17 Apr 2013 - {{hitsCtrl.values.hits}}

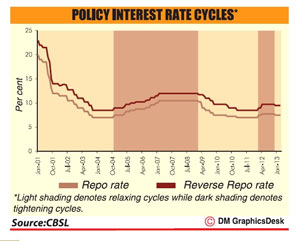

The Central Bank has taken a decision yesterday to hold key policy rates at current levels for the fourth straight month, despite the inflation falling down to 7.5 percent in March from 9.8 percent a month ago.

The Central Bank has taken a decision yesterday to hold key policy rates at current levels for the fourth straight month, despite the inflation falling down to 7.5 percent in March from 9.8 percent a month ago. During the month, credit extended to the private sector increased by Rs. 18 billion, recording a Year-on-Year (YoY) growth of 13.3 percent while the credit obtained by the public sector amounted to Rs. 36.7 billion.

During the month, credit extended to the private sector increased by Rs. 18 billion, recording a Year-on-Year (YoY) growth of 13.3 percent while the credit obtained by the public sector amounted to Rs. 36.7 billion.

23 Nov 2024 2 hours ago

23 Nov 2024 2 hours ago

23 Nov 2024 4 hours ago

23 Nov 2024 5 hours ago

23 Nov 2024 7 hours ago