia’, Sri Lanka’s demographics are not one of the most appealing factors and other markets such as Vietnam, Bangladesh and Pakistan collectively stand out for their higher youth populations and larger populations.

Golden Opportunity for Frontier Asia’, Sri Lanka’s demographics are not one of the most appealing factors and other markets such as Vietnam, Bangladesh and Pakistan collectively stand out for their higher youth populations and larger populations.

Sources of growth: Services are the largest sector of the economy and account for roughly 58 percent of total GDP; the most important segments of services include wholesale and retail trade, transportation and communication, banking, insurance and real estate. Manufacturing accounts for 18 percent of GDP, while mining and construction account for 10 percent. The remaining 12 percent of GDP comes from agriculture, livestock, forestry and fishing.

Inflation: Inflation rose by 4.5 percent during December 2016, driven by a rise in food and beverages (4.1 percent), education (5.6 percent), communication (16 percent) and miscellaneous goods and services (7.7 percent).

Inflation: Inflation rose by 4.5 percent during December 2016, driven by a rise in food and beverages (4.1 percent), education (5.6 percent), communication (16 percent) and miscellaneous goods and services (7.7 percent).

Employment: Sri Lanka’s population mainly works in the following areas: 28.7 percent in agriculture, 18.0 percent in manufacturing, 13.5 percent in wholesale and retail trade and 6.1 percent in transportation and storage. Unemployment peaked at 6 percent in 2007 and has since improved.

High dependence on SMEs and consumption: The majority of businesses in Sri Lanka are SMEs. My  first thought observing things on the ground was the striking similarity between Sri Lanka and India in this sense and specifically the opportunities presented from microfinance. Some banks are active in this sphere and have experienced success as modelled by Muhammad Yunus. Sri Lanka’s economy is also highly dependent on consumption, with consumption accounting for 79.9 percent of GDP as of 2013. Sri Lanka’s respectable growth has not been coupled with similar growth in its exports.

first thought observing things on the ground was the striking similarity between Sri Lanka and India in this sense and specifically the opportunities presented from microfinance. Some banks are active in this sphere and have experienced success as modelled by Muhammad Yunus. Sri Lanka’s economy is also highly dependent on consumption, with consumption accounting for 79.9 percent of GDP as of 2013. Sri Lanka’s respectable growth has not been coupled with similar growth in its exports.

Geographic advantage: One advantage that I previously noted in ‘Sri Lanka Is Intriguing: Initiating Coverage’ was the country’s geographic advantage. Sri Lanka is strategically positioned on the Indian Ocean, and its Colombo Port serves as a significant economic catalyst for the country, primarily making shipments to India.

Geographic advantage: One advantage that I previously noted in ‘Sri Lanka Is Intriguing: Initiating Coverage’ was the country’s geographic advantage. Sri Lanka is strategically positioned on the Indian Ocean, and its Colombo Port serves as a significant economic catalyst for the country, primarily making shipments to India.

Position in frontier Asia: Overall, Sri Lanka is less favourable than its frontier peers in Asia in terms of GDP per capita, population, demographics, debt and economic growth. Moreover, while many markets in frontier Asia are thriving off of the high growth in their exports, particularly in the textile sector, Sri Lanka is not positioned to be a significant manufacturing powerhouse in Asia for multiple reasons.

Sri Lanka’s economy is projected to expand by 5.5-6.0 percent in 2017, according to Central Bank Governor Indrajit Coomaraswamy, a respectable pace as compared to other frontier and emerging markets in Asia. Although Sri Lanka will face issues in the future, including a slowdown in consumption, issues with debt, political risks and a slowdown in exports, there are several areas where Sri Lanka can be considered superior to other frontier and/or emerging markets and worth considering: 1) Transparency 2) Stock market valuation 3) High presence of wide moat companies and 4) Openness to foreign ownership.

Having said that, the turnover for Sri Lanka’s stock market is disappointing, much lower than Vietnam and Pakistan and its minute stock market cap of over US $ 20 billion makes this country an inevitable smaller area of focus.

Having said that, the turnover for Sri Lanka’s stock market is disappointing, much lower than Vietnam and Pakistan and its minute stock market cap of over US $ 20 billion makes this country an inevitable smaller area of focus.

Transparency and foreign ownership: Sri Lanka is a major victor

One reason that Sri Lanka was on my radar and I decided to take this trip is due to some of the comparative advantages of its stock market, namely higher transparency and openness to foreign investors. There are also a large number of companies in areas such as FMCG and healthcare, which have drastically outperformed the index’s lacklustre movement this year.

Transparency: Even small and mid-cap stocks in Sri Lanka have transparent annual reports in English. Meanwhile, Vietnam is a completely different story. According to the HSX, only 59.8 percent of companies have a website in English, only 35.4 percent have disclosures in English and only 32.9 percent have the same information in Vietnamese and English.

As mentioned before in my insight ‘Vietnam’s Emerging Market Upgrade: Worth the Wait’, Pakistan’s relative openness to foreign investors and transparency of information in English is one of the key reasons it was upgraded over Vietnam. I admire Sri Lanka for its similar transparency, although its emerging upgrade is not in the cards.

