06 Feb 2018 - {{hitsCtrl.values.hits}}

A Goldilocks economy is an economy that is not too hot or cold, in other words sustains moderate economic growth, and that has low inflation, which allows a market-friendly monetary policy. The name comes from the children’s story Goldilocks & the Three Bears. The U.S. economy of the mid- to late-1990s was considered a Goldilocks economy because it was “not too hot, not too cold, but just right’.

A Goldilocks economy is an economy that is not too hot or cold, in other words sustains moderate economic growth, and that has low inflation, which allows a market-friendly monetary policy. The name comes from the children’s story Goldilocks & the Three Bears. The U.S. economy of the mid- to late-1990s was considered a Goldilocks economy because it was “not too hot, not too cold, but just right’.

Nearly ten years ago creating a global shock waveon September 15, 2008, Lehman Brothers filed for bankruptcy. With US$639 billion in assets and US$619 billion in debt, Lehman’s bankruptcy filing was the largest in history, as its assets far surpassed those of previous bankrupt giants such as WorldCom and Enron. Lehman was the fourth-largest U.S. investment bank at the time of its collapse, with 25,000 employees worldwide. The crisis had contributed to the erosion of close to US$10 trillion in market capitalization from global equity markets in October 2008. Since this economic crisis of 2008, businesses dependent on international trade have been doing their best to cope with challenging market conditions, as global recovery from the recession continues to prove frustratingly sluggish.

One of the major sectors that suffered during this crisis was the global shipping industry, which had to bear the brunt of trade imbalance and capacity management. The outcome of the global crisis was shipping becoming a clear oligopolistic industry, which may have positive as well as negative impacts in the coming years for global traders.

Unpredictability

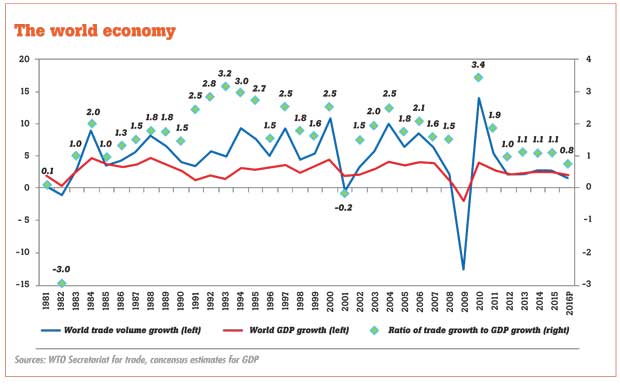

World Trade Organization (WTO) data for 2016 showed a weak trade growth rate of just 1.3 percent for the year, with economic activity slowing down across the board as major economies continue to adjust and reposition themselves.

This unpredictability has proven problematic for businesses operating in all sectors and expected continuous low growth for the foreseeable future. However, first half of 2017 showed the pattern changing after nearly a decade and now things are turning around as 2017 end showed a strong recovery and the 2018 forecastare atvery positive levels with world trade growing well over 3.2 percent.

The IMF in a January 2018 report says, global economic activity continues to firm up. Global output is estimated to have grown by 3.7 percent in 2017, which is 0.1 percentage point faster than projected in the fall.

The pickup in growth has been broad based, with notable upside surprises in Europe and Asia. Global growth forecasts for 2018 and 2019 have been revised upward by 0.2 percentage point to 3.9 percent.

The positive nature of the US economy, stable growth in China and strong growth in India and the Africa’s, along with stabilizing EU, the overall performance of the global growth recovery story seems to be a moving towardspositive territories.

The crude oil industry and commodity markets are showing signs of better conditions, it is expected that by end of 2018 the crude oil will be between US$65-75 a barrel which most analysts believe will remain at those levels for some time which will help the global trade growth.

Managing macroeconomic fundamentals

In a Goldilocks economic situation, its known that intervention by the central banks are less as conditions are observed as stable, however it is important to note that all nations including Sri Lanka must be very careful in managing macroeconomic fundamentals including debt management as some serious challenges such as protectionism and inequality of wealth distribution can derail the recovery and the stability of nations.

It’s indeed an appropriate time for a country like Sri Lanka to put the foot on the peddle to drive on investment promotion and export promotion as the markets and investors will be more receptive to emerging economies. However, in my opinion political and policy stability is the key for success and economic health of the country.

(The writer is the CEO of Shippers’ Academy Colombo, an economics graduate from the Connecticut State University USA, and immediate past secretary general of the Asian Shippers’ Council)

01 Jan 2025 51 minute ago

01 Jan 2025 1 hours ago

01 Jan 2025 2 hours ago

01 Jan 2025 3 hours ago

01 Jan 2025 4 hours ago