17 May 2017 - {{hitsCtrl.values.hits}}

Mainstream economics is under heavy pressure. Consistently wrong policies and forecasts have damaged the field dubbed ‘the dismal science’. But what do critics propose should supersede the prevailing neo-Keynesian and neoclassical schools? Almost all alternative economists are calling for more government involvement to ‘fix’ the free market and make it work better.

Mainstream economics is under heavy pressure. Consistently wrong policies and forecasts have damaged the field dubbed ‘the dismal science’. But what do critics propose should supersede the prevailing neo-Keynesian and neoclassical schools? Almost all alternative economists are calling for more government involvement to ‘fix’ the free market and make it work better.

But there is one school of economics, once prevalent in academia until it was pushed into obscurity, that places the power to fix the world’s problems in the hands of the people.

“Economists err if they forget that economic life existed before them and that it operates, for the most part, independently of them,” American economist Peter J. Boettke wrote in his book ‘Living Economics’.

Economics was once tasked with describing how man manages the world’s scarce resources, a process far older than economics as a science. But it has morphed into a field that blames the individual and reality for not measuring up to its theories and then uses the coercive power of the state in an attempt to shape individuals and reality according to its ends.

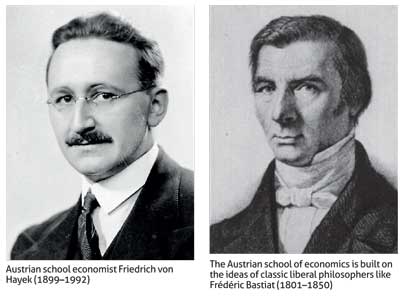

The Austrian School of Economics, the once dominant school of economic thought at the turn of the 19th century, focuses on the individual—and his or her actions and motivations—to explain economic life. It derives its name from the many scholars from Austria who developed 19th-century classic liberalism into a coherent explanation of economic life.

“Economics is in reality very simple. It functions in the same way that it did thousands of years ago. People come together to voluntarily engage in commerce with one another for their mutual benefit. People specialize and divide work among themselves to advance their condition,” writes modern Austrian economist Philipp Bagus in his book ‘Blind Robbery!’

Reason versus force

A bedrock principle of this understanding is that exchange should occur voluntarily and not under the coercion of the state or any other party. If exchange is voluntary, the individual or company must offer something of value if it wants to obtain something of value.

This premise encourages innovative, creative and productive behaviour. It also forces individuals to think about what their fellow humans may appreciate or need. Every decision to allocate capital and labour needs to stand the test of reason, argument and negotiation.

On aggregate, this decision-making process is much more elaborate and prudent than any central planning decision, which must use force to compel its subjects.

“Production is directed either by profit-seeking businessmen or by the decisions of a director to whom supreme and exclusive power is entrusted. . . . The question is: Who should be master, the consumers or the director?” Austrian school economist Ludwig von Mises (1881-1973) writes in his book ‘Human Action’.

Skin in the game

This approach to economics can do without the complex mathematical models of the current schools because it admits that perfection doesn’t exist. There is no equilibrium. Things aren’t perfect, but the best possible solution to economic problems will be found by private individuals acting voluntarily, each assessing new situations for themselves.

“This is precisely what the price system does under competition and which no other system even promises to accomplish. It enables entrepreneurs, by watching the movement of comparatively few prices, as an engineer watches the hands of a few dials, to adjust their activities to those of their fellows,” Nobel laureate Friedrich von Hayek wrote in his 1944 classic ‘The Road to Serfdom’.

This acceptance of imperfection and the insight that those on the ground are best suited to make decisions about allocating scarce resources, avoids the false promise that central planning can solve every problem if only the right people are in power.

Even if central planners, including politicians and bureaucrats who pass laws and regulations, are not corrupt, they can never have enough information to make the right decisions for all individuals impacted by their directives.

They are also insulated from the consequences of their decisions, since their offices are protected until the next election. They have “no skin in the game,” as contemporary philosopher Nassim Taleb put it.

Positive view

The Austrian school also dispenses with the myth that individuals and companies are inherently greedy and need a government to restrain their avarice.

It takes a more positive view of humanity, which includes mutually beneficial exchange as well as charity. Anybody who has ever made time and money available to help a fellow human knows that the neoclassical description of man as only maximizing his material welfare does not hold true in the real world.

In fact, Austrian economists argue that the welfare state, which has so far failed to deliver on its promise to completely eradicate poverty—a promise the competitive system never makes—reduces the individual’s incentives to give. It limits the individual’s material resources through taxation and provides an excuse to evade philanthropy because the government is taking care of the problem.

What holds for market pricing also holds for charity. Individuals and communities can make charitable decisions based on their values and local considerations, rather than a one-size-fits-all policy.

Furthermore, if we are to believe that the individual is fundamentally selfish and cannot be trusted with these decisions, why should we trust central planners, if they can only be removed from office every couple of years (or never, in the case of some bureaucrats)?

“Since the natural tendencies of mankind are so bad that it is not safe to allow them liberty, how comes it to pass that the tendencies of organisers are always good? Do not the legislators and their agents form a part of the human race?” asked Frédéric Bastiat in his 1850 essay ‘The Law’.

The answer, of course, is that the organisers are driven by the same flawed, human incentives as everyone else, and the more centralized power becomes, the greater the potential for maximum damage if bad decisions are made.

The Chinese tyrant Mao Zedong’s decision to increase steel output to rival that of the United States starting in the late 1950s cost an estimated 38 million lives, because he did not know or care that the situation on the ground dictated food production for survival.

The farmers, if left to their own devices, would have known better. If a couple of farmers had gone into steel of their own volition, they might have suffered losses, but the rest of the population would have been unaffected. Although this is an extreme example, the principles behind it are applicable to bureaucracies in democratic countries.

Limited government

If individuals, entrepreneurs and companies have the best information for making the best decisions and if their mistakes cost society less than under central planning, then naturally the state will have to take a limited role in interfering with people’s lives. The system would also limit the scope of corporate and government collusion to limit competition, a malady many blame on free markets alone.

Bastiat said the only law the state should enforce is the protection of life, liberty and property, including a court system for the enforcement of private contracts. He and many Austrian economists looked favourably on the U.S. Constitution, which envisions very limited powers for the federal government.

This is also the reason you’ve likely never heard of this school of economic thought or read classic liberal teachings in high school or college. Since the majority of secondary and tertiary education is either government-run or sponsored, bureaucrats and politicians would undermine their own claims to necessity if Austrian-school ideas flourished.

A competition among ideas, however, is critical for intellectual discourse. According to another champion of the Austrian school, Ludwig von Mises, it is ideas that determine the fate of our civilization.

“The aim of the popularization of economic studies is not to make every man an economist. The idea is to equip the citizen for his civic functions in community life. The conflict between capitalism and totalitarianism, on the outcome of which the fate of civilization depends, will not be decided by civil wars and revolutions,” von Mises pronounced. “It is a war of ideas. Public opinion will determine victory and defeat.”

(Courtesy The Epoch Times)

08 Jan 2025 14 minute ago

08 Jan 2025 59 minute ago

08 Jan 2025 3 hours ago

08 Jan 2025 4 hours ago