Foreign ownership: The market in Sri Lanka is open to full foreign investment, with the exception of banks (15 percent limit) and plantations (40 percent limit). One point I will elaborate on in the next part of this insight is that some of Vietnam’s most attractive sectors, including healthcare, food and beverages and retail, are not open to foreign investors. Meanwhile, investors can easily find similar stocks in these sectors in Sri Lanka, at reasonable valuation and with no foreign room restrictions. This is one small, but significant, market entry signal for Sri Lanka in my opinion.

Sri Lanka’s stock market

Sri Lanka’s stock market only has just under 300 listed companies up from 235 in 2007. Sri Lanka’s  stock market is significantly undervalued (11.6X PE for MSCI Sri Lanka and 9.64X PE for MSCI Sri Lanka IMI), a considerable discount to Vietnam. This serves as an appropriate reason to venture further, although Sri Lanka should always trade at a discount to Vietnam.

stock market is significantly undervalued (11.6X PE for MSCI Sri Lanka and 9.64X PE for MSCI Sri Lanka IMI), a considerable discount to Vietnam. This serves as an appropriate reason to venture further, although Sri Lanka should always trade at a discount to Vietnam.

A serious discussion of Sri Lanka’s future emerging market upgrade is not currently worthwhile, mainly because the liquidity is too low. However, the market can be considered an appropriately valued frontier market and stands as a unique global outlier that allows investors to access high-growth consumption themed companies at low valuation. Given Sri Lanka’s economic challenges ahead, I think investing in growth stocks is a much safer plan, although there are certainly some decent value sectors to note.

Sri Lanka is in dire need of diversification in its exports

In addition to the looming issue of Sri Lanka’s debt, one of the main critiques of Sri Lanka’s economy is the country’s lack of diversification in its exports. Sri Lanka’s main exports include textiles and garments (approximately 52 percent) and tea (17 percent) according to Trading Economics.

Exports in Sri Lanka fell by 4.1 percent during 9M 2016. Some of the higher-end brands that are manufactured in Sri Lanka include Victoria’s Secret, Nike, Gap, Ralph Lauren and Marks & Spencer. While economic growth post-2009 has been rapid, this growth has not been coupled with strong growth in exports.

Between 2000 and 2015, China added 76 products to its export basket; Thailand added 70 products, while Sri Lanka only added five products. This puts Sri Lanka at a major disadvantage to other frontier markets, which are developing and diversifying their exports, which has resulted in rapid economic growth. Consequently, Vietnam is positioned to outperform Sri Lanka in its export-oriented growth, driven by its strong growth in diverse areas of manufacturing.

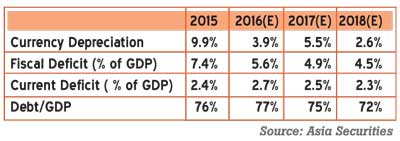

Issues with debt/assistance from IMF

One potential positive catalyst for Sri Lanka’s stock market includes the approval of a US $ 1.5 billion loan (three-year programme) from the IMF last year, which will focus on improving its fiscal policy, creating a more flexible exchange rate and reforming some of its poor-performing SOEs.

A successful implementation of this IMF loan would bode well for Sri Lanka’s stock market. Pakistan, which recently cut ties with the IMF, also had a strong market rally amid the completion of a three-year IMF programme, although this was attributed to more than the IMF’s aid and largely occurred on the back of its acceptance into MSCI Emerging Markets.

Having said that, Sri Lanka has a historical benchmark of having a strong stock market rally amid its previous IMF loan received in 2012. Sri Lanka’s stock market rallied by over 40 percent six months after last receiving its IMF loan in 2012, according to HSBC. Sri Lanka surely has much to resolve economically and the slowdown in consumption ahead this year does not present the brightest picture for rushing in and value investing in this market. Although it may be more psychologically comfortable to invest when signs of recovery are confirmed in the future, there is still more merit to entering before this rally.

Sri Lanka’s FDI drops to a new low

Sri Lanka’s FDI has been on a sharp downtrend, declining by 54 percent during 2016.

Asia Securities’ outlook for FDI is positive driven by loosening measures for foreign investment, several key planned investments for 2017 and proven projects towards the end of 2016, as well as the loosening of land ownership for foreigners for both residential and commercial investments. The government plans to sell investments in non-strategic SOEs this year, with a combined total value of US $ 1 billion according to Asia Securities.

Some major investments planned for the future include the following:

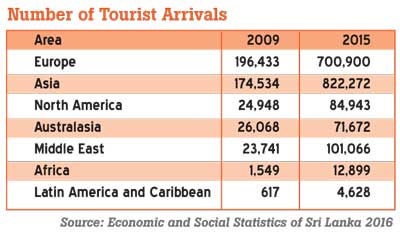

Sri Lanka’s tourism industry

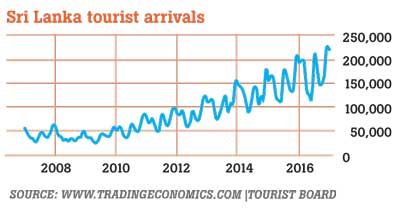

One significant catalyst for Sri Lanka’s economy includes the growth of its tourism industry, which has been delivering robust growth since the end of the country’s civil war in 2009.

