19 Jul 2017 - {{hitsCtrl.values.hits}}

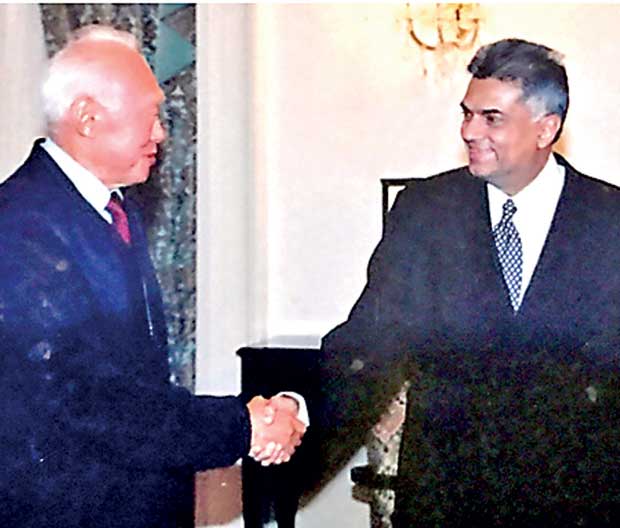

The late Lee Kuwan Yew, the man who transformed Singapore into an investment hub, with Prime Minister Ranil Wickremesinghe in 2002

The late Lee Kuwan Yew, the man who transformed Singapore into an investment hub, with Prime Minister Ranil Wickremesinghe in 2002

Last week, a TV channel and a newspaper highlighted that a project that had been submitted for approval to the Board of Investment (BOI) had been approved without proper assessments being done. This type of negative publicity can result in the credibility of the BOI and its integrity being questioned.

Last week, a TV channel and a newspaper highlighted that a project that had been submitted for approval to the Board of Investment (BOI) had been approved without proper assessments being done. This type of negative publicity can result in the credibility of the BOI and its integrity being questioned.

Recently, at an economic forum, it was mentioned that while Sri Lanka attracted US $ 450 million in foreign direct investment (FDI), Singapore got US $ 40 billion and Ireland got US $ 30 billion and the low level of FDI is becoming a serious constraint to sustain the rapid economic development. Moreover, it was highlighted that it is not only the amount of FDI that matters but also the types of FDI.

The country has been unable to attract the kinds of investments that would have multiplied the benefits to the economy from increased exports and transfer of technology. The drop in export income also reflects this trend.

Significant driver

Foreign investment is a significant driver of economic development. FDI fills the savings-investment gap and enhances investment and economic growth. FDI contributes to improving work ethics, discipline, skills and the knowledge of workers. It is an important means of technology transfer and transmission of best practices in management and often brings with them international markets.

It is the realization of these economic benefits that has made former communist countries like China and Vietnam and the formerly inward-looking Indian economy to actively seek foreign investment. In 2015, for example, China attracted around US $ 60 billion, India around US $ 63 billion and Vietnam around US $ 23 billion.

Policy reforms

Despite the policy reforms towards private sector development, the private sector investment is constrained by several factors, which need urgent corrective action by strengthening the institutional set up. If Sri Lanka is to achieve 6 percent growth, foreign investment has to be increased to around 30 percent of gross domestic product (GDP).

In Sri Lanka, during periods of relative economic and political stability, FDI inflows have responded positively. Sri Lanka expects FDI to more than quadruple to US $ 4 billion by 2020. FDI is thought to be ‘bolted down and cannot leave so easily at the first sign of trouble’, unlike short-term debt and capital market investment.

FDI has been proven to many to be resilient during a financial crisis. A good example would be the Mexican crisis that took place during 1994-1995 and the Latino crisis in the 1980s. The resilient of FDI during a financial crisis can lead to many developing countries to monitor it as private capital inflow of choice, rather than investing in other forms of private capital such as portfolio equity, debt flows and in particular, short-term flows, which were all subjected to large reversals during the same period.

Generally, private capital flows across borders, because it allows capital to seek out the highest rate of return. Countries often choose to exempt some of its revenue when they cut corporate tax rates in an attempt to attract FDI from other countries. FDI also allows the transfer of expertise and technology, particularly in the form of varieties of capital inputs, which cannot be got via financial investments or trade in goods and services.

However, there are many findings that show FDI is a relatively bigger portion of total inward investment in some countries, where the risks are very high. This is often because FDI tends to take advantage of the countries where the market is inefficient. It happens because the foreign investors prefer more to operate directly instead of relying on local financial markets, supplies or legal arrangements. In high-risk countries, the share of total inflows is higher and the risk is measured by the countries’ credit ratings.

Attracting FDI

The best solution for developing countries to increase their overall amount of inward investment of all kind is to focus on concentrating on improving the environment for investment, the functioning of capital markets and private companies need to improve governance within their enterprises, skill level, internationalize and work towards becoming multinational enterprises. By doing so, they are likely to be rewarded with increased investment as well as with more capital inflows, given the very low returns in the West.

There is a clear shift of focus to frontier and emerging markets since they remain the only source of growth in the world economy. Given the limitation of our market, Sri Lanka could very well attract more foreign investment and develop faster, if we improve our infrastructure, workforce skills, have policy consistency, efficient capital markets, provide sustainable legal guarantees to protect investment and strengthen governance in both the public and

private sectors.

The BOI also needs to develop a competitive value proposition that can compete with the likes of EDB Singapore, IDA Ireland, MIDA Malaysia and Sharjah Investment and Development Authority to position Sri Lanka for the future. Sri Lanka is strategically placed to benefit from a changing global marketplace and trade routes. We are between Europe and Far East on the major East-West shipping lanes. We have easy access to lucrative Middle Eastern markets and rising African markets, while the growth engine that is India lies just 20 miles away.

(Dinesh Weerakkody

is a thought leader)

07 Jan 2025 6 hours ago

07 Jan 2025 6 hours ago

07 Jan 2025 7 hours ago

07 Jan 2025 07 Jan 2025

07 Jan 2025 07 Jan 2025