05 Feb 2016 - {{hitsCtrl.values.hits}}

Will Yahapalana’s plan to develop the country as announced recently - “Our objective is to make Sri Lanka the most competitive nation in the Indian Ocean and to develop the island as a MEGA CITY for the region that will go between Singapore and Dubai…” - end up as a pipe dream?

Will Yahapalana’s plan to develop the country as announced recently - “Our objective is to make Sri Lanka the most competitive nation in the Indian Ocean and to develop the island as a MEGA CITY for the region that will go between Singapore and Dubai…” - end up as a pipe dream?

How are they going to do this? Singapore was developed with large-scale foreign investment. Dubai was developed with its own oil wealth. To achieve these objectives in Sri Lanka, foreign investors should start pouring in money, in a big way; maybe the Yahapalana expectation is that prospective billionaires will start scrambling to get a place in the long line of investors because Sri Lanka recently introduced democratic institutions, rule of law and good governance.

All these are non sequitur. In the recently held Economic Forum in Colombo attended by investors and academics, what did the top investor George Soros say? Reportedly “Money is not going to pour in here. You lower your expectations and improve your performance.” An academic announced that Sri Lanka should start worrying about growing foreign debt. An ex-Central Bank Deputy Governor lamented that Sri Lanka was heading towards a debt crisis.

Putting house in order first

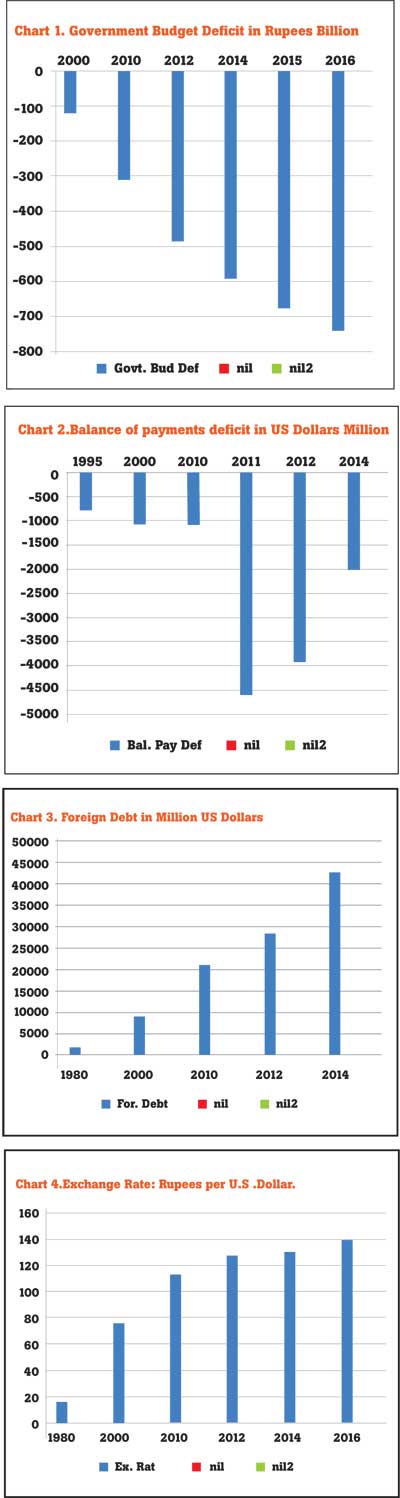

Before thinking big, Sri Lanka should put the house in order. The current bleak economic outlook, which is summarized in Charts 1, 2, 3 and 4 may not augur well with prospective investors.

We have lost control over our finances. We cannot raise enough revenue to meet our growing demand for social services, specially for education and health and for construction of roads and houses for shanty dwellers and others. The result is a huge budget deficit, a staggering Rs.740 billion projected for 2016 as against Rs.675 billion for the previous year. The Finance Minister in his 2016 Budget indicated a revenue target in terms of its ratio to gross domestic product (GDP). He envisaged raising the current ratio of 11 percent to 18 percent by 2018; as for the avenues for raising revenue he expects to strengthen the Customs Department, which collects almost 60 percent of the total revenue.

