27 Feb 2017 - {{hitsCtrl.values.hits}}

Many enjoy playing sports. Let’s take football as an example. It is amazing to note how focused the players, coaching staff and trainers are on game day. Each game is treated as the biggest game of the year because they know to make the playoffs and is aware that the title requires giving it their all.

Many enjoy playing sports. Let’s take football as an example. It is amazing to note how focused the players, coaching staff and trainers are on game day. Each game is treated as the biggest game of the year because they know to make the playoffs and is aware that the title requires giving it their all.

While we love watching 60 minutes of game time spread over several hours, what we don’t see is the work going on behind the scenes. Endless hours of practice, followed by an exhausting game with coaches analysing the game from high above the playing field and reviewing the game to correct mistakes is a common occurrence.

If you think about it, investing in the stock market is a lot like football for most investors.

Different types of investors

Many would think that the typical lifestyle of investors will fall within the following categories:

Scenario A – Active investor

An active investor will read stock newsletters, research reports and recap the market at night. They will wake up and check general market news in the morning, when market opens they trade with real-time charting, quotes, etc. After the market closes, they once again start their homework on investing.

Scenario B – Hobby investor

Wake up, exercise, go to work, check quotes and adjust any orders during the lunch break, check quotes at close, go home, eat dinner with family, put kids to bed, watch TV with wife, research about the market then go to sleep.

Many full-time investors may agree with the aforesaid monotonous lifestyles. Yet, will this lifestyle enable you to succeed in the market? Incorrect, there is something crucial missing in your routine.

Actually, this is something so critical that many would not realize it until they make it part of their lifestyle. The missing key was something that pro football teams dedicate 20 percent of their time, if not more. What is that activity? It is reviewing the performance of the team. In the investment world, it could be referred to as post-trade analysis.

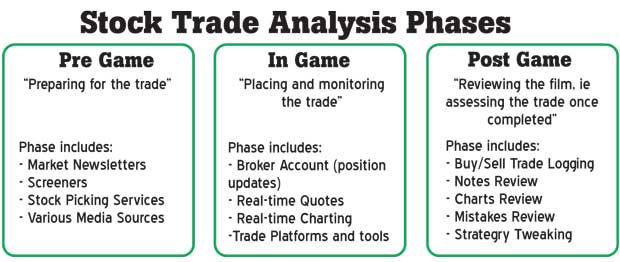

Phases of post-trade analysis

Pre-game – Preparing for the trade

Everything that goes into finding and narrowing to the eventual trade is part of your pre-game analysis. Thus, market newsletters, stock pick services, research reports, screeners, etc. are part of this phase.

In game – Buying, monitoring, selling

Everything that your investment advisor suggests makes up the ‘in game’ experience. Real-time quotes, streaming stock charts, performing technical analysis, placing market, limit and stop-loss orders, trade alerts and quality executions are all examples.

Post-game – Reviewing the film

Reviewing the film is a critical part of professional sports and investing is no different. Taking a screenshot of the stock chart after the trade is completed, plotting buy and sell points, writing down your notes recapping the trade and tweaking trade rules thereafter, fall under the post-game.

Post-game (trade) analysis breakdown

Performing post-trade analysis is one of the most overlooked and underutilized steps by investors. Recapping trades to break down how they went right or wrong will help prevent future mistakes and improve returns down the road. For those investors who do conduct recaps of their trades, one of the common mistakes often made is only doing post-analysis on losers. This is a mistake. Every trade has something to offer and winners can sometimes be even more educational than losers.

Who, What, When, Where, Why

When looking back at past trades, all the bases must be covered.

Who

You are responsible for your portfolio. If you find yourself saying, “this is that trade Joe told me to do…,” then you are already off on the wrong foot. How can you be successful if you are not learning as you go?

What

These include the nitty-gritty facts about the trade which includes examining the industry group and/or sector, purchase price/s, strategy used, initial stop-loss price and any adjustments as the trade progressed, initial portfolio allocation, risk/reward ratio, initial target price, sale price/s and profit/loss breakdown.

When

This is the date you made the trade, any subsequent purchases and thereafter any sales. For those involved in day trading, this can get far more advanced by looking at hours, minutes and seconds. A full-time day trader tracks his trade times so in depth that he knows, by the hour, which time of day he is most profitable. Talk about effective trading.

Where

Not as relevant as the other Ws, but where was the trade made can also be important. Were you at home, mobile trading, out of town or on vacation? Track this data point and you may, for example, find that you have a habit of making poor trades while on vacation.

Why

This is your detailed trade overview of what you were thinking when you made the trade initially. The more detailed you are, the better. For example, “Gold broke out of a fresh x month base on heavy volume so I bought x shares of GLD on the breakout. The breakout came on heavy volume and…” If possible, also note your emotions. In the end, successful investors are emotionless, and if you sold too early because of nerves, then there is room for improvement.

The aforementioned process could be made easier if investors focus on the following:

Log the trade details (ticker, date, purchased price and number of shares, sold price and quantity, rate of return) in your excel document or other software. Other great data points to track include stop price, risk and transaction costs.

Download a chart of the stock, mark buy and sell points alongside any trend lines, support, resistance, etc. Then, mark this chart with the trade info and archive it.

Write your trade notes either on the chart itself, in your excel journal or on paper, write down what you did right, wrong and finally recap the trade in your own words.

Reflect back on trade data, chart and notes. This is the true “reviewing the film” exercise. Use the information to take an outsider’s view and identify potential bad habits, make rule tweaks, identify areas for improvement and overall set the focus for the next trade.

Many might wonder if they would have sufficient time to dedicate amidst their busy schedules. Further on, not everyone knows how to create a custom excel spread sheet or is comfortable to journal on paper, knows how to mark-up charts and organise them by trade, calculate profitability and return against the market, etc. Investors should not be discouraged instead strive towards giving weightage towards post-trading analysis. A good investment advisor will assist their clients in conducting post-trade analysis. Going through the above does take time, but it is well worth the patience. Like anything, making a habit out of doing it right the first time will save you the effort later on. And in the end, when it comes to your personal portfolio, dedication to the long term is the key to profits. Bear in mind that there lies a huge opportunity for investors, they can improve their success rate and ultimately make more money from investing if they put in the time to conduct post-trade analysis.

09 Jan 2025 24 minute ago

09 Jan 2025 2 hours ago

09 Jan 2025 2 hours ago

09 Jan 2025 3 hours ago

09 Jan 2025 3 hours ago