19 Dec 2016 - {{hitsCtrl.values.hits}}

The last two weeks of October 2016 saw many pronouncements about the future of Sri Lanka. These two weeks started with the Annual Sessions of the Sri Lanka Economic Association (SLEA), which highlighted where we are, where we would be if we don’t heed their very well meant advice and move away from the debt trap we are in. Then the Prime Minister came out with his 1500-day programme, read out in parliament to ensure that Sri Lanka becomes a very prosperous nation as a result of its implementation.

The last two weeks of October 2016 saw many pronouncements about the future of Sri Lanka. These two weeks started with the Annual Sessions of the Sri Lanka Economic Association (SLEA), which highlighted where we are, where we would be if we don’t heed their very well meant advice and move away from the debt trap we are in. Then the Prime Minister came out with his 1500-day programme, read out in parliament to ensure that Sri Lanka becomes a very prosperous nation as a result of its implementation.

Then there was the pronouncement by a few responsible persons about the Chinese agreeing for a swap of writing off the debt-for-equity of some holdings at the Hambantota port, which got an excited governor of the Central Bank requesting the money to be received from the Chinese to settle some debts.

Then there was the Commonwealth Secretariat publishing its recommendations on enhancing our export revenue by US $ 2 billion by bringing in some 60 additions like laces, etc., into our export basket. Finally, the last Friday of the month saw some leading businessmen listening to the well-known futurist Dr. Patrick Dixon on ‘The Future of (almost) Everything’.

Here I have not touched upon of course, the most disturbing link between the past – only of a two-year span – and the future associated with it as unfurled within the chamber of parliament and I do not intend to write about it as there would be too many more qualified people to do so. Here, I will write only about the things I have really studied and studied enough to share with others, out of all these things.

SLEA pronouncements

Here, President Prof. A.D.V. de S. Indraratna in his address stressed the need to reduce the budget deficit by increasing the current revenue and reducing current expenditure and enhancing foreign direct investment (FDIs) by improving good governance. The need to address the public debt was also emphasized and the need to improve quality of our manufacturing processes as well. His expectations for the five-year plan to be spelt out later in the week by the Prime Minister to be a home grown one was also expressed.

Then keynote speaker, W.A. Wijewardena added the need to provide funds for growth-related sectors, reforms needed in state-owned enterprises and addressing current fiscal crisis to the above-mentioned concerns. He also emphasized the need to have all Sri Lanka’s debt captured properly in the government debt records.

This disparity in our debt records was addressed by me in reasonable detail when I wrote about our public debt to Daily FT on 22-04-2016. In that article, I gave details about the specific tables in our Central Bank annual report where you see discrepancies and also the names of relevant countries. This discrepancy had been there in this report for a very long time. I always tried to match these figures in those few tables and checked them for accuracy and they never matched.

This is why I strongly suggest that just as much as we debate the budget on several days in great detail in parliament, we also need to debate and discuss this annual report of the Central Bank which, at least to me, is the statement of how we, as a country, have performed economically.

This will also pave the way for better financial reporting and will help capture anomalies. I am waiting to see how our public debt figures will be altered in the Central Bank’s annual report for the year 2016 due to the equity-debt swap we are going to execute with the People’s Republic of China or would it happen after 31-12-2016.

PM’s five-year plan

Then came the five-year plan presented in parliament by the prime minister. I do not know whether it is a home-grown plan or not and I am not so concerned about that. As long as the plan delivers goods, that is what the country needs.

Prime Minister’s five-year plan is a very comprehensive plan; it has captured all the relevant components I would expect in such a plan excepting one. Although intermingled with many expressions of what the prime minister had attempted to implement in the past and overall comments, it has the material to be used in developing our economy aggressively. I also want to demonstrate why I say so.