The growth of Sri Lanka’s tourism industry began after the end of the country’s 25-year civil war in 2009. Tourist arrivals rose from 654,500 in 2010 to 1,784,900 in 2015 and this growth has been spearheaded by tourists from Europe and Asia.

Sri Lanka is positioned to continue having an increase in tourists from China and India, as well as other destinations in Europe, which may perceive Sri Lanka as a cheaper and untapped alternative (relative to the Maldives). Sri Lanka is also relatively undiscovered as compared to other popular destinations such as Thailand and I noticed tourists could be found entering or exiting at nearly every train station from Colombo to Matara, along some of the smaller, relatively unknown beach towns.

I had the opportunity to travel to Kandy, Galle and Matara by train. The people in the picture are standing outside because there is barely any room on the train and they decided to jump on at the last minute and squeeze in on the back of the train. I actually missed my first train because I did not feel like following suit. I travelled by second class train the entire time (as low as US $ 1 for a four to six-hour trip) and spent the majority of the time standing.

Kandy

Kandy is one of the country’s most popular tourist destinations, especially for the local population, which goes there to escape the heat. Kandy is Sri Lanka’s second largest city, located in central Sri Lanka and most of the economic activity in this area centres around tea plantations, textile, furniture and jewellery.

Galle

I also travelled to Galle, which is located in southwestern Sri Lanka and is the administrative centre of the Southern Province. Apart from its prominent location along the coast of Sri Lanka, one of the major draws for foreign tourists is Galle Fort, which was originally built by the Portuguese and later fortified by the Dutch.

The atmosphere in Galle was serene and the city is also a reasonable day trip away from the plethora of towns in Sri Lanka with amazing beaches.

Overview of part: Preferred sectors

It was very interesting to be able to travel to Sri Lanka and to share ideas with companies that are on the ground here. Sri Lanka is certainly an intriguing frontier market, which deserves more recognition than it is given. The next part of this insight will outline some sector picks and stock picks and show how they compare to other frontier benchmarks, namely Pakistan and Vietnam.

One of the main points of this is to show how Sri Lanka can fill in some of the gaps for areas of Vietnam’s stock market that are not fully open to foreign investors, as well as to highlight some of the comparative advantages of certain areas of Pakistan and Vietnam’s stock markets.

Alcohol: I prefer Vietnam for its stronger growth story, and Sri Lanka’s alcohol sales may decline due to the increase in VATs. Another interesting trend to note is indirectly accessing this industry by investing in glass bottle producer.

Cigarettes: As outlined in Sri Lanka’s tobacco industry, consumers may switch to beedi for lower prices. I also previously outlined how new pictorial warnings could harm the industry. Being on the ground, I saw that most cigarettes were sold loose, offsetting this issue.

Conglomerates: Sri Lanka has a flurry of strong conglomerates operating in healthcare, FMCG and retail. My goal is to point out companies available at reasonable valuation and to steer away from companies that target high-end consumption. This is one of the most promising areas I see.

Banks: I will provide a brief overview of opportunities in the banking sector and one company that has tapped into microfinance.

Healthcare: There are some pure plays for healthcare, namely private hospital operators, while some conglomerates operate in pharmaceutical production and also operate hospitals. This is crucial to note given that Vietnam’s pharmaceutical industry is highly desirable, but there are not enough options for foreign investors.

Construction: Sri Lanka’s construction industry is also poised to benefit in the future. I am also bullish on Vietnam’s construction industry and Pakistan’s industry, which is poised to benefit from the China-Pakistan Economic Corridor.

Insurance: This is another strong area to note, although my preference lies for Vietnam, particularly in the non-life insurance sector.

Telecommunications: This is a straightforward consumption area to access and there is one wide moat company that is well worth noting.

Tourism: An obvious catalyst for Sri Lanka’s economy, although this can only be accessed indirectly through conglomerates.

Other value investing areas to note: I will also briefly note opportunities for companies which are undervalued and may be better to note when Sri Lanka’s economy/stock market outlook is more positive. This includes tea producers, tile manufacturers and cable producers.

My end goal is to find a list of high-growth companies that can access domestic consumption in Sri Lanka and to continue monitoring Sri Lanka’s economic progress. A future economic turnaround would increase the merit of value investing in the future, while many growth stocks can currently be regarded as strong stock picks.

(Nomadic Equity - Dylan Waller is a market researcher and financial writer with a focus on Asia. He can be contacted at [email protected])

09 Jan 2025 39 minute ago

09 Jan 2025 2 hours ago

09 Jan 2025 3 hours ago

09 Jan 2025 3 hours ago

09 Jan 2025 3 hours ago