01 Sep 2016 - {{hitsCtrl.values.hits}}

To lose faith in the market after having faced mounting losses on a regular basis is understandable and is Infacta commondilemma faced by many investors. But don’t blame the market entirely for bad experiences you’ve had with your investments.It could be a result of your own misconceptions.

Myth #1: Stock market investments are similar to gambling

The reason as to why gaining equity exposure is equated to gambling is that people don’t understand the reason underlying share price movements. In the short term, the share price is determined based on demand and supply, which in turn is influenced by temporary trends, such as:changes in foreign investor interest in the market due to global economic and political events,temporary slowdown in the local economyetc.

For example, when the US FED raised policy rates in December,foreign investors reacted by pulling out of emerging markets, which affected capital markets of emerging economies negatively. Most often, people simply misinterpret short term market volatility aspermanentmovements.

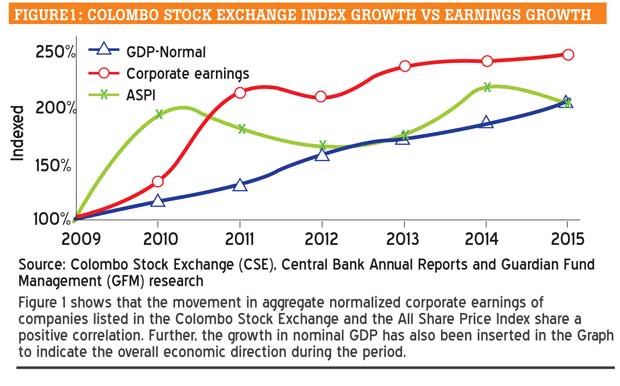

In the long term, share prices move because of change in business fundamentals pertaining to a particular stock. Mainly, fundamentals are represented by earnings or financial performance of a corporate. That is, there exists a correlation between share price and corporate earnings in the long term, when the value of a share reflects the profitability and growth of a company. You would see this over, say, a 10 year span in the share price of a good company. If a company consistently underperforms financially, it is reflected in the share price as it implies weak fundamentals. That is, their future growth potential may be low or the company may be in a dying or saturated industry and has not engaged in any innovations etc.

The graph below actually shows how company earnings track the stock market index in the long term, with the market showing greater volatility.

Further, gambling is a zero sum game. That is, the gain of one party is an equal loss to another. Investing in the stock market is not so, because when an investor puts down his/her money on a company, he/she is buying into an underlying asset. In Gambling, there is no underlying asset.

Myth #2: Markets can be timed perfectly

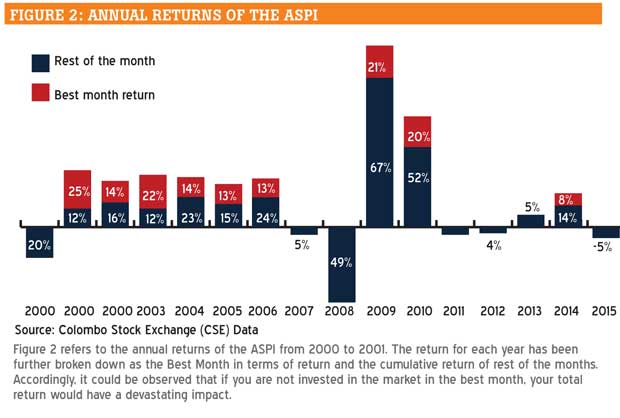

People often tend to shy away from investing when the market is going through a dull phase. What they’re really doing is waiting for the next rally to start so that they feel there’s some assurance that their investment will not fall in value. In reality this is exactly what happens, as evident by the value of investments made in the market as the rally approaches the peak. But what people don’t understand is that in a rally, the initial pickup happens at a rapid pace resulting in a sharp upward spike in share price. This is especially true in a small market like Sri Lanka where liquidity is limited.Thus, bulk of the price appreciation happens within a very brief period of time(see graph below).Therefore to actually make a decent gain from a rally you should have been invested at an early stage, or else it may be too late. That is if you wait to time the market (waiting for the right time to invest), there’s a lower probability that you’ll be able to benefit from an abnormal return.

In conclusion, whilst you should try not to time the market, the time at which you enter and remain invested, matters because your gain depends on it. So what you should really bother about is the price you are paying for the stock, or to be more precise,whether you are buying at a discount to its real value.

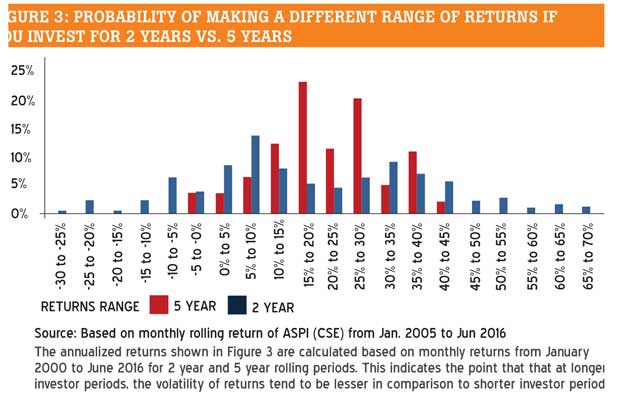

Myth #3: The stock market is a place to earn a quick buck

Equity Investors of a company actually share a portion of the company’s ownership. Therefore view your stock investments from the perspective of an entrepreneur, waiting for the profits of your business to grow. That is, if your start a business with your own capital, do you expect to recover your investment in a short time period? The answer is no as it is practically impossible to break even in a matter of days or few months in most cases. Accordingly, if the same ‘Entrepreneur’ mentality is adopted towards your stock market investments, one would not panic in times of volatility. More often than not, a stock market pullback is an opportunity, not a reason to sell.

(Asanka Jayasekara is the Lead Fund Manager for Guardian Acuity Equity funds and Ceylon Guardian’s key client portfolios. He has over 9 years of experience in the fields of asset management and investment research. Asanka is a graduate of the University of Sri Jayewardenepura and is an associate member of CIMA (UK). He is also a visiting lecturer at the department of finance, University of Sri Jayewardenepura.)

26 Nov 2024 2 hours ago

26 Nov 2024 2 hours ago

26 Nov 2024 2 hours ago

26 Nov 2024 3 hours ago

26 Nov 2024 3 hours ago