28 Mar 2016 - {{hitsCtrl.values.hits}}

The external financing situation for Sri Lanka is certainly a big worry for both the government and private sector. This is largely due to the monstrous financial profligacy of the past not yet fully explained; however, also due to a large trade deficit and a drop in exports and worker remittance.

The external financing situation for Sri Lanka is certainly a big worry for both the government and private sector. This is largely due to the monstrous financial profligacy of the past not yet fully explained; however, also due to a large trade deficit and a drop in exports and worker remittance.

In 2015, our trade deficit was around US $ 8.5. Worker remittance was around US $ 6.9 billion. Capital flows were negative.

In 2015, our trade deficit was around US $ 8.5. Worker remittance was around US $ 6.9 billion. Capital flows were negative.

We had a balance of payment (BoP) deficit of US $ 1.5 billion. The only upside in 2015, was tourism – US $ 3 billion - a 24 percent increase. If the trade deficit can be managed to around US $ 7 billion, the higher income from tourism, exports and technology services could help our BoP to have a surplus.

However, there are many other challenges for our external finances like the stability of the rupee, declining reserves and capital flows. Our export income is only around 55 percent of our imports. Therefore, it is a must that Sri Lanka in the short term limits the foreign debt financing only for projects that have multiple benefits for the economy.

Furthermore, we need to focus more on debt refinancing, debt swaps, work hard to attract more foreign direct investment (FDI) by introducing investment-friendly policies and restructure the Board of Investment (BoI) to support that drive and more importantly manage the export trade supply side of the equation.

Government debt

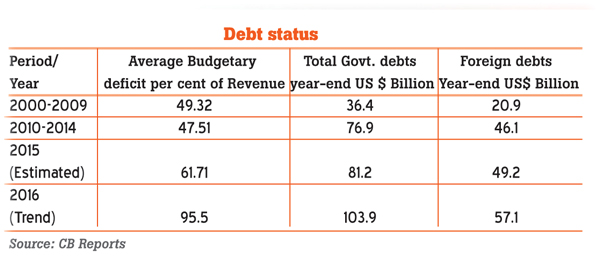

Sri Lanka’s total government debt at the end of 2015 was US $ 81 billion out of this foreign debt was around 60 percent. According to the Central Bank data, our total debt will touch US $ 103 billion this year – around 98 percent of revenue and foreign debt will increase to US $ 57 billion this year. Today public debt is almost 100 percent of gross domestic product (GDP). Therefore, there is lot of work that needs to be done, given that we have a BoP deficit of US $ 1.5 billion from 2015 to manage first.

Many of the short-term loans got at exorbitant rates taken for unproductive projects are one of the root causes for this situation. For example, the Mattala Airport debt arrangement needs to be renegotiated and those assets need to be productively used for the betterment of society. The International Monetary Fund (IMF) Structural Adjustment Facility, if effectively negotiated, could help the economy to ride over this crisis. However, the policy direction to improve the supply side is a must as well as tightening of fiscal and monetary policies.

Way forward for Sri Lanka

While the government is looking for short-term options to ride over this crisis, like the recent currency swap with India for US $ 1.1 billion and the proposed one with China for US $ 1 billion. All these arrangements have their cost and political consequences. It is important from now on to only invest in the ongoing projects if there are clear benefits over cost and projects that don’t drain our foreign exchange reserves. Some of the big-ticket projects like the Megapolis, mega road development projects, may need to be phased over the next few years.

However, if we are to attract more FDI, we need to invest more on education and skills to improve the productivity of the workforce and to improve our inward remittances, given that the dependency of inward remittance may no longer be sustainable in the long term. FDI instead of debt financing and foreign borrowings is what we need: that however would require a conducive investment climate that protects equity rights and property rights and deregulation.

Sri Lanka urgently needs a medium-term plan to increase commercial exports and services. The Sri Lankan economy has faced much bigger challenges before. Therefore, given its strategic location within South Asia and the good will we have earned in the last 12 months with the international community, Sri Lanka should look to exploit those opportunities to improve the living standards of all the people.

(Dinesh Weerakkody is a senior company director)

26 Nov 2024 33 minute ago

26 Nov 2024 54 minute ago

26 Nov 2024 1 hours ago

26 Nov 2024 2 hours ago

26 Nov 2024 3 hours ago