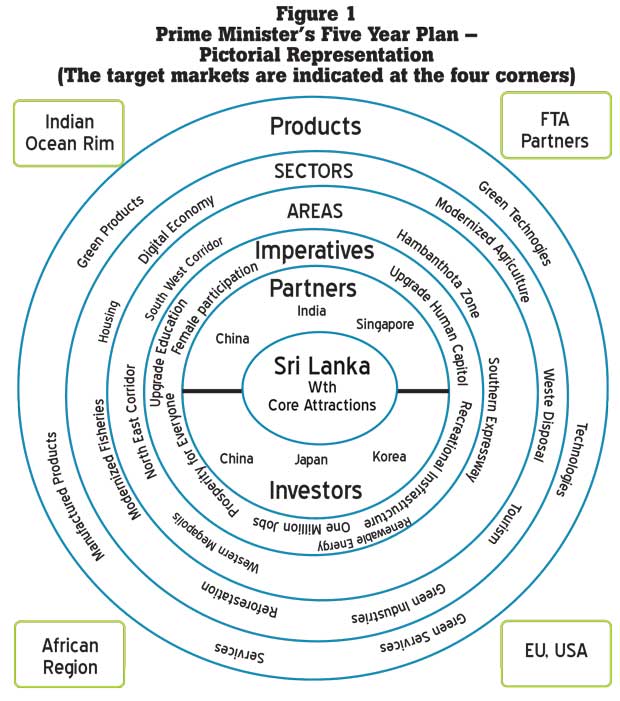

I would like to present it as indicated below. This model was derived based on a model used by Kao Organisation as given in ‘Innovation Explosion’- probably the best management book read by me, in 1998, by Dr. James Brian Quinn, Dr. Jordan D. Baruch and Karen Anne Zien. Dr. Quinn had won the McKinsey Award for the Best Harvard Business Review article thrice and Dr. Baruch was a former Assistant Secretary of Commerce in Carter Administration, while Zien is an Innovation Systems Anthropologist.

The objectives of this presentation is to depict how comprehensive the prime minister’s plan is and to indicate how this presentation would help to (i) identify the strategies that need to be adopted, (ii) establish the objectives and (iii) set up targets to be achieved. It is my very strong belief that this representation would facilitate its smooth, timely implementation on time with significant benefits to all Sri Lankans.

It is heartening to see that we have accepted the fact that we can’t be expecting FDIs from all over the world with or without good governance. As we have quoted in an earlier article, International Monetary Fund (IMF) MD Christine Laggarde mentioned at a Maryland Alumni Meeting that we live in an age where FDIs are not readily available. So the willingness of China, Japan and Korea to invest in Sri Lanka is welcome news. Then with China, India, Singapore willing to become partners with us through trade agreements, we have a reasonable framework within which to move forward. We have also plans to tap the ever growing Indian Ocean Rim market.

When it comes to the target markets, I believe we have missed out on Africa. Since of late, Africa has been left out from major trade deals and it is my opinion that this is deliberately done to retain it for exploitation by the US and European Union (EU) and also to direct Chinese interests away from Africa. But with the possibility of Africa greatly interested in expediting its own development and our closeness to it we believe that it would be a good market to tap.

The other key thing that is missing in this arrangement is an indication about the products we intend to supply to the target markets. We need to accept the fact that products in demand – both in respect of physical products and services – do change very fast. The prime minister mentioned in his statement the limitations of our export product basket and this implies that he plans to bring in more innovative products into the basket.

It may be that the three key partners who are expected to invest in Sri Lanka – China, Japan and Korea – are expected to bring in new futuristic products into Sri Lanka, especially so as they would be occupying very large spaces for their manufacturing outfits in Sri Lanka. Of course one thing we need to remember is that due to its very central geographic location, just as much as we tend to make Sri Lanka the hub of everything from knowledge, energy to supply chain, Sri Lanka cannot afford to be generating too much of greenhouse gases due to the very poor (numbers available) longitudinal circulation and very high, cyclic latitudinal circulation of its atmosphere. Such an excessive emission trail will definitely be disastrous. At Maryland, Laggarde also stressed about this aspect in respect of planning of Megapolis Development.

As such, I wish the Prime Minister to listen to the extremely logical advice given by Prof. Joseph Stiglitz. Prof. Stiglitz, after his stay in Sri Lanka, suggested that we need to look at renewable energy – solar and wind – and that we need to go in for a green economy. I have been always suggesting that we go into establish a green economy in Sri Lanka and in fact, in my article in Daily FT on 14-08-2014 on ‘Positive balance of trade – Dream to reality’ I went to the extent of suggesting that we create an incubator for green industries in Hambantota like Silicon Valley for IT industries. I also worked out the potential revenue from a few such industries and came out with a figure of US $ 11 billion only from four or five possible sectors.

I strongly hope that this plan would see the light of day within the specified five-year period.

Future of (almost) everything

Then came the most interesting presentation on ‘future’ by the well-known futurist Dr. Patrick Dixon. He touched upon some interesting things from import of science, technology, engineering and mathematics (STEM) graduates by US from Asian countries to the aspect of solar energy been mobilized all over the world.

He used a cube with six faces to depict that the ‘future’ he wants to talk about consists of a future which is fast, urban, tribal, universal, radical and ethical. For sure, he had enough things to demonstrate the relevance of each of these to the future we talk about. After all, he has written a 320-page book ‘Future of (almost) Everything’ on the subject explaining why he considers these components to depict the future we all talk about.

He, according to this book, has even given a trends lecture to 500 senior military leaders at the Pentagon in the USA. I, obviously have nothing to say about almost everything in the book excepting two topics I intend to deal with here. I should also say that I have studied these in adequate detail to present my thoughts here.

(To be continued)

(K.C. Somaratna is Managing Director of Somaratna Consultants (Pvt.) Ltd)

10 Jan 2025 23 minute ago

10 Jan 2025 43 minute ago

10 Jan 2025 2 hours ago

10 Jan 2025 2 hours ago

10 Jan 2025 3 hours ago