29 Nov 2016 - {{hitsCtrl.values.hits}}

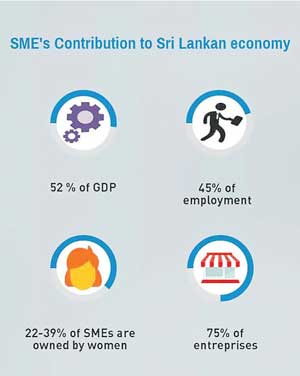

Small and Medium Enterprises (SMEs) play an important role in economies in terms of their contribution to national output, employment and share of firms operating in countries. In Sri Lanka, they form the backbone of the economy and can be found in all sectors of the economy.

The SME sector in Sri Lanka accounts for 52 percent of the GDP, and 45 percent of the total employment, whilst making up more than 75 percent of the total number of enterprises in the country.

Moreover, SMEs are significant employers of women and youth. In developing countries, for example, one in three SMEs are owned by women though the figure is reportedly less in South Asia.In Sri Lanka, the figure is about 22 and 39 percent in the case of small and medium scale enterprises, respectively.

By enhancing SMEs’ opportunities in the global economy, the lives of many individuals and communities can be improved. For this reason, SMEs are receiving prominent attention in the global agenda. For example, the Sustainable Development Goals (SDGs) under Goal 8 recognizes the potential of these enterprisesto support inclusive and sustainable growth and decent work for all.

However, SMEs participation in trade simply does not equal their economic importance domestically; SMEs trade relatively less internationally compared to their larger counterparts in both developed and developing countries. According to the World Bank Enterprise Survey, exports represent about 6.2 and 11 per centof total sales of small and medium scale enterprises, respectively in manufacturingsector compared with 23 per cent for large firms.

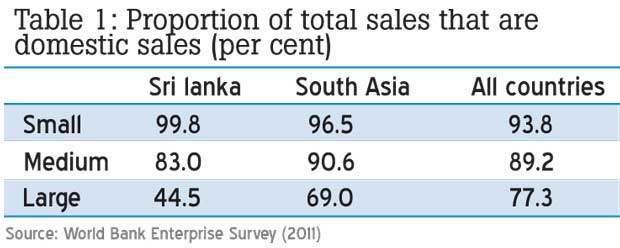

The differences are much greater in South Asia and Sri Lanka (Table 1). Even in a region such as developing Asia with the highest forward and backward participation of SMEs in global value chains, most manufacturing SMEs have low participation rates in international trade compared to larger enterprises. In Sri Lanka, there are 3,027 SMEs registered as exporters. However, they contribute to less than 5 percent of Sri Lanka’s exports (compared to 235 large firms, which account for bulk of the export revenue).

Table 1: Proportion of Total Sales that are Domestic Sales (per cent)

Smaller the business, bigger the barriers to trade

According to international firm surveys,trade barriers, poor access to information, costly requirements/regulations, burdensome customs procedures and lack of trade finance are major hurdles to international trade for SMEs. These costs in trading represent bigger barriers for SMEs than large firms, and this appears to be true in the case of Sri Lanka.

Non-tariff measures (NTMs) are particularly burdensome for SMEs because of their fixed costs, which are independent of the size of the exporter. Sanitary and Phytosanitary (SPS)and Technical Barriers to Trade (TBT) measures are costly for smaller firms to meet. When a restrictive or new measure is introduced in a foreign market, it has been found that larger firms can comply more easily and at a lower cost. According to the ITC Flagship Report ‘SME Competitiveness Outlook: Meeting the Standards for Trade’, standards affect small firms’ twice as much as larger firms; a 10 percent increase in the frequency of regulatory/procedural trade obstacles decreases exports of large firms by 1.6 percent compared to 3.2 per cent in the case of SMEs.

High tariffs are also considered a major obstacle to exporting by SMEs; which are more sensitive to changes in tariffs than larger firms. High tariffs not only reduce the participation of SMEs in trade but they also reduce the volume of exports. Whilst SMEs in apparel sector in Sri Lanka do not face many problems related to NTMs when exporting to the USA, which buys 44 percent of apparel from the country, they find high tariffs affect their competitiveness in the international markets, amongst other issues.

