03 May 2016 - {{hitsCtrl.values.hits}}

Sri Lanka’s overall macro-economic conditions deteriorated in 2015.

Despite government adopting expansionary policies to boost consumption spending, both internal and external balance deteriorated in 2015, and GDP growth declined to 4.8 percent. This deterioration forced the government to seek an IMF support programme.

However, GDP growth alone may not be a reflection of underlying entrepreneurial activities of an economy. It is important to examine data which are indicators of new businesses/project initiatives. When we closely analyze data provided in the recently released Central Bank Annual report for 2015, we could observe several positive trends. These trends suggest that the entrepreneurial activities have seen an increased compared to 2013 and 2014. Discussed below are some of these positive developments seen in 2015.

Growth in “job creators”

One of the closely watched data in evaluating a state of an economy is data relating to employment.

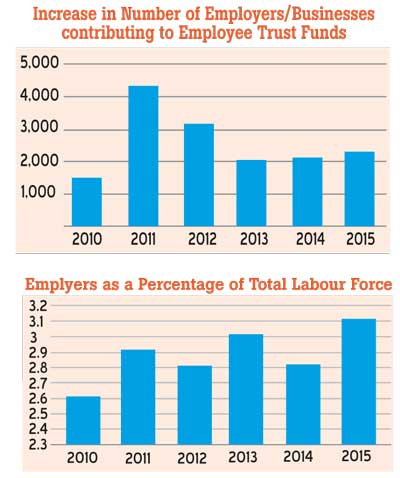

A data series which could be used to assess the level of “entrepreneurial” activity is the trends in “job creators” or number of employers. Increase in new employers is a barometer for new business start ups/ new ventures. The number of employers (as represented by businesses contributing to Employee Trust Fund) has seen an increase in 2015 compared to 2013 and 2014.

This trend is also reflected in labor-force data. Percentage share of persons who are classified as “employers” have increased sharply in 2015, and has been at the highest level since 2010. This suggests that there had been a healthy level of new business start-ups or new business initiatives in 2015.

Increase in project approvals

Another indicator of new business initiatives is the trend in project approvals. A project approval from the Board of Investment (BOI), which is the main business promotion agency in the country, is a good indicator in this regard. Although some businesses no longer consider it important to obtain BOI, it is (was) required to obtain BOI approval if a project/company is backed by foreign investors. Data shows that the number of BOI project approvals in 2015 were more than the approvals granted in 2013 and 2014.

Foreign Direct Investment

Compared to 2014, FDI declined by 36.6 percent to US$ 0.9 billion in 2105. However, overall FDI is not an accurate indicator of foreign risk capital flowing into the county as major share of total FDI consists of retained earnings and borrowings (which are mostly from local lending). Data shows that equity inflows to privately held businesses in 2015 were almost at the same level as in 2014. Equity FDI is a good indicator of startup activities of forging funded projects/ventures. It should be also noted that the level of equity capital flowing into Sri Lanka remains very low for a middle income country.

Private sector investment

The level of private sector capital formation is also a good indicator of the entrepreneurial activity in the economy. However, (for the first time) Central Bank Annual report for 2015 does not provide a breakup of the investment expenditure (i.e., private sector and government) thus depriving analysts to carry out any analysis regarding private sector investment. (Furthermore this exclusion will deprive economists and students of economics to examine vital economic trends such as crowding out effect, etc.) Overall level of investment expenditure in 2015 was 30.1 percent of GDP - which has been the lowest level since 2010. It is likely that the government investment declined sharply in 2015 due to the tight government finances in 2015. This means the level of private sector investment likely to have increased significantly in 2015.

Economic and investment outlook

Despite Sri Lanka’s worsening economic conditions in 2015, level of entrepreneurial activity appears to have remained at a healthy level during the year. Data shows that entrepreneurial activity improved in 2015 compared to 2013 and 2014. Both employer data and BOI project approval data suggest that there had been a recovery of new business activity in 2015. FDI data shows that the level of foreign investor risk taking activities did not decline in 2015.

Hence it is likely that increase in entrepreneurial activity will result in higher economic growth in the future. It is also likely that more investment opportunities will be available for financial investors as many entrepreneurial initiatives reach growth phase.

(The writer is the Founder/ Managing Director, Jupiter Capital Partners. He could be contact via: [email protected])

26 Nov 2024 13 minute ago

26 Nov 2024 22 minute ago

26 Nov 2024 1 hours ago

26 Nov 2024 2 hours ago

26 Nov 2024 2 hours ago