In order to pay or our essential imports and other payments, Sri Lanka depends on receipts from exports of mainly plantation products, garments and other sources—mainly repatriation of earnings by foreign workers in the Middle East and elsewhere. Unfortunately, these receipts are never enough to pay for imports and other payments; so we have a continuing balance of payments deficit. What is the consequence? We have to borrow abroad to finance the deficit, which means we have heavily borrowed as seen in Chart 3.

Our foreign debt has been increasing for many years. At the end of 2014 it was US $ 42,988 million. Our foreign reserves are so low and we’ve been borrowing heavily from international markets by way of selling severing bonds and government securities to replenish our reserves. The situation has got to such a low point that the Finance Minister recently resorted to a so called “mystery investor” from Belgium to beef up the reserves. This has raised a lot of eyebrows and demands have been made from various quarters to reveal the identity of the investor.

All this aptly shows that we are in debt “up to the neck” and we still need to borrow. What about servicing the debt? In 2014, the amount spent on servicing the debt was as much as US $ 3,386 million.

Another consequence of our balance of payments difficulties is the rise in the exchange rate. The Central Bank, until recently, intervened to stabilize the exchange rate by providing dollars when necessary from its reserves to the foreign exchange market. Reserves are now precariously low and the Central Bank has stopped stabilizing the exchange rate. This has resulted in an upward pressure on the exchange rate i.e. the depreciation of the rupee. Hence, we have to pay more for our imports as the prices of imported goods have started rising, affecting our living costs. Chart 4 shows the movements of the rupee/dollar exchange rate.

Future prospects

Budget deficit

Expenditure on health, educational and other social services is rising, so is capital expenditure, specially on roads and housing. There is a dire need to expand the road network to ease congestion, to provide housing for those living in shanties and so on. On the other hand, the possibility of raising more revenue to match the higher expenditure is bleak. Strengthening the Customs Department, which brings 60 percent of the total revenue, is not enough. There must be drastic action to increase revenue such as taxing every man, woman and child in the country however unpopular it may be.

Balance of payments

Sri Lanka’s main exports are still tea, rubber, rubber products (tyres) and garments. Possibilities of innovation and technological advancement—for instance to produce new exports—do exist but these are long-term prospects. One important item on the receipts side is the large inflow of earnings of domestic workers in the Middle East and elsewhere. Oil prices are falling—now at US $ 28 per barrel—there is the possibility of it falling further. Morgan Stanley Chase expects a crude oil barrel to fall to US $ 20. Countries like Saudi Arabia, short of cash, are considering imposing income tax and removing subsidies. Working in the Middle East hence will no longer be attractive for expatriates.

Also with a reduction of spending power for the Arabs, housemaids and other workers will not be affordable for them.

In the near future, large inflows of repatriation of earnings by expatriates—a major positive item in our balance of payments—will be history. The only other item, which has a bright future, is tourism, which is still growing. It will be many years before receipts from tourism will make a sizeable contribution to the country’s balance of payments.

Foreign debt

Prospects for improving balance of payments are bleak and the deficit is likely to continue, resulting in further borrowing to finance the deficits.

Exchange rate

Balance of payments deficit will very likely result in a shortage of dollars in the foreign exchange market. Since the Central Bank is no longer able to stabilize the exchange rates, the depreciation of the rupee will continue.

Foreign investment

Large-scale foreign investment is needed for the government’s grandiose plans. In Sri Lanka, regardless of the several concessions in Budget 2016 to attract foreign direct investment, the country’s economic outlook, not propitious at present, may be a factor influencing foreign investor decisions.

It is imperative that the government should find means of reducing budget deficit and balance of payments deficits before initiating their grandiose projects. Similar sentiments were expressed by several speakers at the recent Economic Forum held in Colombo when they said, “Sri Lanka should get its fundamentals right.”

Our foreign debt being already high and any new foreign financing will increase our debt and debt servicing to greater heights. The current mega plans to develop the country should go hand in hand with, if not follow, a mega plan to improve the country’s balance of payments.

(The above discussion did not include GDP and growth rate because major revisions of these statistics are reportedly underway by the Census and Statistics Department. The charts were prepared using data from official sources.)

(Dunstan Perera is a former United Nations Advisor on National Accounts)

26 Nov 2024 1 hours ago

26 Nov 2024 2 hours ago

26 Nov 2024 2 hours ago

26 Nov 2024 3 hours ago

26 Nov 2024 3 hours ago