Access to information about border procedures/regulations and markets are another issue for SMEs. Timely publication of trade related procedures/regulations, and establishing an inquiry point on export/import procedures were identified to be of high priority for traders, especially SMEs in Sri Lanka based on a transport and trade audit of Sri Lanka recently undertaken by the IPS. In fact, there is increasing evidence that trade facilitation encourages smaller firms which would have otherwise sold to the domestic market to enter export markets.

Therefore, the implementation of the WTO Trade Facilitation Agreement (TFA) will be particularly beneficial for SMEs by improving transparency of information on rules and regulations governing foreign markets.Importantly, Sri Lanka earlier this year ratified the Agreement, which will enter into force once two-thirds of the WTO membership has formally accepted it.

Access to finance is a common problem for SMEs across countries including Sri Lanka; SMEs often struggle to obtain finance including trade finance, which constrain their development and opportunities for trade. Selling abroad involves various costs ranging from marketing to adapting products and packaging to meet foreign requirements; all of which entail additional costs and require credit. Lending to SMEs suffers from informational problems, and the inability to provide collateral/ guarantees and credit history means that SMEs incur higher interest rates and fees compared to larger firms. This problem is compounded by the difficulty to access affordable trade financeand lack of dedicated financial services for the trading sector, which further reduces their export potential.

Development of e-commerce provides export opportunities for SMEs to engage in international trade. Online platforms can dramatically reduce the cost of doing business across borders, eliminating the barriers created by distance. However, affordability and access to communication and infrastructure(i.e., logistics of shipping a good or delivering a service, ICT security and data protection, payments) create difficulties for SMEs. Thus, SMEs tend to be less represented online than larger enterprises.

Trade policy solutions

At a time when growth in world trade is slowing down to 1.7 per cent, it is important to ensure that trade is inclusive by allowing SMEs, particularly those owned and led by women to participate in international trade. Some steps can be taken to expand SMEs’ trading potential through trade policy.

In this regard, WTO and regional trade agreements (RTAs) can help reduce tariffs and NTMs and increase transparency in the trading system for SMEs. While SMEs are not always specifically mentioned in WTO Agreements, multilateral rules can have the effect of reducing trade costs that hinder SMEs from entering foreign markets. As mentioned, implementing the WTO’s TFA could reduce trade costs by an average of 14.5 percent and increase the participation of SMEs in trade.

It is only recently that RTAsare increasingly addressing SMEs with specific provisions. However, most SME related provisions in RTAs are framed in best endeavour language. For example, SAFTA agreement, which Sri Lanka is a member, makes reference to SMEs under export promotion andpledges’ Support for improving technical, managerial and entrepreneurial skills of small and medium size enterprises engaged in export production. ’In the case of Sri Lanka’s other trade agreements; there is no reference to SMEs at all. Nevertheless, it is important to note that draft national trade policy of Sri Lanka acknowledges the SMEs role in trade and the need for inclusive policies to improve their supply capacities to enter into global markets.

However, trade policy is one of the important tools to allow participation of SMEs in trade in parallel with other policies to redress challenges SMEs face in terms of access to finance, infrastructure, information, technology, skills development,and wider issues affecting firms at all levels. These include creating an enabling environment for their growth and expansion up the value chain to increase their contribution to exports of the country.

For example,Sri Lanka can also support SMEs to participate in trade by helping them get easy access totrade finance andinformation by setting up credit guarantee schemes or keeping businesses updated about developments/business opportunities in export markets using the commercial sections of embassies to address financial issuesand information failures, respectively; some of which have been highlighted in the recently presented budget speech.

(Dr. Janaka Wijayasiri is a Research Fellow at the Institute of Policy Studies of Sri Lanka (IPS). To view the article online and comment, visit the IPS blog ‘Talking Economics’ – www.ips.lk/talkingeconomics)

10 Jan 2025 5 minute ago

10 Jan 2025 10 minute ago

10 Jan 2025 39 minute ago

10 Jan 2025 56 minute ago

10 Jan 2025 1 hours ago