06 Apr 2016 - {{hitsCtrl.values.hits}}

Sri Lanka is negotiating an Economic and Technological Cooperation Agreement (ECTA) with India. It envisages liberalising trade in services. The lack of information on what is being negotiated has fuelled speculation on the outcomes. A previous Verité Insight titled ‘Trade in Services: Sri Lanka needs to pull up its socks’ pointed out, with reference to the current trade agreements (TAs) of Sri Lanka, that the devil is really in the details – not the concept itself.

Sri Lanka is negotiating an Economic and Technological Cooperation Agreement (ECTA) with India. It envisages liberalising trade in services. The lack of information on what is being negotiated has fuelled speculation on the outcomes. A previous Verité Insight titled ‘Trade in Services: Sri Lanka needs to pull up its socks’ pointed out, with reference to the current trade agreements (TAs) of Sri Lanka, that the devil is really in the details – not the concept itself.

The present Insight attempts to unearth the devil in the details (pitfalls and opportunities) by a quantitative and case analysis of India’s trade agreement with Japan. Explaining at the outset some of the trade-related terminology will help to unpack the implications.

Terminology of trade agreements

Macro: Sectors and modes

In trade agreements, countries give preferential access to partners. The scope of this access is described in two dimensions. One, the sectors opened up – such as IT, logistics, etc. This is usually denominated by an international coding system that has 160 categories of services. Two, the modes of supply of the services. There are four modes as set out below:

Mode 1 (cross border) - service crossing the border while the supplier remains in country ‘X’ and consumer remains in country ‘Y’ (e.g. IT-enabled services such as an Indian doctor offering to provide his views for a fee on medical reports sent via email by a Sri Lankan patient)

Mode 2 (consumption abroad) - consumer in country ‘Y’, going to country ‘X’ to obtain the services (e.g. Sri Lankan patient going to an Indian hospital for a surgery)

Mode 3 (commercial presence) - services supplier in country ‘X’, opening an office in country ‘Y to provide services to consumers in country ‘Y’ (e.g. a hospital in India opening a branch in Sri Lanka)

Mode 4 (movement of natural persons) - workers in country ‘X’ moving to country ‘Y’ to provide services to consumers in country ‘Y’ (e.g. an Indian doctor moving and performing surgeries in a hospital located in Sri Lanka)

Micro: Market access and national treatment

In trade agreements, countries also give legally binding commitments to partners. These are usually in two dimensions. One, on market access – that is setting out and limiting the conditions and restrictions for the preferential trade access and two, on national treatment – that is setting out and limiting the extent of preference given to domestic suppliers over the suppliers of the trading country.

Neither of these prevents a country from enacting measures to ensure quality or protect the consumer or environment, provided that these measures are applied to all suppliers without favouritism.

Learning from India-Japan CEPA

An analysis of the scope and commitments in the India-Japan TA provides insights into pitfalls and opportunities that could arise for Sri Lanka. This Insight analyses the scope and commitments in quantitative terms and the limitations as a case analysis.

Quantitative analysis of scope and commitments

In the agreement, India has opened up 99 out of the 160 services sectors – amounting to 62 percent. However, in some of these sectors India has opened up only part of that sector. For example, ‘accounting, auditing and bookkeeping services’ is one sector. India has opened up only accounting and bookkeeping and excluded auditing services.

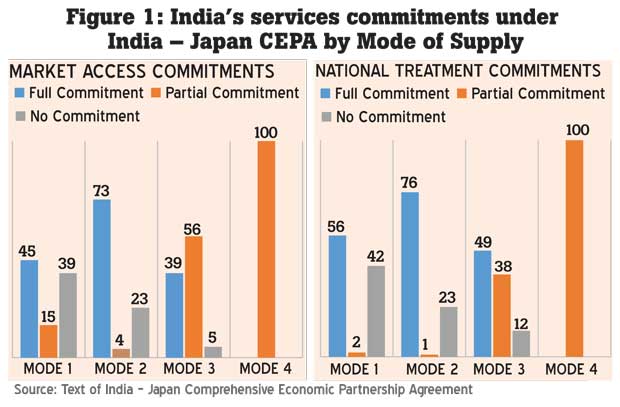

The modes of delivery that have opened up vary in the level of commitment (see Figure 1). A full commitment means agreeing to no restrictions/favouritism; a partial commitment means agreeing to limit itself to a pre-defined structure of restrictions/favouritism and no commitments means not agreeing to limiting the restrictions/favouritism in any way.

Even though 62 percent of sectors are included in the trade agreement, Exhibit 1 shows that full commitment has been accepted for less than half of those included sectors in Modes 1 and 3; and in none in Mode 4. A common restriction in Mode 3 is with regard to foreign equity and Mode 4 limits the movement of people to high skilled services providers.

In Mode 2, around 75 percent of included sectors have received a full commitment – but restricting Mode 2 for most sectors is not feasible either. As long as people can travel to other countries, it is almost impossible to prevent them from accessing services abroad. Full commitment has been accepted in Mode 1 for about half the included sectors. These are also difficult to restrict in practice. For example, it is difficult to prevent an Indian patient sending medical reports to a Japanese doctor on email and getting his opinion for a fee paid by credit card.

Case analysis of market access and national treatment

The India-Japan agreement shows that the choice of Modes to open up in specific sectors is a key determinant of the practical viability of market access. This is because each sector is more readily delivered in some Modes rather than others. For example, for research and development (R&D) services in agriculture, India has opened up in Mode 1 (online, phone, etc.) but not in any of the other Modes. As such, Indian firms going to Japan to consult on agriculture R&D, Japanese firms setting up in India or Japanese persons arriving in India to provide the service are all excluded from the agreement, while agriculture R&D may not be practically deliverable in Mode 1.

In addition to limiting Modes of supply, other restrictions can be placed to limit market access – the voice/cellular mobile telecommunication services are an example of this, where Mode 3 market access faces significant curbs by India. Likewise, restriction on foreign equity to 74 percent and requiring government approval beyond 49 percent also curbs overall Mode 3 access. The national treatment conditions create additional curbs on Mode 3 and Mode 4 access. For example, in telecom, India requires Japanese firms to recruit resident Indian nationals to various posts (chief officer in charge of technical network operations, chief security officer and officer/officials of the licensee companies). Further, Indian citizens have to comprise a majority in the board of directors; when any C-level post is held by a foreigner their security has to be vetted by Indian Home Affairs Ministry annually and only Indian engineers can operate and maintain the telecom network.

The quantitative and case analysis of the India-Japan trade agreement provides important lessons for Sri Lanka as it negotiates ETCA and other trade agreements. First, it highlights the level of detail in restrictions placed by India and provides insight into the depth of attention needed in negotiating the nuts-and bolts of a trade agreement. Second, it is a clear example of how the implications of a trade agreement are driven by the details.

(Verité Research is an independent think-tank based in Colombo that provides strategic analysis to high- level decision-makers in economics, law, politics and media. Comments are welcome. Email [email protected])

26 Nov 2024 5 minute ago

26 Nov 2024 1 hours ago

26 Nov 2024 2 hours ago

26 Nov 2024 2 hours ago

26 Nov 2024 2 hours ago